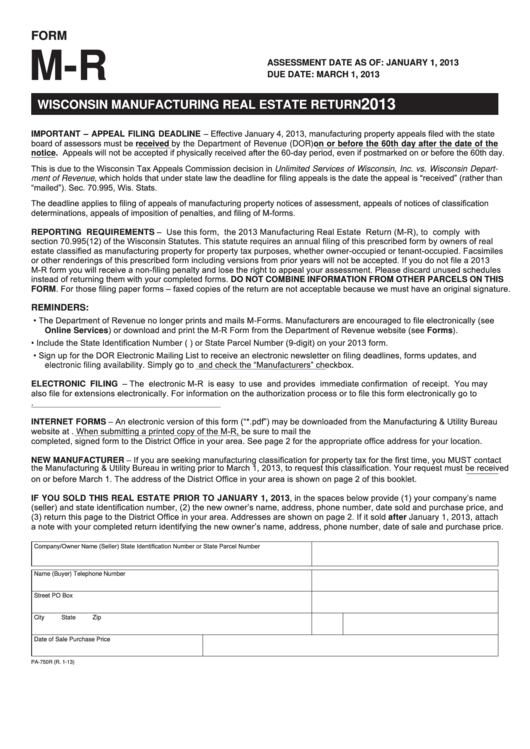

FORM

M-R

ASSESSMENT DATE AS OF:

JANUARY 1, 2013

DUE DATE:

MARCH 1, 2013

2013

WISCONSIN MANUFACTURING REAL ESTATE RETURN

IMPORTANT – APPEAL FILING DEADLINE – Effective January 4, 2013, manufacturing property appeals filed with the state

board of assessors must be received by the Department of Revenue (DOR) on or before the 60th day after the date of the

notice. Appeals will not be accepted if physically received after the 60-day period, even if postmarked on or before the 60th day.

This is due to the Wisconsin Tax Appeals Commission decision in Unlimited Services of Wisconsin, Inc. vs. Wisconsin Depart‑

ment of Revenue, which holds that under state law the deadline for filing appeals is the date the appeal is “received” (rather than

“mailed”). Sec. 70.995, Wis. Stats.

The deadline applies to filing of appeals of manufacturing property notices of assessment, appeals of notices of classification

determinations, appeals of imposition of penalties, and filing of M-forms.

REPORTING REQUIREMENTS – Use this form, the 2013 Manufacturing Real Estate Return (M-R), to comply with

section 70.995(12) of the Wisconsin Statutes. This statute requires an annual filing of this prescribed form by owners of real

estate classified as manufacturing property for property tax purposes, whether owner-occupied or tenant-occupied. Facsimiles

or other renderings of this prescribed form including versions from prior years will not be accepted. If you do not file a 2013

M-R form you will receive a non-filing penalty and lose the right to appeal your assessment. Please discard unused schedules

instead of returning them with your completed forms. DO NOT COMBINE INFORMATION FROM OTHER PARCELS ON THIS

FORM. For those filing paper forms – faxed copies of the return are not acceptable because we must have an original signature.

REMINDERS:

• The Department of Revenue no longer prints and mails M-Forms. Manufacturers are encouraged to file electronically (see

Online Services) or download and print the M-R Form from the Department of Revenue website (see Forms).

• Include the State Identification Number (e.g. 76-13-251-R-000136257) or State Parcel Number (9-digit) on your 2013 form.

• Sign up for the DOR Electronic Mailing List to receive an electronic newsletter on filing deadlines, forms updates, and

and check the “Manufacturers” checkbox.

electronic filing availability. Simply go to

ELECTRONIC FILING – The electronic M-R is easy to use and provides immediate confirmation of receipt. You may

also file for extensions electronically. For information on the authorization process or to file this form electronically go to

INTERNET FORMS – An electronic version of this form (“*.pdf”) may be downloaded from the Manufacturing & Utility Bureau

website at When submitting a printed copy of the M-R, be sure to mail the

completed, signed form to the District Office in your area. See page 2 for the appropriate office address for your location.

NEW MANUFACTURER – If you are seeking manufacturing classification for property tax for the first time, you MUST contact

the Manufacturing & Utility Bureau in writing prior to March 1, 2013, to request this classification. Your request must be received

on or before March 1. The address of the District Office in your area is shown on page 2 of this booklet.

IF YOU SOLD THIS REAL ESTATE PRIOR TO JANUARY 1, 2013, in the spaces below provide (1) your company’s name

(seller) and state identification number, (2) the new owner’s name, address, phone number, date sold and purchase price, and

(3) return this page to the District Office in your area. Addresses are shown on page 2. If it sold after January 1, 2013, attach

a note with your completed return identifying the new owner’s name, address, phone number, date of sale and purchase price.

Company/Owner Name (Seller)

State Identification Number or State Parcel Number

Name (Buyer)

Telephone Number

Street

PO Box

City

State

Zip

Date of Sale

Purchase Price

PA-750R (R. 1-13)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12