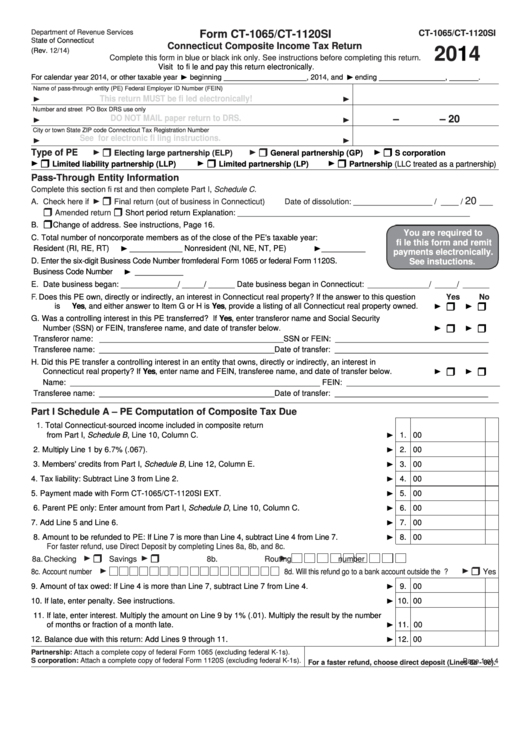

Form Ct-1065/ct-1120si - Connecticut Composite Income Tax Return - 2014

ADVERTISEMENT

Department of Revenue Services

Form CT-1065/CT-1120SI

CT-1065/CT-1120SI

State of Connecticut

Connecticut Composite Income Tax Return

2014

(Rev.

12/14)

Complete this form in blue or black ink only. See instructions before completing this return.

Visit to fi le and pay this return electronically.

For calendar year 2014, or other taxable year

beginning ____________________ , 2014, and

ending ________________ , _______ .

Name of pass-through entity (PE)

Federal Employer ID Number (FEIN)

This return MUST be fi led electronically!

Number and street

PO Box

DRS use only

DO NOT MAIL paper return to DRS.

–

– 20

City or town

State

ZIP code

Connecticut Tax Registration Number

See for electronic fi ling instructions.

Type of PE

Electing large partnership (ELP)

General partnership (GP)

S corporation

Limited liability partnership (LLP)

Limited partnership (LP)

Partnership (LLC treated as a partnership)

Pass-Through Entity Information

Complete this section fi rst and then complete Part I, Schedule C.

20

A. Check here if

Final return (out of business in Connecticut)

Date of dissolution: __________________ / ____ /

___

Amended return

Short period return

Explanation: _____________________________________________________

B.

Change of address. See instructions, Page 16.

You are required to

C. Total number of noncorporate members as of the close of the PE's taxable year:

fi le this form and remit

Resident (RI, RE, RT)

____________

Nonresident (NI, NE, NT, PE)

__________

payments electronically.

D. Enter the six-digit Business Code Number from federal Form 1065 or federal Form 1120S.

See instuctions.

Business Code Number

___________

E. Date business began: _____________ / _____/ ______ Date business began in Connecticut:

______________ / _____ / ______

F.

Does this PE own, directly or indirectly, an interest in Connecticut real property? If the answer to this question

Yes

No

is Yes, and either answer to Item G or H is Yes, provide a listing of all Connecticut real property owned. ........

G. Was a controlling interest in this PE transferred? If Yes, enter transferor name and Social Security

Number (SSN) or FEIN, transferee name, and date of transfer below. ................................................................

Transferor name: __________________________________________ SSN or FEIN: ___________________________________

Transferee name: ________________________________________ Date of transfer: ___________________________________

H. Did this PE transfer a controlling interest in an entity that owns, directly or indirectly, an interest in

Connecticut real property? If Yes, enter name and FEIN, transferee name, and date of transfer below. ............

Name: _________________________________________________________ FEIN: ___________________________________

Transferee name: ________________________________________ Date of transfer: ___________________________________

Part I Schedule A – PE Computation of Composite Tax Due

1.

Total Connecticut-sourced income included in composite return

from Part I, Schedule B, Line 10, Column C.

................................................................................

1.

00

2. Multiply Line 1 by 6.7% (.067). ...........................................................................................................

2.

00

3. Members' credits from Part I, Schedule B, Line 12, Column E. .........................................................

3.

00

4. Tax liability: Subtract Line 3 from Line 2. ............................................................................................

4.

00

5. Payment made with Form CT-1065/CT-1120SI EXT. .........................................................................

5.

00

6. Parent PE only: Enter amount from Part I, Schedule D, Line 10, Column C. .....................................

6.

00

7. Add Line 5 and Line 6. .......................................................................................................................

7.

00

8. Amount to be refunded to PE: If Line 7 is more than Line 4, subtract Line 4 from Line 7. ...................

8.

00

For faster refund, use Direct Deposit by completing Lines 8a, 8b, and 8c.

8a. Checking

Savings

8b. Routing number

8c. Account number

8d. Will this refund go to a bank account outside the U.S.?

Yes

9. Amount of tax owed: If Line 4 is more than Line 7, subtract Line 7 from Line 4. ...............................

9.

00

10. If late, enter penalty. See instructions. ...............................................................................................

10.

00

11. If late, enter interest. Multiply the amount on Line 9 by 1% (.01). Multiply the result by the number

of months or fraction of a month late. .................................................................................................

11.

00

12. Balance due with this return: Add Lines 9 through 11. .......................................................................

12.

00

Partnership: Attach a complete copy of federal Form 1065 (excluding federal K-1s).

S corporation: Attach a complete copy of federal Form 1120S (excluding federal K-1s).

Page 1 of 4

For a faster refund, choose direct deposit (Lines 8a - 8c).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4