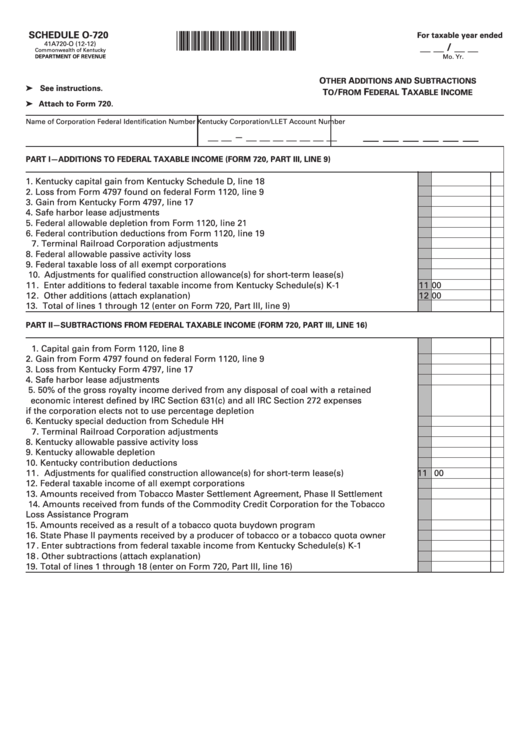

SCHEDULE O-720

For taxable year ended

*1200020300*

41A720-O (12-12)

__ __ / __ __

Commonwealth of Kentucky

Mo.

Yr.

DEPARTMENT OF REVENUE

O

A

S

THER

DDITIONS AND

UBTRACTIONS

➤ See instructions.

F

T

T

/F

I

O

ROM

EDERAL

AXABLE

NCOME

➤ Attach to Form 720.

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __

__ __ __ __ __ __ __

—

PART I—ADDITIONS TO FEDERAL TAXABLE INCOME (FORM 720, PART III, LINE 9)

1. Kentucky capital gain from Kentucky Schedule D, line 18 .........................................................

1

00

2. Loss from Form 4797 found on federal Form 1120, line 9 ..........................................................

2

00

3. Gain from Kentucky Form 4797, line 17 .......................................................................................

3

00

4. Safe harbor lease adjustments .....................................................................................................

4

00

5. Federal allowable depletion from Form 1120, line 21 .................................................................

5

00

6. Federal contribution deductions from Form 1120, line 19 .........................................................

6

00

7. Terminal Railroad Corporation adjustments ...............................................................................

7

00

8. Federal allowable passive activity loss ........................................................................................

8

00

9. Federal taxable loss of all exempt corporations .........................................................................

9

00

10. Adjustments for qualified construction allowance(s) for short-term lease(s) ............................ 10

00

11. Enter additions to federal taxable income from Kentucky Schedule(s) K-1 .............................. 11

00

12. Other additions (attach explanation) ............................................................................................ 12

00

13. Total of lines 1 through 12 (enter on Form 720, Part III, line 9) .................................................. 13

00

PART II—SUBTRACTIONS FROM FEDERAL TAXABLE INCOME (FORM 720, PART III, LINE 16)

1. Capital gain from Form 1120, line 8 .............................................................................................

1

00

2. Gain from Form 4797 found on federal Form 1120, line 9 .........................................................

2

00

3. Loss from Kentucky Form 4797, line 17 .......................................................................................

3

00

4. Safe harbor lease adjustments .....................................................................................................

4

00

5. 50% of the gross royalty income derived from any disposal of coal with a retained

economic interest defined by IRC Section 631(c) and all IRC Section 272 expenses

if the corporation elects not to use percentage depletion ..........................................................

5

00

6. Kentucky special deduction from Schedule HH ..........................................................................

6

00

7. Terminal Railroad Corporation adjustments ...............................................................................

7

00

8. Kentucky allowable passive activity loss .....................................................................................

8

00

9. Kentucky allowable depletion .......................................................................................................

9

00

10. Kentucky contribution deductions ................................................................................................ 10

00

11. Adjustments for qualified construction allowance(s) for short-term lease(s) ............................ 11

00

12. Federal taxable income of all exempt corporations .................................................................... 12

00

13. Amounts received from Tobacco Master Settlement Agreement, Phase II Settlement .......... 13

00

14. Amounts received from funds of the Commodity Credit Corporation for the Tobacco

Loss Assistance Program .............................................................................................................. 14

00

15. Amounts received as a result of a tobacco quota buydown program ...................................... 15

00

16. State Phase II payments received by a producer of tobacco or a tobacco quota owner ......... 16

00

17. Enter subtractions from federal taxable income from Kentucky Schedule(s) K-1 .................... 17

00

18. Other subtractions (attach explanation) ....................................................................................... 18

00

19. Total of lines 1 through 18 (enter on Form 720, Part III, line 16) ................................................ 19

00

1

1 2

2