1302210057

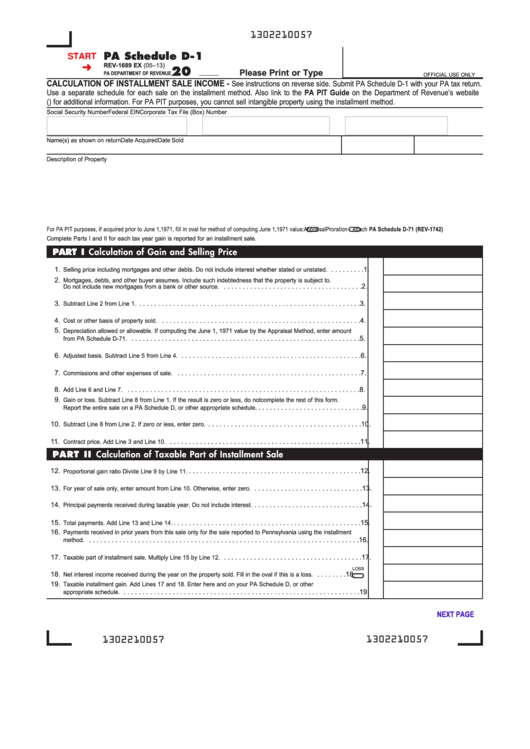

PA Schedule D-1

START

REV-1689 EX (05–13)

20

Please Print or Type

PA DEPARTMENT OF REVENUE

OFFICIAL USE ONLY

CALCULATION OF INSTALLMENT SALE INCOME -

See instructions on reverse side. Submit PA Schedule D-1 with your PA tax return.

Use a separate schedule for each sale on the installment method. Also link to the PA PIT Guide on the Department of Revenue’s website

( ) for additional information. For PA PIT purposes, you cannot sell intangible property using the installment method.

Social Security Number

Federal EIN

Corporate Tax File (Box) Number

Name(s) as shown on return

Date Acquired

Date Sold

Description of Property

For PA PIT purposes, if acquired prior to June 1,1971, fill in oval for method of computing June 1,1971 value:

Appraisal

Proration - Attach PA Schedule D-71 (REV-1742)

Complete Parts I and II for each tax year gain is reported for an installment sale.

PART I Calculation of Gain and Selling Price

1.

. . . . . . . . .

1.

Selling price including mortgages and other debts. Do not include interest whether stated or unstated.

2.

Mortgages, debts, and other buyer assumes. Include such indebtedness that the property is subject to.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

Do not include new mortgages from a bank or other source.

3.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Subtract Line 2 from Line 1.

4.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Cost or other basis of property sold.

5.

Depreciation allowed or allowable. If computing the June 1, 1971 value by the Appraisal Method, enter amount

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

from PA Schedule D-71.

6.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Adjusted basis. Subtract Line 5 from Line 4.

7.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

Commissions and other expenses of sale.

8.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Add Line 6 and Line 7.

9.

Gain or loss. Subtract Line 8 from Line 1. If the result is zero or less, do not complete the rest of this form.

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Report the entire sale on a PA Schedule D, or other appropriate schedule.

10.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

Subtract Line 8 from Line 2. If zero or less, enter zero.

11.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11.

Contract price. Add Line 3 and Line 10.

PART II Calculation of Taxable Part of Installment Sale

12.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

Proportional gain ratio Divide Line 9 by Line 11.

13.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13.

For year of sale only, enter amount from Line 10. Otherwise, enter zero.

14.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14.

Principal payments received during taxable year. Do not include interest.

15.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

Total payments. Add Line 13 and Line 14.

16.

Payments received in prior years from this sale only for the sale reported to Pennsylvania using the installment

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16.

method.

17.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

Taxable part of installment sale. Multiply Line 15 by Line 12.

LOSS

18.

. . . . . . . .

18.

Net interest income received during the year on the property sold. Fill in the oval if this is a loss.

19.

Taxable installment gain. Add Lines 17 and 18. Enter here and on your PA Schedule D, or other

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19.

appropriate schedule.

Reset Entire Form

PRINT FORM

NEXT PAGE

1302210057

1302210057

1

1 2

2