Print

Reset

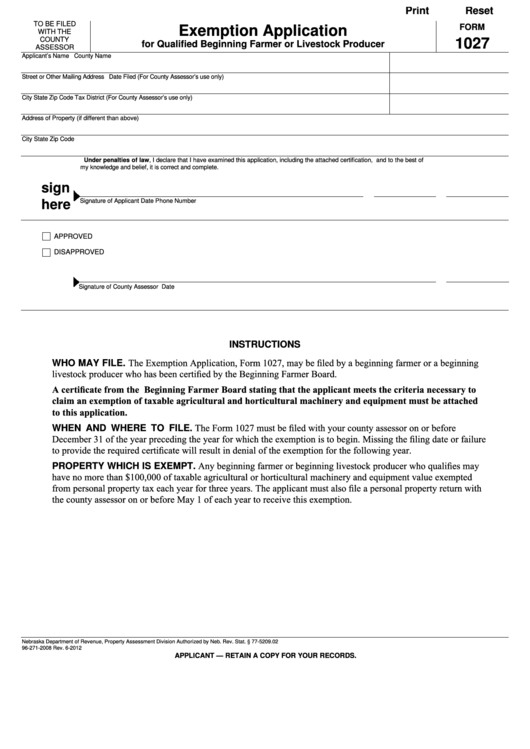

TO BE FILED

FORM

Exemption Application

WITH THE

COUNTY

1027

for Qualified Beginning Farmer or Livestock Producer

ASSESSOR

Applicant’s Name

County Name

Street or Other Mailing Address

Date Filed (For County Assessor’s use only)

City

State

Zip Code Tax District (For County Assessor’s use only)

Address of Property (if different than above)

City

State

Zip Code

Under penalties of law, I declare that I have examined this application, including the attached certification, and to the best of

my knowledge and belief, it is correct and complete.

sign

Signature of Applicant

Date

Phone Number

here

APPROVED

DISAPPROVED

Signature of County Assessor

Date

INSTRUCTIONS

WHO MAY FILE. The Exemption Application, Form 1027, may be filed by a beginning farmer or a beginning

livestock producer who has been certified by the Beginning Farmer Board.

A certificate from the Beginning Farmer Board stating that the applicant meets the criteria necessary to

claim an exemption of taxable agricultural and horticultural machinery and equipment must be attached

to this application.

WHEN AND WHERE TO FILE. The Form 1027 must be filed with your county assessor on or before

December 31 of the year preceding the year for which the exemption is to begin. Missing the filing date or failure

to provide the required certificate will result in denial of the exemption for the following year.

PROPERTY WHICH IS EXEMPT. Any beginning farmer or beginning livestock producer who qualifies may

have no more than $100,000 of taxable agricultural or horticultural machinery and equipment value exempted

from personal property tax each year for three years. The applicant must also file a personal property return with

the county assessor on or before May 1 of each year to receive this exemption.

Nebraska Department of Revenue, Property Assessment Division

Authorized by Neb. Rev. Stat.

§

77-5209.02

96-271-2008 Rev. 6-2012

APPLICANT — RETAIN A COPY FOR YOUR RECORDS.

1

1