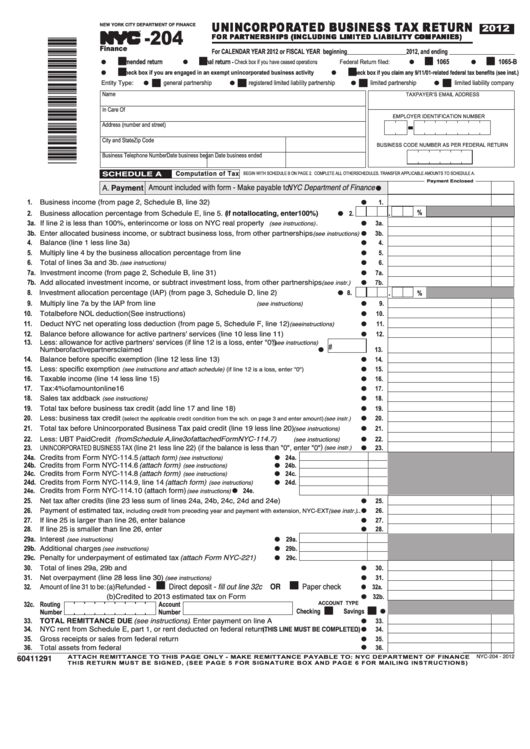

U U N N I I N N C C O O R R P P O O R R A A T T E E D D B B U U S S I I N N E E S S S S T T A A X X R R E E T T U U R R N N

-204

2012

NEW YORK CITY DEPARTMENT OF FINANCE

F F O O R R P P A A R R T T N N E E R R S S H H I I P P S S ( ( I I N N C C L L U U D D I I N N G G L L I I M M I I T T E E D D L L I I A A B B I I L L I I T T Y Y C C O O M M P P A A N N I I E E S S ) )

TM

Finance

For CALENDAR YEAR 2012 or FISCAL YEAR beginning

2012, and ending

___________________________

______________________________

I I

I I

I I

I I

Amended return

Final return

1065

1065-B

- Check box if you have ceased operations.

Federal Return filed:

G

G

G

G

I I

I I

Check box if you claim any 9/11/01-related federal tax benefits (see inst.)

Check box if you are engaged in an exempt unincorporated business activity

G

G

I I

I I

I I

I I

Entity Type:

general partnership

registered limited liability partnership

limited partnership

limited liability company

G

G

G

G

Name

TAXPAYER’S EMAIL ADDRESS

In Care Of

EMPLOYER IDENTIFICATION NUMBER

Address (number and street)

City and State

Zip Code

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business Telephone Number

Date business began

Date business ended

S C H E D U L E A

Computation of Tax

BEGIN WITH SCHEDULE B ON PAGE 2. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

A. Payment

Amount included with form - Make payable to: NYC Department of Finance

Payment Enclosed

G

Business income (from page 2, Schedule B, line 32)..........................................................................

1.

1.

G

Business allocation percentage from Schedule E, line 5. (if not allocating, enter 100%) .......

.

%

2.

G 2.

3a. If line 2 is less than 100%, enter income or loss on NYC real property

......................

(see instructions)

3a.

G

3b. Enter allocated business income, or subtract business loss, from other partnerships

(see instructions)

3b.

G

Balance (line 1 less line 3a).................................................................................................................

4.

4.

G

Multiply line 4 by the business allocation percentage from line 2........................................................

5.

5.

G

Total of lines 3a and 3b.

(see instructions) ...................................................................................................................

6.

6.

G

7a. Investment income (from page 2, Schedule B, line 31).......................................................................

7a.

G

7b. Add allocated investment income, or subtract investment loss, from other partnerships

.....

(see instr.)

7b.

G

8. Investment allocation percentage (IAP) (from page 3, Schedule D, line 2) ............................

.

G 8.

%

Multiply line 7a by the IAP from line 8. Add the amount on line 7b.

............................

(see instructions)

9.

9.

G

Total before NOL deduction (See instructions)....................................................................................

10.

10.

