Form S-101 - Application For Direct Pay Permit - 2013

ADVERTISEMENT

Wisconsin Department of Revenue

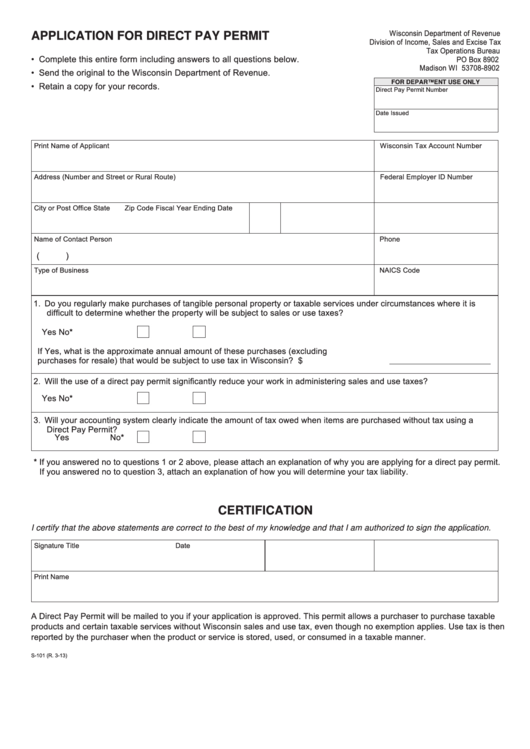

APPLICATION FOR DIRECT PAY PERMIT

Division of Income, Sales and Excise Tax

Tax Operations Bureau

• Complete this entire form including answers to all questions below.

PO Box 8902

Madison WI 53708-8902

• Send the original to the Wisconsin Department of Revenue.

FOR DEPARTMENT USE ONLY

• Retain a copy for your records.

Direct Pay Permit Number

Date Issued

Print Name of Applicant

Wisconsin Tax Account Number

Address (Number and Street or Rural Route)

Federal Employer ID Number

City or Post Office

State

Zip Code

Fiscal Year Ending Date

Name of Contact Person

Phone

(

)

Type of Business

NAICS Code

1. Do you regularly make purchases of tangible personal property or taxable services under circumstances where it is

difficult to determine whether the property will be subject to sales or use taxes?

Yes

No *

If Yes, what is the approximate annual amount of these purchases (excluding

purchases for resale) that would be subject to use tax in Wisconsin? . . . . . . . . . . . . . . . . . $

2. Will the use of a direct pay permit significantly reduce your work in administering sales and use taxes?

Yes

No *

3. Will your accounting system clearly indicate the amount of tax owed when items are purchased without tax using a

Direct Pay Permit?

Yes

No *

* If you answered no to questions 1 or 2 above, please attach an explanation of why you are applying for a direct pay permit.

If you answered no to question 3, attach an explanation of how you will determine your tax liability.

CERTIFICATION

I certify that the above statements are correct to the best of my knowledge and that I am authorized to sign the application.

Signature

Title

Date

Print Name

A Direct Pay Permit will be mailed to you if your application is approved. This permit allows a purchaser to purchase taxable

products and certain taxable services without Wisconsin sales and use tax, even though no exemption applies. Use tax is then

reported by the purchaser when the product or service is stored, used, or consumed in a taxable manner.

S-101 (R. 3-13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2