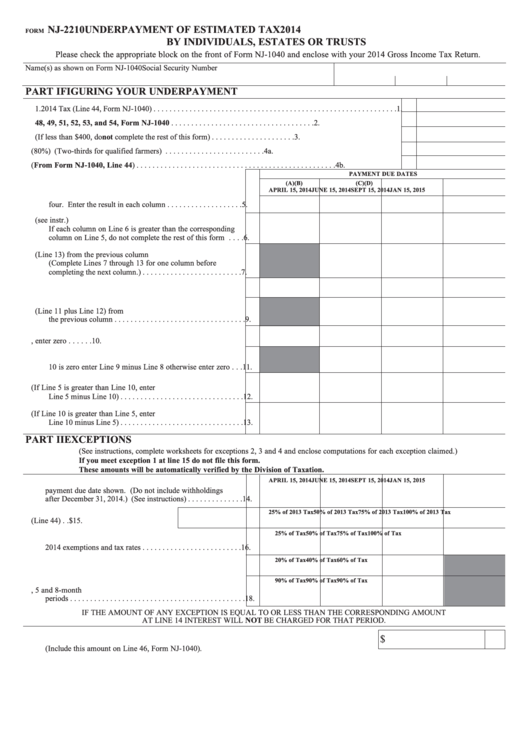

NJ-2210

UNDERPAYMENT OF ESTIMATED TAX

2014

FORM

BY INDIVIDUALS, ESTATES OR TRUSTS

Please check the appropriate block on the front of Form NJ-1040 and enclose with your 2014 Gross Income Tax Return.

Name(s) as shown on Form NJ-1040

Social Security Number

PART I

FIGURING YOUR UNDERPAYMENT

1. 2014 Tax (Line 44, Form NJ-1040) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

2. Enter the total of Lines 48, 49, 51, 52, 53, and 54, Form NJ-1040 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

3. Subtract Line 2 from Line 1 (If less than $400, do not complete the rest of this form) . . . . . . . . . . . . . . . . . . . . . 3.

4a. Multiply the amount on Line 1 by .80 (80%) (Two-thirds for qualified farmers) . . . . . . . . . . . . . . . . . . . . . . . . . 4a.

4b. Enter 2013 tax (From Form NJ-1040, Line 44) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b.

PAYMENT DUE DATES

(A)

(B)

(C)

(D)

APRIL 15, 2014

JUNE 15, 2014

SEPT 15, 2014

JAN 15, 2015

5. Use the lesser amount on either line 4a or 4b and divide by

four. Enter the result in each column . . . . . . . . . . . . . . . . . . .

5.

6. Estimated tax paid and tax withheld per period (see instr.)

If each column on Line 6 is greater than the corresponding

column on Line 5, do not complete the rest of this form . . . .

6.

7. Enter the overpayment (Line 13) from the previous column

(Complete Lines 7 through 13 for one column before

completing the next column.) . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Add Line 6 and Line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Enter the total underpayment (Line 11 plus Line 12) from

the previous column . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Enter Line 8 minus Line 9. If zero or less, enter zero . . . . . . 10.

11. Remaining underpayment from previous period. If Line

10 is zero enter Line 9 minus Line 8 otherwise enter zero . . . 11.

12. UNDERPAYMENT (If Line 5 is greater than Line 10, enter

Line 5 minus Line 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. OVERPAYMENT (If Line 10 is greater than Line 5, enter

Line 10 minus Line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

PART II

EXCEPTIONS

(See instructions, complete worksheets for exceptions 2, 3 and 4 and enclose computations for each exception claimed.)

If you meet exception 1 at line 15 do not file this form.

These amounts will be automatically verified by the Division of Taxation.

APRIL 15, 2014

JUNE 15, 2014

SEPT 15, 2014

JAN 15, 2015

14. Total amount paid and withheld from January 1 through

payment due date shown. (Do not include withholdings

after December 31, 2014.) (See instructions) . . . . . . . . . . . . . . 14.

25% of 2013 Tax

50% of 2013 Tax

75% of 2013 Tax

100% of 2013 Tax

15. Exception 1 - Enter 2013 tax (Line 44) . . $

15.

25% of Tax

50% of Tax

75% of Tax

100% of Tax

16. Exception 2 - Tax on 2013 gross income using

2014 exemptions and tax rates . . . . . . . . . . . . . . . . . . . . . . . . . 16.

20% of Tax

40% of Tax

60% of Tax

17. Exception 3 - Tax on annualized 2014 income . . . . . . . . . . . . . 17.

90% of Tax

90% of Tax

90% of Tax

18. Exception 4 - Tax on 2014 income over 3, 5 and 8-month

periods . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18.

IF THE AMOUNT OF ANY EXCEPTION IS EQUAL TO OR LESS THAN THE CORRESPONDING AMOUNT

AT LINE 14 INTEREST WILL NOT BE CHARGED FOR THAT PERIOD.

$

19. TOTAL INTEREST . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Include this amount on Line 46, Form NJ-1040).

1

1 2

2 3

3 4

4