G

Deduct NYC net operating loss deduction (from page 5, Schedule F, line 12)

(see instructions) ..............

11.

11.

G

Balance before allowance for active partners' services (line 10 less line 11)......................................

12.

12.

G

Less: allowance for active partners' services (if line 12 is a loss, enter "0")

(see instructions)

13.

Number of active partners claimed ................................................................................... G

#

13.

Balance before specific exemption (line 12 less line 13).....................................................................

14.

.

14

G

Less: specific exemption

(see instructions and attach schedule) (if line 12 is a loss, enter "0") ..................................

15.

15.

G

Taxable income (line 14 less line 15)...................................................................................................

16.

16.

G

Tax: 4% of amount on line 16 ..............................................................................................................

17.

17.

G

Sales tax addback

........................................................................................................

(see instructions)

18.

18.

G

Total tax before business tax credit (add line 17 and line 18)..............................................................

19.

19.

G

Less: business tax credit

.....

(

20.

select the applicable credit condition from the sch. on page 3 and enter amount) (see instr.)

20.

G

Total tax before Unincorporated Business Tax paid credit (line 19 less line 20)

..........

(see instructions)

21.

21.

G

Less: UBT Paid Credit (from Schedule A, line 3 of attached Form NYC-114.7)

..........

(see instructions)

22.

22.

G

UNINCORPORATED BUSINESS TAX (line 21 less line 22) (if the balance is less than "0", enter "0" )

(see instr.)

23.

.....

23.

G

24a. Credits from Form NYC-114.5 (attach form)

.........................

(see instructions)

G 24a.

24b. Credits from Form NYC-114.6 (attach form)

.......................

(see instructions)

G 24b.

24c. Credits from Form NYC-114.8 (attach form)

.......................

(see instructions)

G 24c.

24d. Credits from Form NYC-114.9, line 14 (attach form)

..........

(see instructions)

G 24d.

Credits from Form NYC-114.10 (attach form)

......................G 24e.

(see instructions)

24e.

Net tax after credits (line 23 less sum of lines 24a, 24b, 24c, 24d and 24e) .......................................

25.

25.

G

Payment of estimated tax,

..

including credit from preceding year and payment with extension, NYC-EXT (see instr.)

26.

26.

G

If line 25 is larger than line 26, enter balance due

...........................................................................

27.

27.

G

If line 25 is smaller than line 26, enter overpayment ..........................................................................

28.

28.

G

29a. Interest

(see instructions) ...............................................................................................

G 29a.

29b. Additional charges

(see instructions) ..........................................................................

G 29b.

29c. Penalty for underpayment of estimated tax (attach Form NYC-221) ........

G 29c.

Total of lines 29a, 29b and 29c............................................................................................................

30.

30.

G

Net overpayment (line 28 less line 30)

.........................................................................

(see instructions)

31.

31.

G

Direct deposit - fill out line 32c OR

-

Paper check

I I

I I

Amount of line 31 to be: (a) Refunded

.........

32.

G 32a.

(b) Credited to 2013 estimated tax on Form NYC-5UB......................................

G 32b.

32c. Routing

Account

ACCOUNT TYPE

I I

I I

Checking

Savings

Number

Number

G

TOTAL REMITTANCE DUE (see instructions) . Enter payment on line A above.................................

33.

33.

G

NYC rent from Schedule E, part 1, or rent deducted on federal return.

(THIS LINE MUST BE COMPLETED)..G

34.

34.

Gross receipts or sales from federal return

...........................................................................................................G

35.

35.

Total assets from federal return ................................................................................................................

36.

36.

G

60411291

NYC-204 - 2012

ATTACH REMITTANCE TO THIS PAGE ONLY - MAKE REMITTANCE PAYABLE TO: NYC DEPARTMENT OF FINANCE

THIS RETURN MUST BE SIGNED, (SEE PAGE 5 FOR SIGNATURE BOX AND PAGE 6 FOR MAILING INSTRUCTIONS)

1

1 2

2 3

3 4

4 5

5