Form 760e - Virginia Tentative Tax Return And Application For Extension Of Time To File Individual Or Fiduciary Income Tax Return (Forms 760, 760py, 763 And 770) - 1999

ADVERTISEMENT

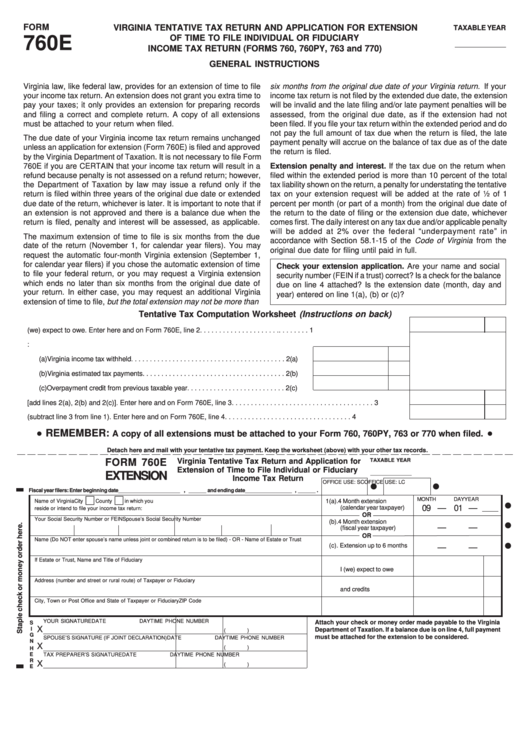

FORM

VIRGINIA TENTATIVE TAX RETURN AND APPLICATION FOR EXTENSION

TAXABLE YEAR

760E

OF TIME TO FILE INDIVIDUAL OR FIDUCIARY

INCOME TAX RETURN (FORMS 760, 760PY, 763 and 770)

GENERAL INSTRUCTIONS

six months from the original due date of your Virginia return. If your

Virginia law, like federal law, provides for an extension of time to file

your income tax return. An extension does not grant you extra time to

income tax return is not filed by the extended due date, the extension

pay your taxes; it only provides an extension for preparing records

will be invalid and the late filing and/or late payment penalties will be

and filing a correct and complete return. A copy of all extensions

assessed, from the original due date, as if the extension had not

must be attached to your return when filed.

been filed. If you file your tax return within the extended period and do

not pay the full amount of tax due when the return is filed, the late

The due date of your Virginia income tax return remains unchanged

payment penalty will accrue on the balance of tax due as of the date

unless an application for extension (Form 760E) is filed and approved

the return is filed.

by the Virginia Department of Taxation. It is not necessary to file Form

760E if you are CERTAIN that your income tax return will result in a

Extension penalty and interest. If the tax due on the return when

refund because penalty is not assessed on a refund return; however,

filed within the extended period is more than 10 percent of the total

the Department of Taxation by law may issue a refund only if the

tax liability shown on the return, a penalty for understating the tentative

return is filed within three years of the original due date or extended

tax on your extension request will be added at the rate of ½ of 1

due date of the return, whichever is later. It is important to note that if

percent per month (or part of a month) from the original due date of

an extension is not approved and there is a balance due when the

the return to the date of filing or the extension due date, whichever

return is filed, penalty and interest will be assessed, as applicable.

comes first. The daily interest on any tax due and/or applicable penalty

will be added at 2% over the federal “underpayment rate” in

The maximum extension of time to file is six months from the due

accordance with Section 58.1-15 of the Code of Virginia from the

date of the return (November 1, for calendar year filers). You may

original due date for filing until paid in full.

request the automatic four-month Virginia extension (September 1,

for calendar year filers) if you chose the automatic extension of time

Check your extension application. Are your name and social

to file your federal return, or you may request a Virginia extension

security number (FEIN if a trust) correct? Is a check for the balance

which ends no later than six months from the original due date of

due on line 4 attached? Is the extension date (month, day and

your return. In either case, you may request an additional Virginia

year) entered on line 1(a), (b) or (c)?

extension of time to file, but the total extension may not be more than

Tentative Tax Computation Worksheet (Instructions on back)

1. Total Virginia income tax I (we) expect to owe. Enter here and on Form 760E, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2. Payments and credits:

(a)

Virginia income tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2(a)

(b)

Virginia estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2(b)

(c)

Overpayment credit from previous taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . 2(c)

3. Total [add lines 2(a), 2(b) and 2(c)]. Enter here and on Form 760E, line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4. Balance due (subtract line 3 from line 1). Enter here and on Form 760E, line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

REMEMBER:

A copy of all extensions must be attached to your Form 760, 760PY, 763 or 770 when filed.

Detach here and mail with your tentative tax payment. Keep the worksheet (above) with your other tax records.

FORM 760E

Virginia Tentative Tax Return and Application for

TAXABLE YEAR

Extension of Time to File Individual or Fiduciary

______________

EXTENSION

Income Tax Return

OFFICE USE: SC

OFFICE USE: LC

Fiscal year filers: Enter beginning date _____________________ , ______ and ending date ________________ , ______ .

MONTH

DAY

YEAR

1(a). 4 Month extension

Name of Virginia City

County

in which you

09

—

01

—

(calendar year taxpayer)

reside or intend to file your income tax return:

OR

Your Social Security Number or FEIN

Spouse’s Social Security Number

(b). 4 Month extension

—

—

(fiscal year taxpayer)

OR

Name (Do NOT enter spouse’s name unless joint or combined return is to be filed) - OR - Name of Estate or Trust

(c). Extension up to 6 months

—

—

If Estate or Trust, Name and Title of Fiduciary

2.

Total Virginia income tax

I (we) expect to owe

Address (number and street or rural route) of Taxpayer or Fiduciary

3.

Total payments

and credits

City, Town or Post Office and State of Taxpayer or Fiduciary

ZIP Code

4.

BALANCE DUE

YOUR SIGNATURE

DATE

DAYTIME PHONE NUMBER

Attach your check or money order made payable to the Virginia

S

X

I

Department of Taxation. If a balance due is on line 4, full payment

(

)

G

must be attached for the extension to be considered.

SPOUSE’S SIGNATURE (IF JOINT DECLARATION)

DATE

DAYTIME PHONE NUMBER

N

X

(

)

H

E

TAX PREPARER’S SIGNATURE

DATE

DAYTIME PHONE NUMBER

R

X

(

)

E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2