Form 4562 - Georgia Depreciation And Amortization (Including Information On Listed Property) - 2012

ADVERTISEMENT

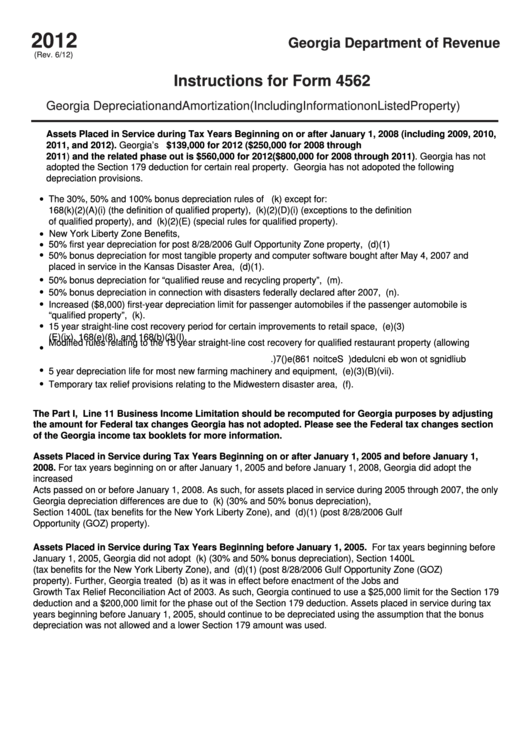

2012

Georgia Department of Revenue

(Rev. 6/12)

Instructions for Form 4562

Georgia Depreciation and Amortization (Including Information on Listed Property)

Assets Placed in Service during Tax Years Beginning on or after January 1, 2008 (including 2009, 2010,

2011, and 2012). Georgia’s I.R.C. Section 179 deduction is $139,000 for 2012 ($250,000 for 2008 through

2011) and the related phase out is $560,000 for 2012 ($800,000 for 2008 through 2011). Georgia has not

adopted the Section 179 deduction for certain real property. Georgia has not adopoted the following

depreciation provisions.

•

The 30%, 50% and 100% bonus depreciation rules of I.R.C. Section 168(k) except for: I.R.C. Section

168(k)(2)(A)(i) (the definition of qualified property), I.R.C. Section 168(k)(2)(D)(i) (exceptions to the definition

of qualified property), and I.R.C. Section 168(k)(2)(E) (special rules for qualified property).

•

New York Liberty Zone Benefits, I.R.C. Section 1400L.

•

50% first year depreciation for post 8/28/2006 Gulf Opportunity Zone property, I.R.C. Section 1400N(d)(1)

•

50% bonus depreciation for most tangible property and computer software bought after May 4, 2007 and

placed in service in the Kansas Disaster Area, I.R.C. Section 1400N(d)(1).

•

50% bonus depreciation for “qualified reuse and recycling property”, I.R.C. Section 168(m).

•

50% bonus depreciation in connection with disasters federally declared after 2007, I.R.C. Section 168(n).

•

Increased ($8,000) first-year depreciation limit for passenger automobiles if the passenger automobile is

“qualified property”, I.R.C. Section 168(k).

•

15 year straight-line cost recovery period for certain improvements to retail space, I.R.C. Sections 168(e)(3)

(E)(ix), 168(e)(8), and 168(b)(3)(I).

•

Modified rules relating to the 15 year straight-line cost recovery for qualified restaurant property (allowing

b

u

d l i

n i

s g

o t

n

o

w

b

e

i

c n

u l

d

e

) d

. I

. R

. C

S

c e

o i t

n

1

6

( 8

) e

7 (

. )

•

5 year depreciation life for most new farming machinery and equipment, I.R.C. Section 168(e)(3)(B)(vii).

•

Temporary tax relief provisions relating to the Midwestern disaster area, I.R.C. Sections 1400N(f).

The Part I, Line 11 Business Income Limitation should be recomputed for Georgia purposes by adjusting

the amount for Federal tax changes Georgia has not adopted. Please see the Federal tax changes section

of the Georgia income tax booklets for more information.

Assets Placed in Service during Tax Years Beginning on or after January 1, 2005 and before January 1,

2008. For tax years beginning on or after January 1, 2005 and before January 1, 2008, Georgia did adopt the

increased I.R.C. Section 179 deduction amounts and the related phase outs that were enacted as part of Federal

Acts passed on or before January 1, 2008. As such, for assets placed in service during 2005 through 2007, the only

Georgia depreciation differences are due to I.R.C Section 168(k) (30% and 50% bonus depreciation), I.R.C.

Section 1400L (tax benefits for the New York Liberty Zone), and I.R.C. Section 1400(d)(1) (post 8/28/2006 Gulf

Opportunity (GOZ) property).

Assets Placed in Service during Tax Years Beginning before January 1, 2005. For tax years beginning before

January 1, 2005, Georgia did not adopt I.R.C. Section 168(k) (30% and 50% bonus depreciation), Section 1400L

(tax benefits for the New York Liberty Zone), and I.R.C. 1400N(d)(1) (post 8/28/2006 Gulf Opportunity Zone (GOZ)

property). Further, Georgia treated I.R.C. Section 179(b) as it was in effect before enactment of the Jobs and

Growth Tax Relief Reconciliation Act of 2003. As such, Georgia continued to use a $25,000 limit for the Section 179

deduction and a $200,000 limit for the phase out of the Section 179 deduction. Assets placed in service during tax

years beginning before January 1, 2005, should continue to be depreciated using the assumption that the bonus

depreciation was not allowed and a lower Section 179 amount was used.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3