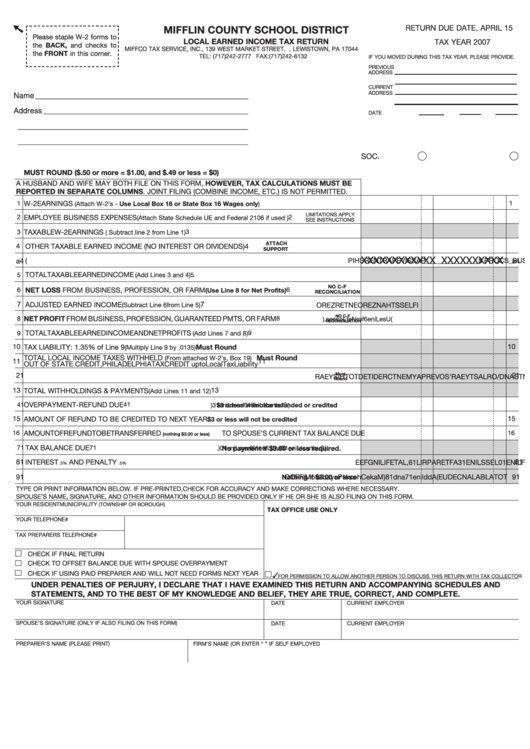

Local Earned Income Tax Return - Mifflin County School District - 2007

ADVERTISEMENT

RETURN DUE DATE, APRIL 15

MIFFLIN COUNTY SCHOOL DISTRICT

Please staple W-2 forms to

LOCAL EARNED INCOME TAX RETURN

TAX YEAR 2007

the BACK, and checks to

MIFFCO TAX SERVICE, INC., 139 WEST MARKET STREET, P.O.BOX 746, LEWISTOWN, PA 17044

the FRONT in this corner.

TEL: (717) 242-2777 FAX: (717) 242-6132

IF YOU MOVED DURING THIS TAX YEAR, PLEASE PROVIDE.

PREVIOUS

ADDRESS

CURRENT

ADDRESS

Name __________________________________________________

Address ________________________________________________

DATE MOVED

MO.

DAY

YR.

______________________________________________________

______________________________________________________

SOC. SEC. NO. A

SOC. SEC. NO. B

MUST ROUND ($.50 or more = $1.00, and $.49 or less = $0)

A HUSBAND AND WIFE MAY BOTH FILE ON THIS FORM, HOWEVER, TAX CALCULATIONS MUST BE

REPORTED IN SEPARATE COLUMNS. JOINT FILING (COMBINE INCOME, ETC.) IS NOT PERMITTED.

1

W-2 EARNINGS

1

(Attach W-2’s - Use Local Box 18 or State Box 16 Wages only)

LIMITATIONS APPLY

2

EMPLOYEE BUSINESS EXPENSES

2

(Attach State Schedule UE and Federal 2106 if used )

SEE INSTRUCTIONS

3

TAXABLE W-2 EARNINGS

3

( Subtract line 2 from Line 1)

ATTACH

4

OTHER TAXABLE EARNED INCOME (NO INTEREST OR DIVIDENDS)

4

SUPPORT

XXXXXXXXXXXX XXXXXXXXXX

4

a

N I

F

O

O

N

L

) Y

K

1 -

E

A

R

N

N I

G

S

$

_ _

_ _

_ _

_ _

_ _

_ _

S

U

B

_

S

C

O

R

. P

$

_

_ _

_ _

_ _

_ _

_ _

_ _

_ _

P

A

S

S

V I

E

P

A

R

T

N

E

R

S

H

P I

4

a

TOTAL TAXABLE EARNED INCOME

5

(Add Lines 3 and 4)

5

NO C-F

6

NET LOSS FROM BUSINESS, PROFESSION, OR FARM

6

(Use Line 8 for Net Profits)

RECONCILIATION

7

7

ADJUSTED EARNED INCOME

F I

L

E

S

S

T

H

A

N

Z

E

R

O

E

N

T

E

R

Z

E

R

O

(Subtract Line 6 from Line 5)

