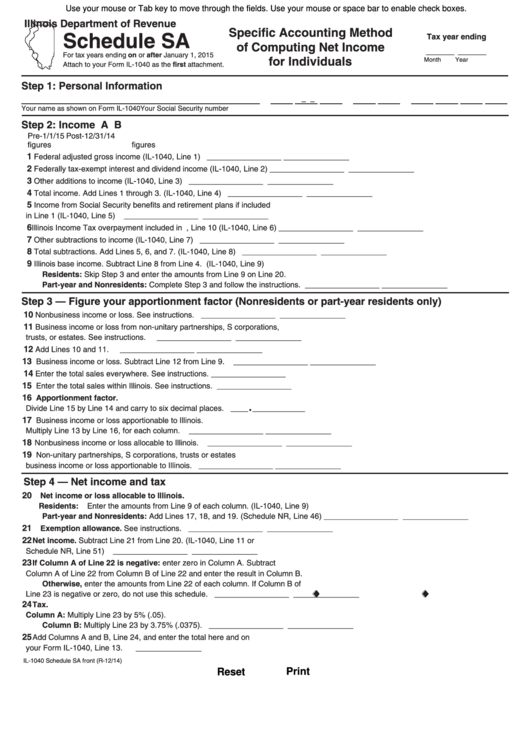

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Specific Accounting Method

Schedule SA

Tax year ending

of Computing Net Income

______ ______

For tax years ending on or after January 1, 2015

for Individuals

Month

Year

Attach to your Form IL-1040 as the first attachment.

Step 1: Personal Information

–

–

Your name as shown on Form IL-1040

Your Social Security number

Step 2: Income

A

B

Pre-1/1/15

Post-12/31/14

figures

figures

1

Federal adjusted gross income (IL-1040, Line 1)

_________________

_______________

2

Federally tax-exempt interest and dividend income (IL-1040, Line 2)

_________________

_______________

3

Other additions to income (IL-1040, Line 3)

_________________

_______________

4

Total income. Add Lines 1 through 3. (IL-1040, Line 4)

_________________

_______________

5

Income from Social Security benefits and retirement plans if included

in Line 1 (IL-1040, Line 5)

_________________

_______________

6

Illinois Income Tax overpayment included in U.S. 1040, Line 10 (IL-1040, Line 6)

_________________

_______________

7

Other subtractions to income (IL-1040, Line 7)

_________________

_______________

8

Total subtractions. Add Lines 5, 6, and 7. (IL-1040, Line 8)

_________________

_______________

9

Illinois base income. Subtract Line 8 from Line 4. (IL-1040, Line 9)

Residents: Skip Step 3 and enter the amounts from Line 9 on Line 20.

Part-year and Nonresidents: Complete Step 3 and follow the instructions.

_________________

_______________

Step 3 — Figure your apportionment factor (Nonresidents or part-year residents only)

10

Nonbusiness income or loss. See instructions.

_________________

_______________

11

Business income or loss from non-unitary partnerships, S corporations,

trusts, or estates. See instructions.

_________________

_______________

12

Add Lines 10 and 11.

_________________

_______________

13

Business income or loss. Subtract Line 12 from Line 9.

_________________

_______________

14

Enter the total sales everywhere. See instructions.

_________________

15

Enter the total sales within Illinois. See instructions.

_________________

16

Apportionment factor.

.

Divide Line 15 by Line 14 and carry to six decimal places.

____

____________

17

Business income or loss apportionable to Illinois.

Multiply Line 13 by Line 16, for each column.

_________________

_______________

18

Nonbusiness income or loss allocable to Illinois.

_________________

_______________

19

Non-unitary partnerships, S corporations, trusts or estates

business income or loss apportionable to Illinois.

_________________

_______________

Step 4 — Net income and tax

20

Net income or loss allocable to Illinois.

Residents: Enter the amounts from Line 9 of each column. (IL-1040, Line 9)

Part-year and Nonresidents: Add Lines 17, 18, and 19. (Schedule NR, Line 46) _________________

_______________

21

Exemption allowance. See instructions.

_________________

_______________

22

Net income. Subtract Line 21 from Line 20. (IL-1040, Line 11 or

Schedule NR, Line 51)

_________________

_______________

23

If Column A of Line 22 is negative: enter zero in Column A. Subtract

Column A of Line 22 from Column B of Line 22 and enter the result in Column B.

Otherwise, enter the amounts from Line 22 of each column. If Column B of

Line 23 is negative or zero, do not use this schedule.

_________________

_______________

24

Tax.

Column A: Multiply Line 23 by 5% (.05).

Column B: Multiply Line 23 by 3.75% (.0375).

_________________

_______________

25

Add Columns A and B, Line 24, and enter the total here and on

your Form IL-1040, Line 13.

_______________

IL-1040 Schedule SA front (R-12/14)

Print

Reset

1

1 2

2