IR 880

June 2013

Paid parental leave

application for an employee

Parental Leave and Employment Protection Act 1987

� Do you qualify for Paid parental leave (PPL)

� Your employer also needs to fill in this form.

� Do you know when your parental leave will start?

� You must apply for the PPL payments before you return to

work or resign.

� If you’re self-employed and are applying for PPL, use a

� The payments will be direct credited to your bank account

Paid parental leave application for a self-employed person (IR 888).

every fortnight.

� If you wish to transfer part or all of your entitlement please

� The maximum payment is $488.17 a week before tax.

complete Paid Parental Leave transfer to an employee (IR 881) or

Paid Parental Leave transfer to a self-employed person (IR 889) as

well as this form

What is paid parental leave?

your baby’ s due date or the date you assume care of a child you

intend to adopt, and you are taking parental leave away from your self-

Paid parental leave is a government-funded entitlement paid to working

employment. Use form IR888 to apply for payments.

mothers while they take parental leave from their job(s). These payments

go towards the loss of income that working mothers experience when

Transfer of payments in special circumstances

they take parental leave from work to care for a new baby.

Where the mother would have qualified for parental leave payments

Who qualifies for paid parental leave?

but has died or no longer has legal guardianship of the child, the

entitlement may be transferred to their spouse or partner if they are

� Expectant Mothers who have worked for an average of 10 hours a

eligible. If you’re a spouse or partner applying for one of these reasons

week for the same employer for either the 6 or 12 months before

please call Inland Revenue.

their due date.

� A parent who adopts a child aged under 6 years and who has

Who doesn’t qualify for PPL?

worked for an average of 10 hours a week for the same employer

� Expectant mothers who do not qualify for parental leave or are not

for either the 6 or 12 months before the date of assuming the care

taking parental leave from work

of a child they intend to adopt.

� Mothers applying whose previous period of parental leave ended

Are you self-employed?

within the last 6 months

If you’re self-employed, you’re entitled to PPL if you’ve worked for an

� Mothers where the family is already receiving parental tax credit for

average of 10 hours a week in the 6 or 12 months immediately before

the child.

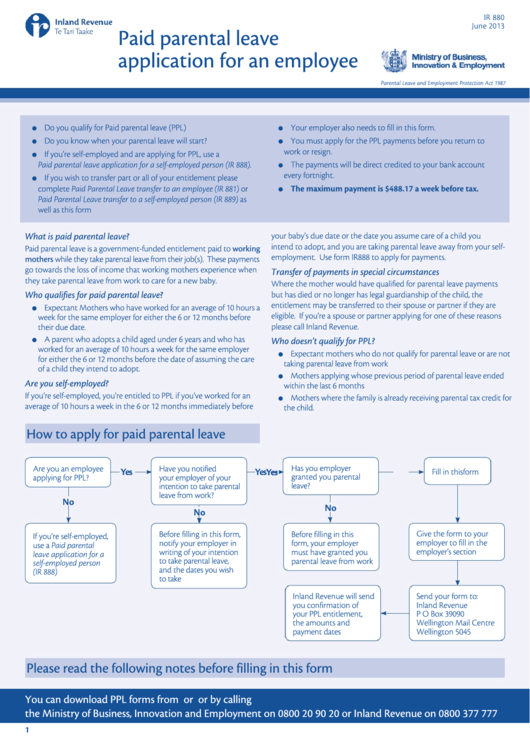

How to apply for paid parental leave

Has you employer

Are you an employee

Have you notified

Yes

Yes

Yes

Fill in this form

granted you parental

applying for PPL?

your employer of your

leave?

intention to take parental

leave from work?

No

No

No

Give the form to your

Before filling in this form,

Before filling in this

If you’re self-employed,

employer to fill in the

notify your employer in

form, your employer

use a Paid parental

employer’ s section

writing of your intention

must have granted you

leave application for a

to take parental leave,

parental leave from work

self-employed person

and the dates you wish

(IR 888)

to take

Inland Revenue will send

Send your form to:

you confirmation of

Inland Revenue

P O Box 39090

your PPL entitlement,

Wellington Mail Centre

the amounts and

payment dates

Wellington 5045

Please read the following notes before filling in this form

You can download PPL forms from or or by calling

the Ministry of Business, Innovation and Employment on 0800 20 90 20 or Inland Revenue on 0800 377 777

1

1

1 2

2 3

3 4

4 5

5 6

6