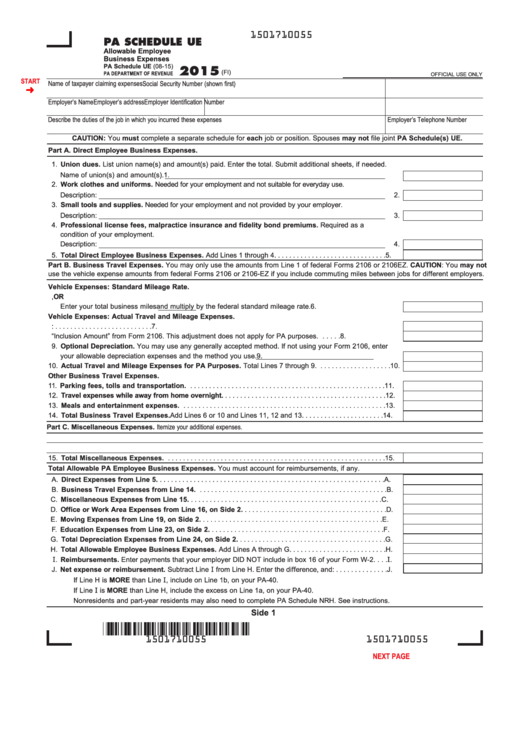

1501710055

PA SCHEDULE UE

Allowable Employee

Business Expenses

PA Schedule UE (08-15)

2015

(FI)

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

START

Name of taxpayer claiming expenses

Social Security Number (shown first)

Employer’s Name

Employer’s address

Employer Identification Number

Describe the duties of the job in which you incurred these expenses

Employer’s Telephone Number

CAUTION: You must complete a separate schedule for each job or position. Spouses may not file joint PA Schedule(s) UE.

Part A. Direct Employee Business Expenses.

1. Union dues. List union name(s) and amount(s) paid. Enter the total. Submit additional sheets, if needed.

Name of union(s) and amount(s).

1.

2. Work clothes and uniforms. Needed for your employment and not suitable for everyday use.

Description:

2.

3. Small tools and supplies. Needed for your employment and not provided by your employer.

Description:

3.

4. Professional license fees, malpractice insurance and fidelity bond premiums. Required as a

condition of your employment.

Description:

4.

5. Total Direct Employee Business Expenses. Add Lines 1 through 4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

Part B. Business Travel Expenses. You may only use the amounts from Line 1 of federal Forms 2106 or 2106EZ. CAUTION: You may not

use the vehicle expense amounts from federal Forms 2106 or 2106-EZ if you include commuting miles between jobs for different employers.

Vehicle Expenses: Standard Mileage Rate.

6. Enter the amount from your Form 2106 or 2106-EZ, OR

Enter your total business miles

and multiply by the federal standard mileage rate.

6.

Vehicle Expenses: Actual Travel and Mileage Expenses.

7. Enter the amount from your Form 2106. Make the following adjustments: . . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Add back the “Inclusion Amount” from Form 2106. This adjustment does not apply for PA purposes. . . . . . 8.

9. Optional Depreciation. You may use any generally accepted method. If not using your Form 2106, enter

your allowable depreciation expenses and the method you use

.

9.

10. Actual Travel and Mileage Expenses for PA Purposes. Total Lines 7 through 9. . . . . . . . . . . . . . . . . . . . 10.

Other Business Travel Expenses.

11. Parking fees, tolls and transportation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. Travel expenses while away from home overnight. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Meals and entertainment expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Total Business Travel Expenses. Add Lines 6 or 10 and Lines 11, 12 and 13. . . . . . . . . . . . . . . . . . . . . . 14.

Part C. Miscellaneous Expenses. Itemize your additional expenses.

15. Total Miscellaneous Expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

Total Allowable PA Employee Business Expenses. You must account for reimbursements, if any.

A. Direct Expenses from Line 5. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . A.

B. Business Travel Expenses from Line 14. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . B.

C. Miscellaneous Expenses from Line 15. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C.

D. Office or Work Area Expenses from Line 16, on Side 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D.

E. Moving Expenses from Line 19, on Side 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E.

F. Education Expenses from Line 23, on Side 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F.

G. Total Depreciation Expenses from Line 24, on Side 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . G.

H. Total Allowable Employee Business Expenses. Add Lines A through G. . . . . . . . . . . . . . . . . . . . . . . . . . H.

. Reimbursements. Enter payments that your employer DID NOT include in box 16 of your Form W-2. . . .

.

J. Net expense or reimbursement. Subtract Line from Line H. Enter the difference, and: . . . . . . . . . . . . . . J.

If Line H is MORE than Line , include on Line 1b, on your PA-40.

If Line is MORE than Line H, include the excess on Line 1a, on your PA-40.

Nonresidents and part-year residents may also need to complete PA Schedule NRH. See instructions.

Side 1

1501710055

1501710055

PRINT FORM

Reset Entire Form

NEXT PAGE

1

1 2

2