Print

Reset

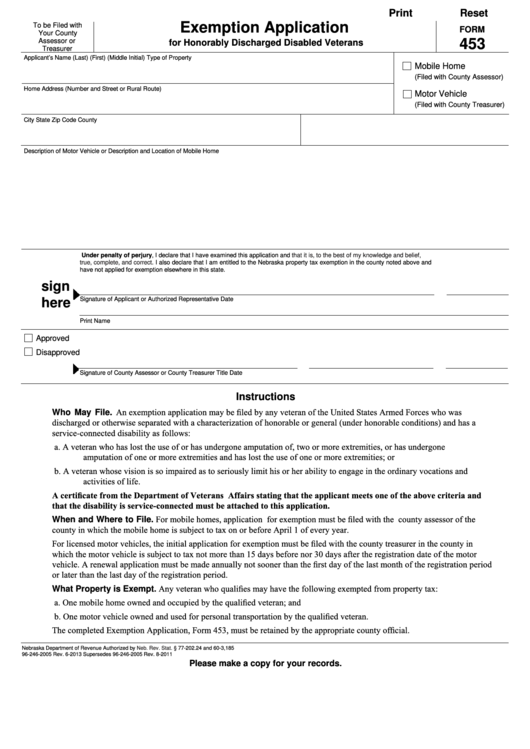

Exemption Application

To be Filed with

FORM

Your County

453

Assessor or

for Honorably Discharged Disabled Veterans

Treasurer

Applicant’s Name (Last)

(First)

(Middle Initial)

Type of Property

Mobile Home

(Filed with County Assessor)

Home Address (Number and Street or Rural Route)

Motor Vehicle

(Filed with County Treasurer)

City

State

Zip Code

County

Description of Motor Vehicle or Description and Location of Mobile Home

Under penalty of perjury, I declare that I have examined this application and

that it is, to the best of my knowledge and belief,

true, complete, and

correct. I also declare that I am entitled to the Nebraska property tax exemption in the county noted above and

have not applied for exemption elsewhere in this state.

sign

Signature of Applicant or Authorized Representative

Date

here

Print Name

Approved

Disapproved

Signature of County Assessor or County Treasurer

Title

Date

Instructions

Who May File. An exemption application may be filed by any veteran of the United States Armed Forces who was

discharged or otherwise separated with a characterization of honorable or general (under honorable conditions) and has a

service-connected disability as follows:

a.

A veteran who has lost the use of or has undergone amputation of, two or more extremities, or has undergone

amputation of one or more extremities and has lost the use of one or more extremities; or

b. A veteran whose vision is so impaired as to seriously limit his or her ability to engage in the ordinary vocations and

activities of life.

A certificate from the Department of Veterans Affairs stating that the applicant meets one of the above criteria and

that the disability is service-connected must be attached to this application.

When and Where to File. For mobile homes, application for exemption must be filed with the county assessor of the

county in which the mobile home is subject to tax on or before April 1 of every year.

For licensed motor vehicles, the initial application for exemption must be filed with the county treasurer in the county in

which the motor vehicle is subject to tax not more than 15 days before nor 30 days after the registration date of the motor

vehicle. A renewal application must be made annually not sooner than the first day of the last month of the registration period

or later than the last day of the registration period.

What Property is Exempt. Any veteran who qualifies may have the following exempted from property tax:

a.

One mobile home owned and occupied by the qualified veteran; and

b. One motor vehicle owned and used for personal transportation by the qualified veteran.

The completed Exemption Application, Form 453, must be retained by the appropriate county official.

Nebraska Department of Revenue

Authorized by

Neb. Rev. Stat. §

77-202.24 and 60-3,185

96-246-2005 Rev. 6-2013 Supersedes 96-246-2005 Rev. 8-2011

Please make a copy for your records.

1

1