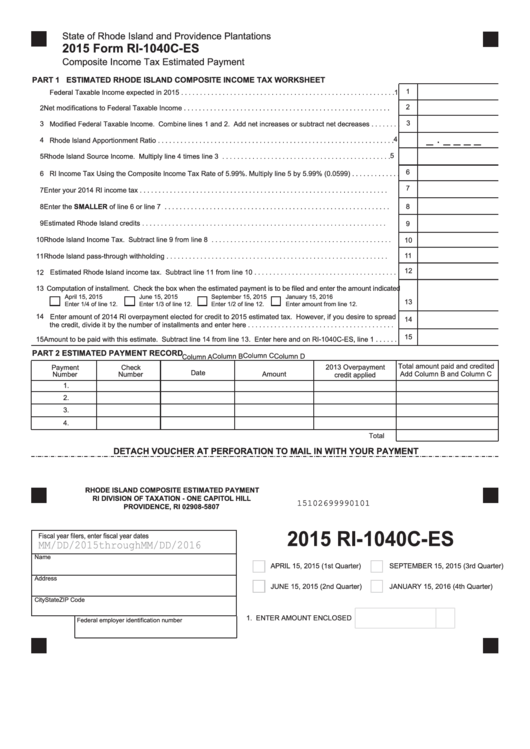

State of Rhode Island and Providence Plantations

2015 Form RI-1040C-ES

Composite Income Tax Estimated Payment

PART 1 ESTIMATED RHODE ISLAND COMPOSITE INCOME TAX WORKSHEET

1

1

Federal Taxable Income expected in 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2 Net modifications to Federal Taxable Income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

3

Modified Federal Taxable Income. Combine lines 1 and 2. Add net increases or subtract net decreases . . . . . . . .

_ . _ _ _ _

4

4

Rhode Island Apportionment Ratio . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Rhode Island Source Income. Multiply line 4 times line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

6

RI Income Tax Using the Composite Income Tax Rate of 5.99%. Multiply line 5 by 5.99% (0.0599) . . . . . . . . . . . . .

7

7 Enter your 2014 RI income tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 Enter the SMALLER of line 6 or line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9 Estimated Rhode Island credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10 Rhode Island Income Tax. Subtract line 9 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11

11 Rhode Island pass-through withholding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

12 Estimated Rhode Island income tax. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Computation of installment. Check the box when the estimated payment is to be filed and enter the amount indicated

April 15, 2015

June 15, 2015

September 15, 2015

January 15, 2016

13

Enter 1/4 of line 12.

Enter 1/3 of line 12.

Enter 1/2 of line 12.

Enter amount from line 12.

14 Enter amount of 2014 RI overpayment elected for credit to 2015 estimated tax. However, if you desire to spread

14

the credit, divide it by the number of installments and enter here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15 Amount to be paid with this estimate. Subtract line 14 from line 13. Enter here and on RI-1040C-ES, line 1 . . . . . .

PART 2 ESTIMATED PAYMENT RECORD

Column C

Column B

Column D

Column A

Total amount paid and credited

Payment

2013 Overpayment

Check

Date

Number

Amount

Add Column B and Column C

Number

credit applied

1.

2.

3.

4.

Total

DETACH VOUCHER AT PERFORATION TO MAIL IN WITH YOUR PAYMENT

RHODE ISLAND COMPOSITE ESTIMATED PAYMENT

RI DIVISION OF TAXATION - ONE CAPITOL HILL

15102699990101

PROVIDENCE, RI 02908-5807

2015 RI-1040C-ES

Fiscal year filers, enter fiscal year dates

MM/DD/2015 through MM/DD/2016

Name

APRIL 15, 2015 (1st Quarter)

SEPTEMBER 15, 2015 (3rd Quarter)

Address

JUNE 15, 2015 (2nd Quarter)

JANUARY 15, 2016 (4th Quarter)

City

State

ZIP Code

1. ENTER AMOUNT ENCLOSED

Federal employer identification number

1

1