Form M-990t Instructions - 2012

ADVERTISEMENT

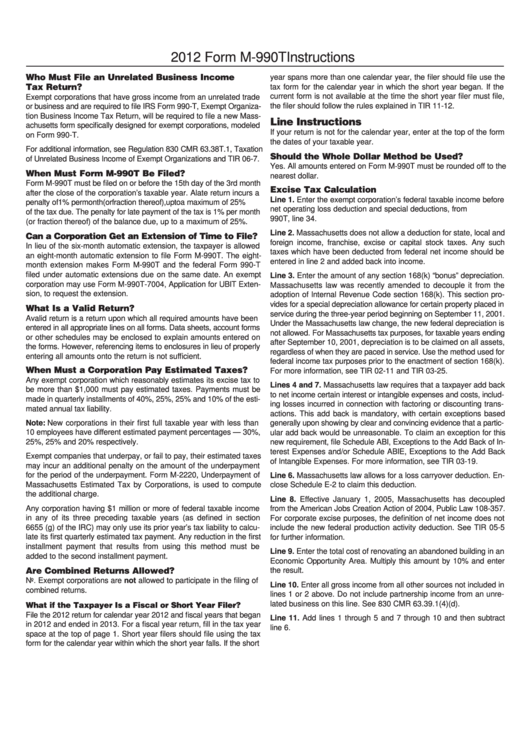

2012 Form M-990T Instructions

Who Must File an Unrelated Business Income

year spans more than one calendar year, the filer should file use the

Tax Return?

tax form for the calendar year in which the short year began. If the

current form is not available at the time the short year filer must file,

Exempt corporations that have gross income from an unrelated trade

the filer should follow the rules explained in TIR 11-12.

or business and are required to file IRS Form 990-T, Exempt Organiza-

tion Business Income Tax Return, will be required to file a new Mass-

Line Instructions

achusetts form specifically designed for exempt corporations, modeled

If your return is not for the calendar year, enter at the top of the form

on Form 990-T.

the dates of your taxable year.

For additional information, see Regulation 830 CMR 63.38T.1, Taxation

Should the Whole Dollar Method be Used?

of Unrelated Business Income of Exempt Organizations and TIR 06-7.

Yes. All amounts entered on Form M-990T must be rounded off to the

When Must Form M-990T Be Filed?

nearest dollar.

Form M-990T must be filed on or before the 15th day of the 3rd month

Excise Tax Calculation

after the close of the corporation’s taxable year. A late return incurs a

Line 1. Enter the exempt corporation’s federal taxable income before

penalty of 1% per month (or fraction thereof), up to a maximum of 25%

net operating loss deduction and special deductions, from U.S. Form

of the tax due. The penalty for late payment of the tax is 1% per month

990T, line 34.

(or fraction thereof) of the balance due, up to a maximum of 25%.

Line 2. Massachusetts does not allow a deduction for state, local and

Can a Corporation Get an Extension of Time to File?

foreign income, franchise, excise or capital stock taxes. Any such

In lieu of the six-month automatic extension, the taxpayer is allowed

taxes which have been deducted from federal net income should be

an eight-month automatic extension to file Form M-990T. The eight-

entered in line 2 and added back into income.

month extension makes Form M-990T and the federal Form 990-T

filed under automatic extensions due on the same date. An exempt

Line 3. Enter the amount of any section 168(k) “bonus” depreciation.

corporation may use Form M-990T-7004, Application for UBIT Exten-

Massachusetts law was recently amended to decouple it from the

sion, to request the extension.

adoption of Internal Revenue Code section 168(k). This section pro-

vides for a special depreciation allowance for certain property placed in

What Is a Valid Return?

service during the three-year period beginning on September 11, 2001.

A valid return is a return upon which all required amounts have been

Under the Massachusetts law change, the new federal depreciation is

entered in all appropriate lines on all forms. Data sheets, account forms

not allowed. For Massachusetts tax purposes, for taxable years ending

or other schedules may be enclosed to explain amounts entered on

after September 10, 2001, depreciation is to be claimed on all assets,

the forms. However, referencing items to enclosures in lieu of properly

regardless of when they are paced in service. Use the method used for

entering all amounts onto the return is not sufficient.

federal income tax purposes prior to the enactment of section 168(k).

When Must a Corporation Pay Estimated Taxes?

For more information, see TIR 02-11 and TIR 03-25.

Any exempt corporation which reasonably estimates its excise tax to

Lines 4 and 7. Massachusetts law requires that a taxpayer add back

be more than $1,000 must pay estimated taxes. Payments must be

to net income certain interest or intangible expenses and costs, includ-

made in quarterly installments of 40%, 25%, 25% and 10% of the esti-

ing losses incurred in connection with factoring or discounting trans-

mated annual tax liability.

actions. This add back is mandatory, with certain exceptions based

Note: New corporations in their first full taxable year with less than

generally upon showing by clear and convincing evidence that a partic-

10 employees have different estimated payment percentages — 30%,

ular add back would be unreasonable. To claim an exception for this

25%, 25% and 20% respectively.

new requirement, file Schedule ABI, Exceptions to the Add Back of In-

terest Expenses and/or Schedule ABIE, Exceptions to the Add Back

Exempt companies that underpay, or fail to pay, their estimated taxes

of Intangible Expenses. For more information, see TIR 03-19.

may incur an additional penalty on the amount of the underpayment

for the period of the underpayment. Form M-2220, Underpayment of

Line 6. Massachusetts law allows for a loss carryover deduction. En-

Massachusetts Estimated Tax by Corporations, is used to compute

close Schedule E-2 to claim this deduction.

the additional charge.

Line 8. Effective January 1, 2005, Massachusetts has decoupled

Any corporation having $1 million or more of federal taxable income

from the American Jobs Creation Action of 2004, Public Law 108-357.

in any of its three preceding taxable years (as defined in section

For corporate excise purposes, the definition of net income does not

6655 (g) of the IRC) may only use its prior year’s tax liability to calcu-

include the new federal production activity deduction. See TIR 05-5

late its first quarterly estimated tax payment. Any reduction in the first

for further information.

installment payment that results from using this method must be

Line 9. Enter the total cost of renovating an abandoned building in an

added to the second installment payment.

Economic Opportunity Area. Multiply this amount by 10% and enter

Are Combined Returns Allowed?

the result.

No. Exempt corporations are not allowed to participate in the filing of

Line 10. Enter all gross income from all other sources not included in

combined returns.

lines 1 or 2 above. Do not include partnership income from an unre-

lated business on this line. See 830 CMR 63.39.1(4)(d).

What if the Taxpayer Is a Fiscal or Short Year Filer?

File the 2012 return for calendar year 2012 and fiscal years that began

Line 11. Add lines 1 through 5 and 7 through 10 and then subtract

in 2012 and ended in 2013. For a fiscal year return, fill in the tax year

line 6.

space at the top of page 1. Short year filers should file using the tax

form for the calendar year within which the short year falls. If the short

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4