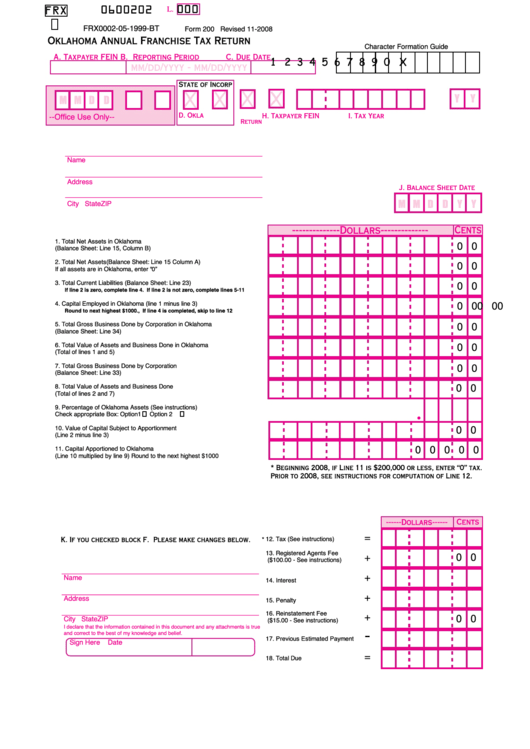

L.

000

0600202

FRX

FRX0002-05-1999-BT

Form 200 Revised 11-2008

Oklahoma Annual Franchise Tax Return

Character Formation Guide

A. Taxpayer FEIN

B. Reporting Period

C. Due Date

1 2 3 4 5 6 7 8 9 0 X

mm/dd/yyyy - mm/dd/yyyy

State of Incorp

Y

Y

M M D D

D. Okla E.Other

F.Change G.Estimated

--Office Use Only--

F.C.

P.T.

H. Taxpayer FEIN

I. Tax Year

Return

_____________________________________________

Name

_____________________________________________

Address

J. Balance Sheet Date

_____________________________________________

M M D D Y Y

City

State

ZIP

Cents

--------------Dollars--------------

1. Total Net Assets in Oklahoma

0 0

(Balance Sheet: Line 15, Column B) ...........................................................

2. Total Net Assets(Balance Sheet: Line 15 Column A)

0 0

If all assets are in Oklahoma, enter “0” .......................................................

3. Total Current Liabilities (Balance Sheet: Line 23)

0 0

If line 2 is zero, complete line 4. If line 2 is not zero, complete lines 5-11

4. Capital Employed in Oklahoma (line 1 minus line 3)

0

0 0

0 0

Round to next highest $1000., If line 4 is completed, skip to line 12 .....................

5. Total Gross Business Done by Corporation in Oklahoma

0 0

(Balance Sheet: Line 34) ............................................................................

6. Total Value of Assets and Business Done in Oklahoma

0 0

(Total of lines 1 and 5) ................................................................................

7. Total Gross Business Done by Corporation

0 0

(Balance Sheet: Line 33) ............................................................................

8. Total Value of Assets and Business Done

0 0

(Total of lines 2 and 7) ................................................................................

9. Percentage of Oklahoma Assets (See instructions)

Check appropriate Box:

Option1

Option 2 ..............................

•

10. Value of Capital Subject to Apportionment

0 0

(Line 2 minus line 3) ...................................................................................

0

0 0 0 0

11. Capital Apportioned to Oklahoma

(Line 10 multiplied by line 9) Round to the next highest $1000 ..................

* Beginning 2008, if Line 11 is $200,000 or less, enter “0” tax.

Prior to 2008, see instructions for computation of Line 12.

Cents

------Dollars------

=

K. If you checked block F. Please make changes below.

*

12. Tax (See instructions)

13. Registered Agents Fee

+

0 0

($100.00 - See instructions)

_____________________________________________

+

Name

14. Interest

_____________________________________________

+

Address

15. Penalty

_____________________________________________

16. Reinstatement Fee

+

0 0

City

State

ZIP

($15.00 - See instructions)

I declare that the information contained in this document and any attachments is true

-

and correct to the best of my knowledge and belief.

17. Previous Estimated Payment

Sign Here

Date

=

18. Total Due

1

1 2

2