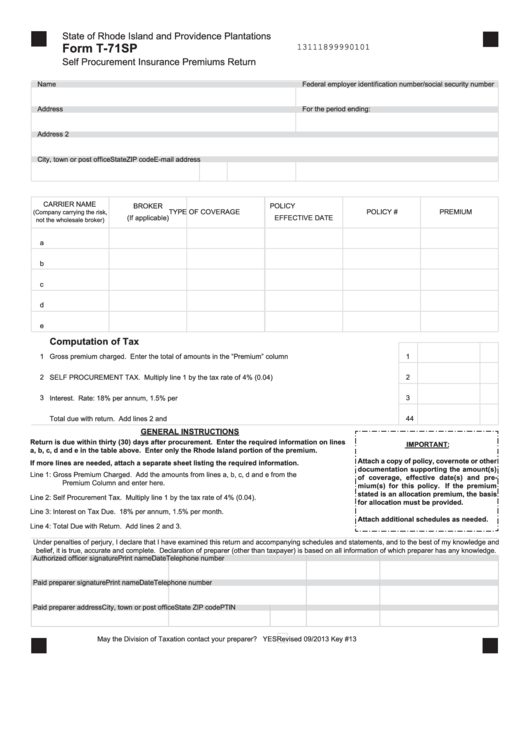

State of Rhode Island and Providence Plantations

Form T-71SP

13111899990101

Self Procurement Insurance Premiums Return

Name

Federal employer identification number/social security number

Address

For the period ending:

Address 2

City, town or post office

State

ZIP code

E-mail address

CARRIER NAME

BROKER

POLICY

TYPE OF COVERAGE

POLICY #

PREMIUM

(Company carrying the risk,

(If applicable)

EFFECTIVE DATE

not the wholesale broker)

a

b

c

d

e

Computation of Tax

1

Gross premium charged. Enter the total of amounts in the “Premium” column above...............................................

1

2

SELF PROCUREMENT TAX. Multiply line 1 by the tax rate of 4% (0.04)..................................................................

2

3

Interest. Rate: 18% per annum, 1.5% per month.......................................................................................................

4

Total due with return. Add lines 2 and 3......................................................................................................................

4

Return is due within thirty (30) days after procurement. Enter the required information on lines

IMPORTANT:

a, b, c, d and e in the table above. Enter only the Rhode Island portion of the premium.

Attach a copy of policy, covernote or other

If more lines are needed, attach a separate sheet listing the required information.

documentation supporting the amount(s)

Line 1:

Gross Premium Charged. Add the amounts from lines a, b, c, d and e from the

of coverage, effective date(s) and pre-

Premium Column and enter here.

mium(s) for this policy. If the premium

stated is an allocation premium, the basis

Line 2:

Self Procurement Tax. Multiply line 1 by the tax rate of 4% (0.04).

for allocation must be provided.

Line 3:

Interest on Tax Due. 18% per annum, 1.5% per month.

Attach additional schedules as needed.

Line 4:

Total Due with Return. Add lines 2 and 3.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, it is true, accurate and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Authorized officer signature

Print name

Date

Telephone number

Paid preparer signature

Print name

Date

Telephone number

Paid preparer address

City, town or post office

State

ZIP code

PTIN

May the Division of Taxation contact your preparer? YES

Revised 09/2013

Key #13

1

1