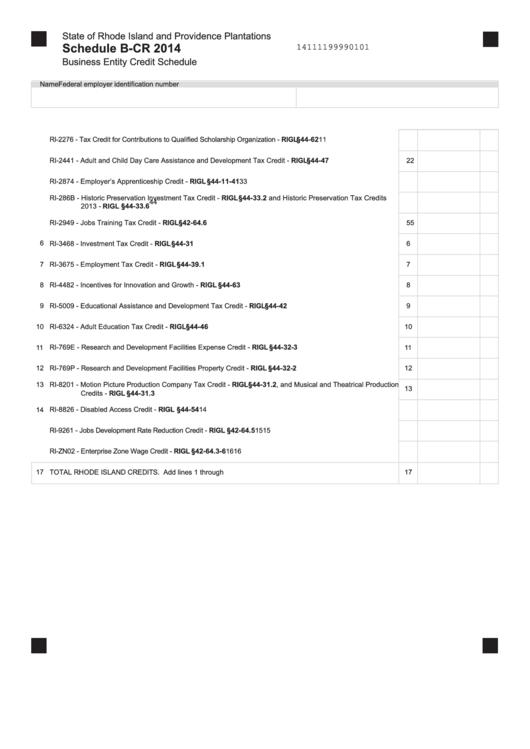

State of Rhode Island and Providence Plantations

Schedule B-CR 2014

14111199990101

Business Entity Credit Schedule

Name

Federal employer identification number

1

RI-2276 - Tax Credit for Contributions to Qualified Scholarship Organization - RIGL §44-62........................................

1

2

RI-2441 - Adult and Child Day Care Assistance and Development Tax Credit - RIGL §44-47...................................

2

3

RI-2874 - Employer’s Apprenticeship Credit - RIGL §44-11-41.................................................................................

3

RI-286B - Historic Preservation Investment Tax Credit - RIGL §44-33.2 and Historic Preservation Tax Credits

4

4

2013 - RIGL §44-33.6..............................................................................................................................

5

RI-2949 - Jobs Training Tax Credit - RIGL §42-64.6...................................................................................................

5

6

RI-3468 - Investment Tax Credit - RIGL §44-31..........................................................................................................

6

7

RI-3675 - Employment Tax Credit - RIGL §44-39.1..................................................................................................

7

8

RI-4482 - Incentives for Innovation and Growth - RIGL §44-63................................................................................

8

9

RI-5009 - Educational Assistance and Development Tax Credit - RIGL §44-42........................................................

9

10

RI-6324 - Adult Education Tax Credit - RIGL §44-46................................................................................................

10

11

RI-769E - Research and Development Facilities Expense Credit - RIGL §44-32-3....................................................

11

12

RI-769P - Research and Development Facilities Property Credit - RIGL §44-32-2....................................................

12

13

RI-8201 - Motion Picture Production Company Tax Credit - RIGL §44-31.2, and Musical and Theatrical Production

13

Credits - RIGL §44-31.3............................................................................................................................

14

RI-8826 - Disabled Access Credit - RIGL §44-54.....................................................................................................

14

15

RI-9261 - Jobs Development Rate Reduction Credit - RIGL §42-64.5......................................................................... 15

RI-ZN02 - Enterprise Zone Wage Credit - RIGL §42-64.3-6.......................................................................................

16

16

TOTAL RHODE ISLAND CREDITS. Add lines 1 through 16...................................................................................... 17

1

1 2

2 3

3