Sample Audit Agreement - Appendix D Template

ADVERTISEMENT

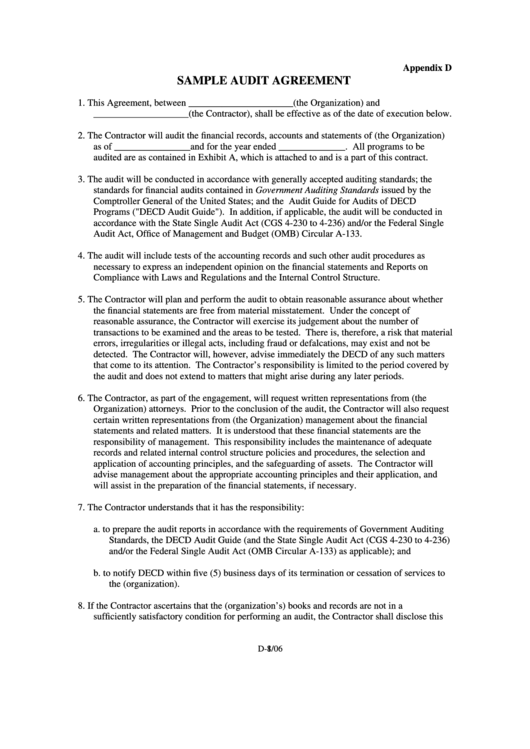

Appendix D

SAMPLE AUDIT AGREEMENT

1. This Agreement, between ______________________(the Organization) and

____________________(the Contractor), shall be effective as of the date of execution below.

2. The Contractor will audit the financial records, accounts and statements of (the Organization)

as of ________________and for the year ended ______________. All programs to be

audited are as contained in Exhibit A, which is attached to and is a part of this contract.

3. The audit will be conducted in accordance with generally accepted auditing standards; the

standards for financial audits contained in Government Auditing Standards issued by the

Comptroller General of the United States; and the Audit Guide for Audits of DECD

Programs ("DECD Audit Guide"). In addition, if applicable, the audit will be conducted in

accordance with the State Single Audit Act (CGS 4-230 to 4-236) and/or the Federal Single

Audit Act, Office of Management and Budget (OMB) Circular A-133.

4. The audit will include tests of the accounting records and such other audit procedures as

necessary to express an independent opinion on the financial statements and Reports on

Compliance with Laws and Regulations and the Internal Control Structure.

5. The Contractor will plan and perform the audit to obtain reasonable assurance about whether

the financial statements are free from material misstatement. Under the concept of

reasonable assurance, the Contractor will exercise its judgement about the number of

transactions to be examined and the areas to be tested. There is, therefore, a risk that material

errors, irregularities or illegal acts, including fraud or defalcations, may exist and not be

detected. The Contractor will, however, advise immediately the DECD of any such matters

that come to its attention. The Contractor’s responsibility is limited to the period covered by

the audit and does not extend to matters that might arise during any later periods.

6. The Contractor, as part of the engagement, will request written representations from (the

Organization) attorneys. Prior to the conclusion of the audit, the Contractor will also request

certain written representations from (the Organization) management about the financial

statements and related matters. It is understood that these financial statements are the

responsibility of management. This responsibility includes the maintenance of adequate

records and related internal control structure policies and procedures, the selection and

application of accounting principles, and the safeguarding of assets. The Contractor will

advise management about the appropriate accounting principles and their application, and

will assist in the preparation of the financial statements, if necessary.

7. The Contractor understands that it has the responsibility:

a. to prepare the audit reports in accordance with the requirements of Government Auditing

Standards, the DECD Audit Guide (and the State Single Audit Act (CGS 4-230 to 4-236)

and/or the Federal Single Audit Act (OMB Circular A-133) as applicable); and

b. to notify DECD within five (5) business days of its termination or cessation of services to

the (organization).

8. If the Contractor ascertains that the (organization’s) books and records are not in a

sufficiently satisfactory condition for performing an audit, the Contractor shall disclose this

D-1

8/06

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5