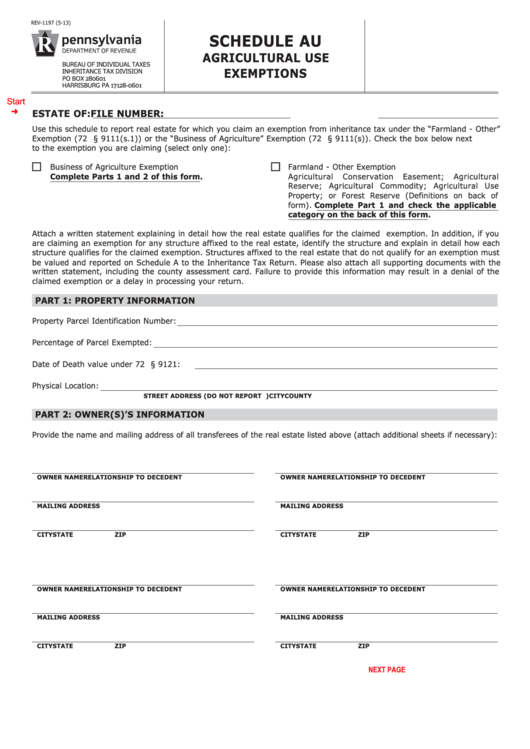

REV-1197 (5-13)

SCHEDULE AU

AGRICULTURAL USE

BUREAU OF INDIVIDUAL TAXES

INHERITANCE TAX DIVISION

EXEMPTIONS

PO BOX 280601

HARRISBURG PA 17128-0601

Start

ESTATE OF:

FILE NUMBER:

Use this schedule to report real estate for which you claim an exemption from inheritance tax under the “Farmland - Other”

Exemption (72 P.S. § 9111(s.1)) or the “Business of Agriculture” Exemption (72 P.S. § 9111(s)). Check the box below next

to the exemption you are claiming (select only one):

®

®

Business of Agriculture Exemption

Farmland - Other Exemption

Complete Parts 1 and 2 of this form.

Agricultural

Conservation

Easement;

Agricultural

Reserve; Agricultural Commodity; Agricultural Use

Property; or Forest Reserve (Definitions on back of

form). Complete Part 1 and check the applicable

category on the back of this form.

Attach a written statement explaining in detail how the real estate qualifies for the claimed exemption. In addition, if you

are claiming an exemption for any structure affixed to the real estate, identify the structure and explain in detail how each

structure qualifies for the claimed exemption. Structures affixed to the real estate that do not qualify for an exemption must

be valued and reported on Schedule A to the Inheritance Tax Return. Please also attach all supporting documents with the

written statement, including the county assessment card. Failure to provide this information may result in a denial of the

claimed exemption or a delay in processing your return.

PART 1: PROPERTY INFORMATION

Property Parcel Identification Number:

Percentage of Parcel Exempted:

Date of Death value under 72 P.S. § 9121:

Physical Location:

STREET ADDRESS (DO NOT REPORT P.O. BOX)

CITY

COUNTY

PART 2: OWNER(S)’S INFORMATION

Provide the name and mailing address of all transferees of the real estate listed above (attach additional sheets if necessary):

OWNER NAME

RELATIONSHIP TO DECEDENT

OWNER NAME

RELATIONSHIP TO DECEDENT

MAILING ADDRESS

MAILING ADDRESS

CITY

STATE

ZIP

CITY

STATE

ZIP

OWNER NAME

RELATIONSHIP TO DECEDENT

OWNER NAME

RELATIONSHIP TO DECEDENT

MAILING ADDRESS

MAILING ADDRESS

CITY

STATE

ZIP

CITY

STATE

ZIP

PRINT FORM

NEXT PAGE

Reset Entire Form

1

1 2

2