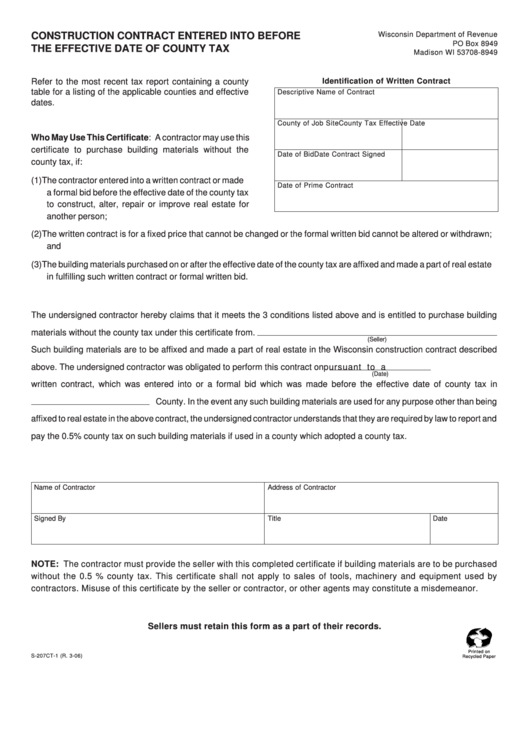

Form S-207ct-1 - Construction Contract Entered Into Before The Effective Date Of County Tax

ADVERTISEMENT

CONSTRUCTION CONTRACT ENTERED INTO BEFORE

Wisconsin Department of Revenue

PO Box 8949

THE EFFECTIVE DATE OF COUNTY TAX

Madison WI 53708-8949

Refer to the most recent tax report containing a county

Identification of Written Contract

table for a listing of the applicable counties and effective

Descriptive Name of Contract

dates.

County of Job Site

County Tax Effective Date

Who May Use This Certificate: A contractor may use this

certificate to purchase building materials without the

Date of Bid

Date Contract Signed

county tax, if:

(1) The contractor entered into a written contract or made

Date of Prime Contract

a formal bid before the effective date of the county tax

to construct, alter, repair or improve real estate for

another person;

(2) The written contract is for a fixed price that cannot be changed or the formal written bid cannot be altered or withdrawn;

and

(3) The building materials purchased on or after the effective date of the county tax are affixed and made a part of real estate

in fulfilling such written contract or formal written bid.

The undersigned contractor hereby claims that it meets the 3 conditions listed above and is entitled to purchase building

materials without the county tax under this certificate from

.

(Seller)

Such building materials are to be affixed and made a part of real estate in the Wisconsin construction contract described

above. The undersigned contractor was obligated to perform this contract on

pursuant to a

(Date)

written contract, which was entered into or a formal bid which was made before the effective date of county tax in

County. In the event any such building materials are used for any purpose other than being

affixed to real estate in the above contract, the undersigned contractor understands that they are required by law to report and

pay the 0.5% county tax on such building materials if used in a county which adopted a county tax.

Name of Contractor

Address of Contractor

Signed By

Title

Date

NOTE: The contractor must provide the seller with this completed certificate if building materials are to be purchased

without the 0.5 % county tax. This certificate shall not apply to sales of tools, machinery and equipment used by

contractors. Misuse of this certificate by the seller or contractor, or other agents may constitute a misdemeanor.

Sellers must retain this form as a part of their records.

Printed on

S-207CT-1 (R. 3-06)

Recycled Paper

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1