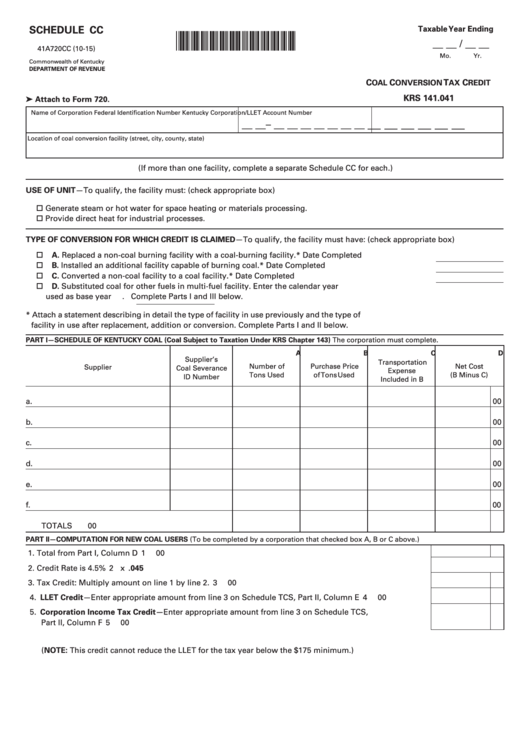

SCHEDULE CC

Taxable Year Ending

*1500030222*

__ __ / __ __

41A720CC (10-15)

Mo.

Yr.

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

C

C

T

C

OAL

ONVERSION

AX

REDIT

KRS 141.041

➤ Attach to Form 720.

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __– __ __ __ __ __ __ __

Location of coal conversion facility (street, city, county, state)

(If more than one facility, complete a separate Schedule CC for each.)

USE OF UNIT—To qualify, the facility must: (check appropriate box)

Generate steam or hot water for space heating or materials processing.

Provide direct heat for industrial processes.

TYPE OF CONVERSION FOR WHICH CREDIT IS CLAIMED—To qualify, the facility must have: (check appropriate box)

A. Replaced a non-coal burning facility with a coal-burning facility.*

Date Completed

Installed an additional facility capable of burning coal.*

Date Completed

B.

C.

Converted a non-coal facility to a coal facility.*

Date Completed

D. Substituted coal for other fuels in multi-fuel facility. Enter the calendar year

used as base year

. Complete Parts I and III below.

* Attach a statement describing in detail the type of facility in use previously and the type of

facility in use after replacement, addition or conversion. Complete Parts I and II below.

PART I—SCHEDULE OF KENTUCKY COAL (Coal Subject to Taxation Under KRS Chapter 143) The corporation must complete.

A

B

C

D

Supplier’s

Transportation

Number of

Purchase Price

Net Cost

Supplier

Coal Severance

Expense

Tons Used

of Tons Used

(B Minus C)

ID Number

Included in B

a.

00

b.

00

c.

00

d.

00

e.

00

f.

00

TOTALS

00

PART II—COMPUTATION FOR NEW COAL USERS (To be completed by a corporation that checked box A, B or C above.)

1. Total from Part I, Column D ................................................................................................................................ 1

00

2. Credit Rate is 4.5% ............................................................................................................................................... 2 x

.045

3. Tax Credit: Multiply amount on line 1 by line 2. .............................................................................................. 3

00

4. LLET Credit—Enter appropriate amount from line 3 on Schedule TCS, Part II, Column E ............................ 4

00

5. Corporation Income Tax Credit—Enter appropriate amount from line 3 on Schedule TCS,

Part II, Column F ................................................................................................................................................... 5

00

(NOTE: This credit cannot reduce the LLET for the tax year below the $175 minimum.)

1

1 2

2 3

3