Print Form

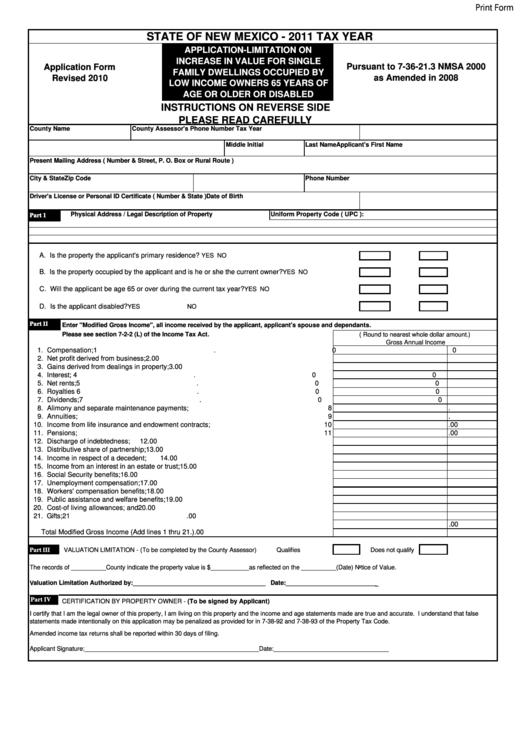

STATE OF NEW MEXICO - 2011 TAX YEAR

APPLICATION-LIMITATION ON

INCREASE IN VALUE FOR SINGLE

Pursuant to 7-36-21.3 NMSA 2000

Application Form

FAMILY DWELLINGS OCCUPIED BY

as Amended in 2008

Revised 2010

LOW INCOME OWNERS 65 YEARS OF

AGE OR OLDER OR DISABLED

INSTRUCTIONS ON REVERSE SIDE

PLEASE READ CAREFULLY

County Name

County Assessor's Phone Number

Tax Year

Applicant's First Name

Middle Initial

Last Name

Present Mailing Address ( Number & Street, P. O. Box or Rural Route )

City & State

Zip Code

Phone Number

Driver's License or Personal ID Certificate ( Number & State )

Date of Birth

Physical Address / Legal Description of Property

Uniform Property Code ( UPC ):

Part 1

Part 1

A. Is the property the applicant's primary residence?

YES

NO

B. Is the property occupied by the applicant and is he or she the current owner?

YES

NO

C. Will the applicant be age 65 or over during the current tax year?

YES

NO

D. Is the applicant disabled?

YES

NO

Part II

Part II

Enter "Modified Gross Income", all income received by the applicant, applicant's spouse and dependants.

Please see section 7-2-2 (L) of the Income Tax Act.

( Round to nearest whole dollar amount.)

Gross Annual Income

1. Compensation;

1

.00

2. Net profit derived from business;

2

.00

3. Gains derived from dealings in property;

3

.00

4. Interest;

4

.00

5. Net rents;

5

.00

6. Royalties

6

.00

7. Dividends;

7

.00

8. Alimony and separate maintenance payments;

8

.00

9. Annuities;

9

.00

10. Income from life insurance and endowment contracts;

10

.00

11. Pensions;

11

.00

12. Discharge of indebtedness;

12

.00

13. Distributive share of partnership;

13

.00

14. Income in respect of a decedent;

14

.00

15. Income from an interest in an estate or trust;

15

.00

16. Social Security benefits;

16

.00

17. Unemployment compensation;

17

.00

18. Workers' compensation benefits;

18

.00

19. Public assistance and welfare benefits;

19

.00

20. Cost-of living allowances; and

20

.00

21. Gifts;

21

.00

.00

Total Modified Gross Income (Add lines 1 thru 21.)

.00

Part III

VALUATION LIMITATION - (To be completed by the County Assessor)

Qualifies

Does not qualify

The records of __________County indicate the property value is $___________as reflected on the __________(Date) Notice of Value.

Valuation Limitation Authorized by:______________________________________ Date:___________________________

Part IV

CERTIFICATION BY PROPERTY OWNER - (To be signed by Applicant)

I certify that I am the legal owner of this property, I am living on this property and the income and age statements made are true and accurate. I understand that false

statements made intentionally on this application may be penalized as provided for in 7-38-92 and 7-38-93 of the Property Tax Code.

Amended income tax returns shall be reported within 30 days of filing.

Applicant Signature:__________________________________________________

Date:_________________________________

1

1