Tab to navigate within form. Use mouse to check

Save

Print

Clear

applicable boxes, press spacebar or press Enter.

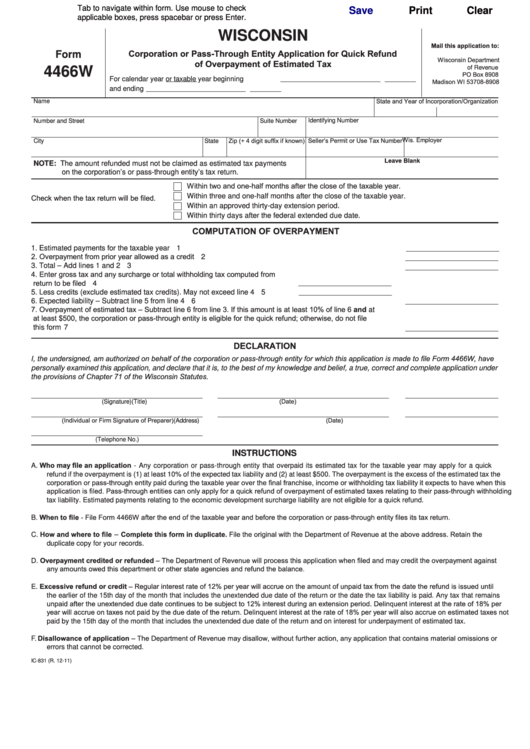

WISCONSIN

Mail this application to:

Corporation or Pass-Through Entity Application for Quick Refund

Form

Wisconsin Department

of Overpayment of Estimated Tax

4466W

of Revenue

PO Box 8908

For calendar year

or taxable year beginning

Madison WI 53708-8908

and ending

State and Year of Incorporation/Organization

Name

Identifying Number

Number and Street

Suite Number

Seller’s Permit or Use Tax Number Wis. Employer I.D. Number

Zip (+ 4 digit suffix if known)

City

State

Leave Blank

NOTE: The amount refunded must not be claimed as estimated tax payments

on the corporation’s or pass-through entity’s tax return.

Within two and one-half months after the close of the taxable year.

Check when the tax return will be filed.

Within three and one-half months after the close of the taxable year.

Within an approved thirty-day extension period.

Within thirty days after the federal extended due date.

COMPUTATION OF OVERPAYMENT

1. Estimated payments for the taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2. Overpayment from prior year allowed as a credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3. Total – Add lines 1 and 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4. Enter gross tax and any surcharge or total withholding tax computed from

return to be filed . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5. Less credits (exclude estimated tax credits). May not exceed line 4 . . . . . . 5

6. Expected liability – Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7. Overpayment of estimated tax – Subtract line 6 from line 3. If this amount is at least 10% of line 6 and at

at least $500, the corporation or pass-through entity is eligible for the quick refund; otherwise, do not file

this form . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

DECLARATION

I, the undersigned, am authorized on behalf of the corporation or pass-through entity for which this application is made to file Form 4466W, have

personally examined this application, and declare that it is, to the best of my knowledge and belief, a true, correct and complete application under

the provisions of Chapter 71 of the Wisconsin Statutes.

(Date)

(Signature)

(Title)

(Individual or Firm Signature of Preparer)

(Date)

(Address)

(Telephone No.)

INSTRUCTIONS

Who may file an application - Any corporation or pass-through entity that overpaid its estimated tax for the taxable year may apply for a quick

A.

refund if the overpayment is (1) at least 10% of the expected tax liability and (2) at least $500. The overpayment is the excess of the estimated tax the

corporation or pass-through entity paid during the taxable year over the final franchise, income or withholding tax liability it expects to have when this

application is filed. Pass-through entities can only apply for a quick refund of overpayment of estimated taxes relating to their pass-through withholding

tax liability. Estimated payments relating to the economic development surcharge liability are not eligible for a quick refund.

When to file - File Form 4466W after the end of the taxable year and before the corporation or pass-through entity files its tax return.

B.

How and where to file – Complete this form in duplicate. File the original with the Department of Revenue at the above address. Retain the

C.

duplicate copy for your records.

D.

Overpayment credited or refunded – The Department of Revenue will process this application when filed and may credit the overpayment against

any amounts owed this department or other state agencies and refund the balance.

Excessive refund or credit – Regular interest rate of 12% per year will accrue on the amount of unpaid tax from the date the refund is issued until

E.

the earlier of the 15th day of the month that includes the unextended due date of the return or the date the tax liability is paid. Any tax that remains

unpaid after the unextended due date continues to be subject to 12% interest during an extension period. Delinquent interest at the rate of 18% per

year will accrue on taxes not paid by the due date of the return. Delinquent interest at the rate of 18% per year will also accrue on estimated taxes not

paid by the 15th day of the month that includes the unextended due date of the return and on interest for underpayment of estimated tax.

Disallowance of application – The Department of Revenue may disallow, without further action, any application that contains material omissions or

F.

errors that cannot be corrected.

IC-831 (R. 12-11)

1

1