Form Rv-207 - Certificate Of Exemption For Rental Vehicles

ADVERTISEMENT

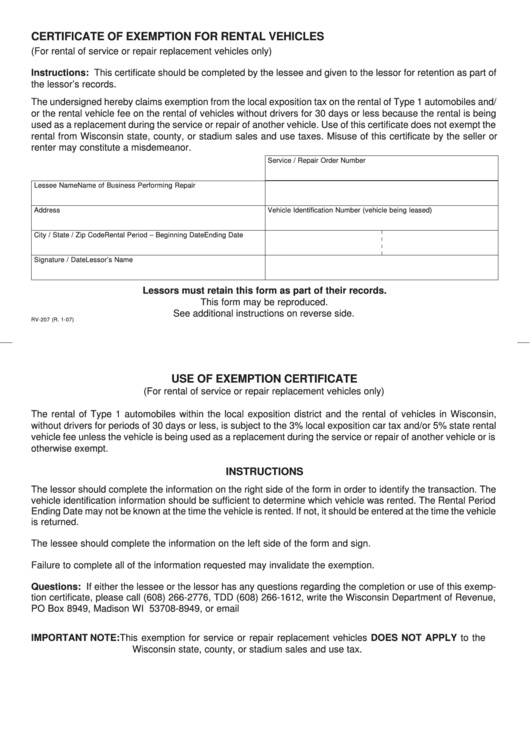

CERTIFICATE OF EXEMPTION FOR RENTAL VEHICLES

(For rental of service or repair replacement vehicles only)

Instructions: This certificate should be completed by the lessee and given to the lessor for retention as part of

the lessor’s records.

The undersigned hereby claims exemption from the local exposition tax on the rental of Type 1 automobiles and/

or the rental vehicle fee on the rental of vehicles without drivers for 30 days or less because the rental is being

used as a replacement during the service or repair of another vehicle. Use of this certificate does not exempt the

rental from Wisconsin state, county, or stadium sales and use taxes. Misuse of this certificate by the seller or

renter may constitute a misdemeanor.

Service / Repair Order Number

Lessee Name

Name of Business Performing Repair

Address

Vehicle Identification Number (vehicle being leased)

City / State / Zip Code

Rental Period – Beginning Date

Ending Date

Signature / Date

Lessor’s Name

Lessors must retain this form as part of their records.

This form may be reproduced.

See additional instructions on reverse side.

RV-207 (R. 1-07)

USE OF EXEMPTION CERTIFICATE

(For rental of service or repair replacement vehicles only)

The rental of Type 1 automobiles within the local exposition district and the rental of vehicles in Wisconsin,

without drivers for periods of 30 days or less, is subject to the 3% local exposition car tax and/or 5% state rental

vehicle fee unless the vehicle is being used as a replacement during the service or repair of another vehicle or is

otherwise exempt.

INSTRUCTIONS

The lessor should complete the information on the right side of the form in order to identify the transaction. The

vehicle identification information should be sufficient to determine which vehicle was rented. The Rental Period

Ending Date may not be known at the time the vehicle is rented. If not, it should be entered at the time the vehicle

is returned.

The lessee should complete the information on the left side of the form and sign.

Failure to complete all of the information requested may invalidate the exemption.

Questions: If either the lessee or the lessor has any questions regarding the completion or use of this exemp-

tion certificate, please call (608) 266-2776, TDD (608) 266-1612, write the Wisconsin Department of Revenue,

PO Box 8949, Madison WI 53708-8949, or email sales10@dor.state.wi.us.

IMPORTANT NOTE:

This exemption for service or repair replacement vehicles DOES NOT APPLY to the

Wisconsin state, county, or stadium sales and use tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1