NO C-F

8

NET PROFIT FROM BUSINESS, PROFESSION, GUARANTEED PMTS, OR FARM

8

U (

e s

i L

e n

f 6

r o

N

e

L t

s o

e s

) . s

RECONCILIATION

9

TOTAL TAXABLE EARNED INCOME AND NET PROFITS

9

(Add Lines 7 and 8)

10

10

TAX LIABILITY: 1.35% of Line 9

Must Round

(Multiply Line 9 by .0135)

TOTAL LOCAL INCOME TAXES WITHHELD

Must Round

(From attached W-2’s, Box 19)

11

11

OUT OF STATE CREDIT, PHILADELPHIA TAX CREDIT up to Local Tax Liability

1

2

Must

1

2

Q

U

A

R

T

E

R

L

Y

P

A

Y

M

E

N

T

S

A

N

/ D

O

R

L

A

S

T

Y

E

A

R

S ’

O

V

E

R

P

A

Y

M

E

N

T

C

R

E

D

T I

E

D

T

O

T

H

S I

Y

E

A

R

Round

13

13

TOTAL WITHHOLDINGS & PAYMENTS

(Add Lines 11 and 12)

1

4

OVERPAYMENT-REFUND DUE

1

4

S (

u

t b

a r

t c

L

n i

e

1

0

f

o r

m

L

n i

e

1

) 3

$3 or less will not be refunded or credited

15

15

AMOUNT OF REFUND TO BE CREDITED TO NEXT YEAR

$3 or less will not be credited

16

AMOUNT OF REFUND TO BE TRANSFERRED

TO SPOUSE’S CURRENT TAX BALANCE DUE

16

(nothing $3.00 or less)

1

7

TAX BALANCE DUE

No payment if $3.00 or less required.

1

7

S (

u

t b

a r

t c

L

n i

e

1

3

a

n

d

L

n i

e

1

6

f

o r

m

L

n i

e

1

0

. )

1

8

1

8

INTEREST

AND PENALTY

1 -

%

P

E

R

M

O

N

T

H

O

F

L

N I

E

1

0

L

E

S

S

L

N I

E

1

3

A

F

T

E

R

A

P

R

L I

1

6

L ,

A

T

E

F

L I

N I

G

F

E

E

.5%

.5%

1

9

T

O

T

A

L

B

A

L

A

N

C

E

D

U

E

A (

d

d

n i l

e

1

7

a

n

d

1

) 8

M

a

k

e

C

h

e

c

s k

P

a

a y

b

e l

o t

M

F I

F

C

. O

Nothing if $3.00 or less

1

9

TYPE OR PRINT INFORMATION BELOW. IF PRE-PRINTED, CHECK FOR ACCURACY AND MAKE CORRECTIONS WHERE NECESSARY.

SPOUSE’S NAME, SIGNATURE, AND OTHER INFORMATION SHOULD BE PROVIDED ONLY IF HE OR SHE IS ALSO FILING ON THIS FORM.

YOUR RESIDENT MUNICIPALITY

(TOWNSHIP OR BOROUGH)

TAX OFFICE USE ONLY

YOUR TELEPHONE#

TAX PREPARERS TELEPHONE#

CHECK IF FINAL RETURN

CHECK TO OFFSET BALANCE DUE WITH SPOUSE OVERPAYMENT

CHECK IF USING PAID PREPARER AND WILL NOT NEED FORMS NEXT YEAR

FOR PERMISSION TO ALLOW ANOTHER PERSON TO DISCUSS THIS RETURN WITH TAX COLLECTOR

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND

STATEMENTS, AND TO THE BEST OF MY KNOWLEDGE AND BELIEF, THEY ARE TRUE, CORRECT, AND COMPLETE.

YOUR SIGNATURE

DATE

CURRENT EMPLOYER

SPOUSE’S SIGNATURE (ONLY IF ALSO FILING ON THIS FORM)

DATE

CURRENT EMPLOYER

PREPARER’S NAME (PLEASE PRINT)

FIRM’S NAME (OR ENTER “S.E.” IF SELF EMPLOYED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1