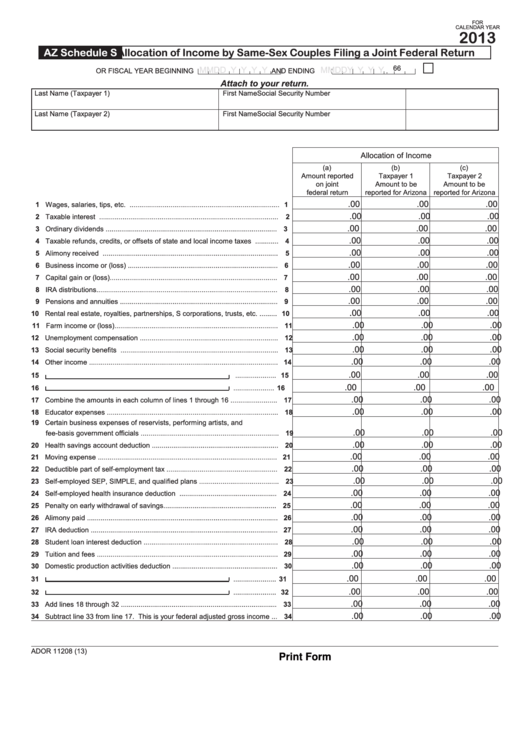

For

Calendar Year

2013

AZ Schedule S

Allocation of Income by Same-Sex Couples Filing a Joint Federal Return

. 66

M M d d Y Y Y Y

M M d d Y Y Y Y

or FISCal Year BeGInnInG

and endInG

Attach to your return.

last name (Taxpayer 1)

First name

Social Security number

last name (Taxpayer 2)

First name

Social Security number

allocation of Income

(a)

(b)

(c)

amount reported

Taxpayer 1

Taxpayer 2

on joint

amount to be

amount to be

federal return

reported for arizona

reported for arizona

.00

.00

.00

1 Wages, salaries, tips, etc. .............................................................................

1

.00

.00

.00

2 Taxable interest ............................................................................................

2

.00

.00

.00

3 ordinary dividends ........................................................................................

3

.00

.00

.00

4 Taxable refunds, credits, or offsets of state and local income taxes ............

4

.00

.00

.00

5 alimony received ..........................................................................................

5

.00

.00

.00

6 Business income or (loss) .............................................................................

6

.00

.00

.00

7 Capital gain or (loss)......................................................................................

7

.00

.00

.00

8 Ira distributions.............................................................................................

8

.00

.00

.00

9 Pensions and annuities .................................................................................

9

.00

.00

.00

10 rental real estate, royalties, partnerships, S corporations, trusts, etc. ......... 10

.00

.00

.00

11 Farm income or (loss).................................................................................... 11

.00

.00

.00

12 Unemployment compensation ....................................................................... 1 2

.00

.00

.00

13 Social security benefits ................................................................................. 13

.00

.00

.00

14 other income ................................................................................................. 14

.00

.00

.00

15

..................... 15

.00

.00

.00

16

..................... 16

.00

.00

.00

17 Combine the amounts in each column of lines 1 through 16 ........................ 17

.00

.00

.00

18 educator expenses ........................................................................................ 18

19 Certain business expenses of reservists, performing artists, and

.00

.00

.00

fee-basis government officials ....................................................................... 19

.00

.00

.00

20 Health savings account deduction ................................................................. 20

.00

.00

.00

21 Moving expense ............................................................................................ 21

.00

.00

.00

22 deductible part of self-employment tax ......................................................... 2 2

.00

.00

.00

23 Self-employed SeP, SIMPle, and qualified plans ......................................... 23

.00

.00

.00

24 Self-employed health insurance deduction .................................................. 24

.00

.00

.00

25 Penalty on early withdrawal of savings.......................................................... 25

.00

.00

.00

26 alimony paid .................................................................................................. 26

.00

.00

.00

27 Ira deduction ................................................................................................ 27

.00

.00

.00

28 Student loan interest deduction ..................................................................... 28

.00

.00

.00

29 Tuition and fees ............................................................................................. 2 9

.00

.00

.00

30 domestic production activities deduction ...................................................... 30

.00

.00

.00

31

...................... 31

.00

.00

.00

32

...................... 32

.00

.00

.00

33 add lines 18 through 32 ................................................................................ 3 3

.00

.00

.00

34 Subtract line 33 from line 17. This is your federal adjusted gross income ... 34

ador 11208 (13)

Print Form

1

1