Form De 3d - Quarterly Contribution Return - 2014

ADVERTISEMENT

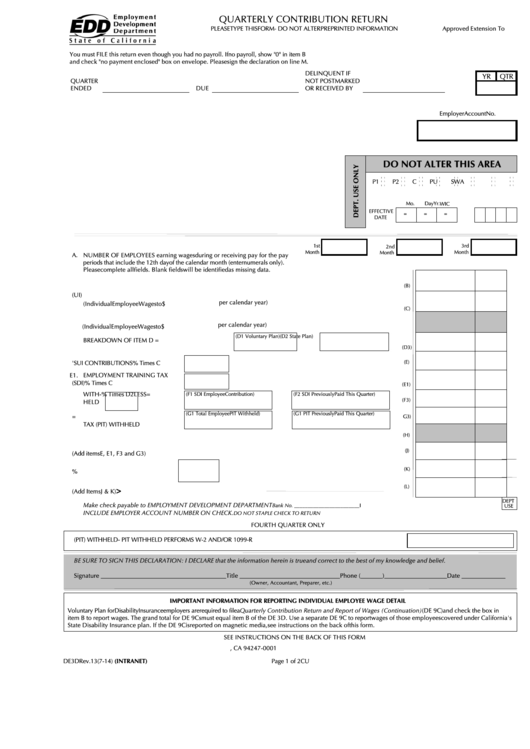

QUARTERLY CONTRIBUTION RETURN

PLEASE TYPE THIS FORM - DO NOT ALTER PREPRINTED INFORMATION

Approved Extension To

You must FILE this return even though you had no payroll. If no payroll, show "0" in item B

and check "no payment enclosed" box on envelope. Please sign the declaration on line M.

DELINQUENT IF

YR

QTR

QUARTER

NOT POSTMARKED

ENDED

DUE

OR RECEIVED BY

Employer Account No.

DO NOT ALTER THIS AREA

P1

P2

C

P

U

S

W

A

Mo.

Day

Yr.

WIC

EFFECTIVE

=

=

=

DATE

1st

3rd

2nd

Month

Month

Month

A.

NUMBER OF EMPLOYEES earning wages during or receiving pay for the pay

periods that include the 12th day of the calendar month (enter numerals only).

Please complete all fields. Blank fields will be identified as missing data.

B. TOTAL SUBJECT WAGES PAID THIS QUARTER ............................................................................................................

(B)

C. UNEMPLOYMENT INSURANCE TAXABLE WAGES (UI)

per calendar year) .........................................................................

(Individual Employee Wages to $

(C)

D. VOLUNTARY AND STATE DISABILITY INSURANCE WAGES

per calendar year) ..........................................................................

(Individual Employee Wages to $

(D1 Voluntary Plan)

(D2 State Plan)

BREAKDOWN OF ITEM D ..............................................

PLUS

=

(D3)

(E)

E. EMPLOYER'S UI CONTRIBUTIONS

% Times C .............................................................................

EMPLOYMENT TRAINING TAX

E1.

F. EMPLOYEE CONTRIBUTIONS (SDI)

% Times C .............................................................................

(E1)

WITH-

% Times D2

(F1 SDI Employee Contribution)

LESS

(F2 SDI Previously Paid This Quarter)

=

(F3)

HELD

(G1 PIT Previously Paid This Quarter)

(G1 Total Employee PIT Withheld)

G3)

G. CALIFORNIA PERSONAL INCOME

LESS

=

TAX (PIT) WITHHELD

(H)

(J)

J.

SUBTOTAL (Add items E, E1, F3 and G3) .......................................................................................................................

(K)

K. DI VOLUNTARY PLAN ASSESSMENT

% Times D1 ..............................................................................

(L)

>

L. TOTAL TAXES DUE OR OVERPAID THIS QUARTER (Add Items J & K)

DEPT

Make check payable to EMPLOYMENT DEVELOPMENT DEPARTMENT

Bank No. ________________________I

USE

INCLUDE EMPLOYER ACCOUNT NUMBER ON CHECK.

DO NOT STAPLE CHECK TO RETURN

FOURTH QUARTER ONLY

M.

CALIFORNIA PERSONAL INCOME TAX (PIT) WITHHELD - PIT WITHHELD PER FORMS W-2 AND/OR 1099-R

BE SURE TO SIGN THIS DECLARATION: I DECLARE that the information herein is true and correct to the best of my knowledge and belief.

Signature ________________________________________ Title ________________________________ Phone (_______)____________________ Date ______________

(Owner, Accountant, Preparer, etc.)

IMPORTANT INFORMATION FOR REPORTING INDIVIDUAL EMPLOYEE WAGE DETAIL

Voluntary Plan for Disability Insurance employers are required to file a Quarterly Contribution Return and Report of Wages (Continuation) (DE 9C) and check the box in

item B to report wages. The grand total for DE 9Cs must equal item B of the DE 3D. Use a separate DE 9C to report wages of those employees covered under California's

State Disability Insurance plan. If the DE 9C is reported on magnetic media, see instructions on the back of this form.

SEE INSTRUCTIONS ON THE BACK OF THIS FORM

P.O. Box 826847 / Sacramento, CA 94247-0001

DE 3D Rev. 13 (7-14) (INTRANET)

Page 1 of 2

CU

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1