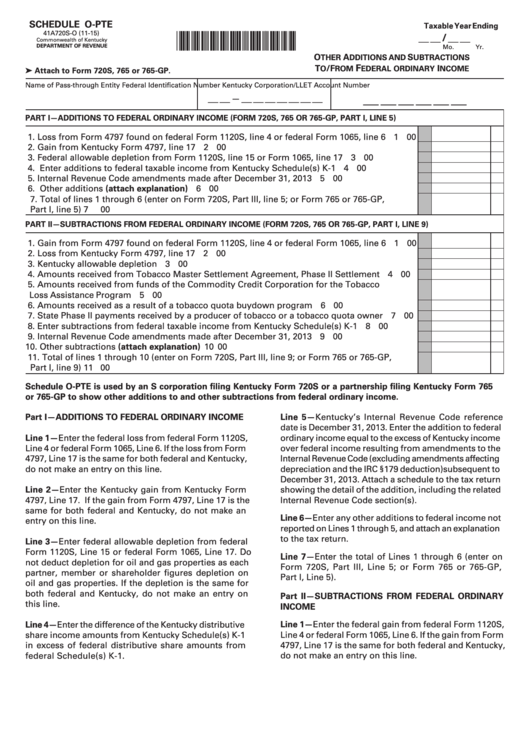

SCHEDULE O-PTE

Taxable Year Ending

41A720S-O (11-15)

*1500030301*

__ __ / __ __

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Mo.

Yr.

O

A

S

THER

DDITIONS AND

UBTRACTIONS

F

T

/F

I

O

ROM

EDERAL ORDINARY

NCOME

➤ Attach to Form 720S, 765 or 765-GP .

Name of Pass-through Entity

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __

__ __ __ __ __ __ __

—

PART I—ADDITIONS TO FEDERAL ORDINARY INCOME (FORM 720S, 765 OR 765-GP , PART I, LINE 5)

1. Loss from Form 4797 found on federal Form 1120S, line 4 or federal Form 1065, line 6 ..........

1

00

2. Gain from Kentucky Form 4797, line 17 .........................................................................................

2

00

3. Federal allowable depletion from Form 1120S, line 15 or Form 1065, line 17 ............................

3

00

4. Enter additions to federal taxable income from Kentucky Schedule(s) K-1 ...............................

4

00

5. Internal Revenue Code amendments made after December 31, 2013 ........................................

5

00

6. Other additions (attach explanation) ............................................................................................

6

00

7. Total of lines 1 through 6 (enter on Form 720S, Part III, line 5; or Form 765 or 765-GP ,

Part I, line 5) .....................................................................................................................................

7

00

PART II—SUBTRACTIONS FROM FEDERAL ORDINARY INCOME (FORM 720S, 765 OR 765-GP , PART I, LINE 9)

1. Gain from Form 4797 found on federal Form 1120S, line 4 or federal Form 1065, line 6 .........

1

00

2. Loss from Kentucky Form 4797, line 17 .........................................................................................

2

00

3. Kentucky allowable depletion ........................................................................................................

3

00

4. Amounts received from Tobacco Master Settlement Agreement, Phase II Settlement .............

4

00

5. Amounts received from funds of the Commodity Credit Corporation for the Tobacco

Loss Assistance Program ................................................................................................................

5

00

6. Amounts received as a result of a tobacco quota buydown program .......................................

6

00

7. State Phase II payments received by a producer of tobacco or a tobacco quota owner ..........

7

00

8. Enter subtractions from federal taxable income from Kentucky Schedule(s) K-1 .....................

8

00

9. Internal Revenue Code amendments made after December 31, 2013 ........................................

9

00

10. Other subtractions (attach explanation) ....................................................................................... 10

00

11. Total of lines 1 through 10 (enter on Form 720S, Part III, line 9; or Form 765 or 765-GP ,

Part I, line 9) ..................................................................................................................................... 11

00

Schedule O-PTE is used by an S corporation filing Kentucky Form 720S or a partnership filing Kentucky Form 765

or 765-GP to show other additions to and other subtractions from federal ordinary income.

Part I—ADDITIONS TO FEDERAL ORDINARY INCOME

Line 5—Kentucky’s Internal Revenue Code reference

date is December 31, 2013. Enter the addition to federal

Line 1—Enter the federal loss from federal Form 1120S,

ordinary income equal to the excess of Kentucky income

Line 4 or federal Form 1065, Line 6. If the loss from Form

over federal income resulting from amendments to the

4797, Line 17 is the same for both federal and Kentucky,

Internal Revenue Code (excluding amendments affecting

do not make an entry on this line.

depreciation and the IRC §179 deduction)subsequent to

December 31, 2013. Attach a schedule to the tax return

Line 2—Enter the Kentucky gain from Kentucky Form

showing the detail of the addition, including the related

4797, Line 17. If the gain from Form 4797, Line 17 is the

Internal Revenue Code section(s).

same for both federal and Kentucky, do not make an

Line 6—Enter any other additions to federal income not

entry on this line.

reported on Lines 1 through 5, and attach an explanation

to the tax return.

Line 3—Enter federal allowable depletion from federal

Form 1120S, Line 15 or federal Form 1065, Line 17. Do

Line 7—Enter the total of Lines 1 through 6 (enter on

not deduct depletion for oil and gas properties as each

Form 720S, Part III, Line 5; or Form 765 or 765-GP,

partner, member or shareholder figures depletion on

Part I, Line 5).

oil and gas properties. If the depletion is the same for

both federal and Kentucky, do not make an entry on

Part II—SUBTRACTIONS FROM FEDERAL ORDINARY

this line.

INCOME

Line 1—Enter the federal gain from federal Form 1120S,

Line 4—Enter the difference of the Kentucky distributive

Line 4 or federal Form 1065, Line 6. If the gain from Form

share income amounts from Kentucky Schedule(s) K-1

in excess of federal distributive share amounts from

4797, Line 17 is the same for both federal and Kentucky,

federal Schedule(s) K-1.

do not make an entry on this line.

1

1 2

2