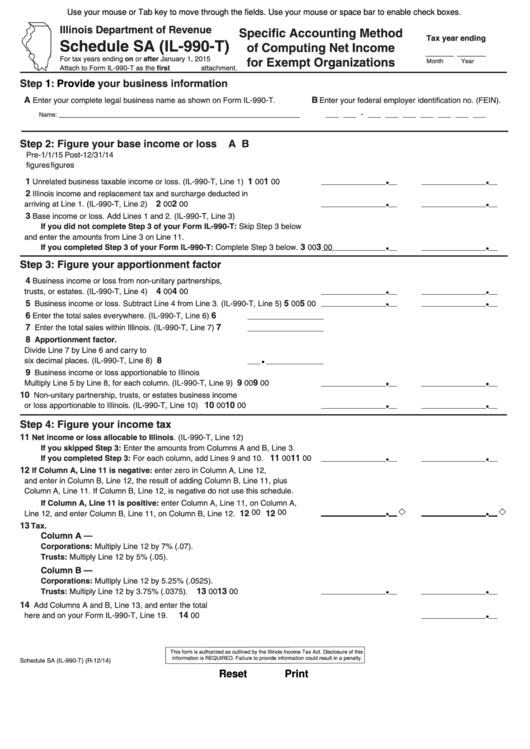

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Specific Accounting Method

Tax year ending

Schedule SA (IL-990-T)

of Computing Net Income

______ ______

For tax years ending on or after January 1, 2015

for Exempt Organizations

Month

Year

Attach to Form IL-990-T as the first attachment.

Step 1:

Provide

your business information

A

B

Enter your complete legal business name as shown on Form IL-990-T.

Enter your federal employer identification no. (FEIN).

_______________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name:

Step 2: Figure your base income or loss

A

B

Pre-1/1/15

Post-12/31/14

figures

figures

1

1

1

Unrelated business taxable income or loss. (IL-990-T, Line 1)

00

00

2

Illinois income and replacement tax and surcharge deducted in

2

2

arriving at Line 1. (IL-990-T, Line 2)

00

00

3

Base income or loss. Add Lines 1 and 2. (IL-990-T, Line 3)

If you did not complete Step 3 of your Form IL-990-T: Skip Step 3 below

and enter the amounts from Line 3 on Line 11.

3

3

If you completed Step 3 of your Form IL-990-T: Complete Step 3 below.

00

00

Step 3: Figure your apportionment factor

4

Business income or loss from non-unitary partnerships,

4

4

00

00

trusts, or estates. (IL-990-T, Line 4)

5

5

5

Business income or loss. Subtract Line 4 from Line 3. (IL-990-T, Line 5)

00

00

6

6

Enter the total sales everywhere. (IL-990-T, Line 6)

7

7

Enter the total sales within Illinois. (IL-990-T, Line 7)

8

Apportionment factor.

Divide Line 7 by Line 6 and carry to

8

six decimal places. (IL-990-T, Line 8)

9

Business income or loss apportionable to Illinois

9

9

Multiply Line 5 by Line 8, for each column. (IL-990-T, Line 9)

00

00

10

Non-unitary partnership, trusts, or estates business income

10

10

or loss apportionable to Illinois. (IL-990-T, Line 10)

00

00

Step 4: Figure your income tax

11

Net income or loss allocable to Illinois. (IL-990-T, Line 12)

If you skipped Step 3: Enter the amounts from Columns A and B, Line 3.

11

11

If you completed Step 3: For each column, add Lines 9 and 10.

00

00

12

If Column A, Line 11 is negative: enter zero in Column A, Line 12,

and enter in Column B, Line 12, the result of adding Column B, Line 11, plus

Column A, Line 11. If Column B, Line 12, is negative do not use this schedule.

If Column A, Line 11 is positive: enter Column A, Line 11, on Column A,

00

00

12

12

Line 12, and enter Column B, Line 11, on Column B, Line 12.

13

Tax.

Column A —

Corporations: Multiply Line 12 by 7% (.07).

Trusts: Multiply Line 12 by 5% (.05).

Column B —

Corporations: Multiply Line 12 by 5.25% (.0525).

13

13

Trusts: Multiply Line 12 by 3.75% (.0375).

00

00

14

Add Columns A and B, Line 13, and enter the total

14

00

here and on your Form IL-990-T, Line 19.

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

Schedule SA (IL-990-T) (R-12/14)

Reset

Print

1

1