AB CD

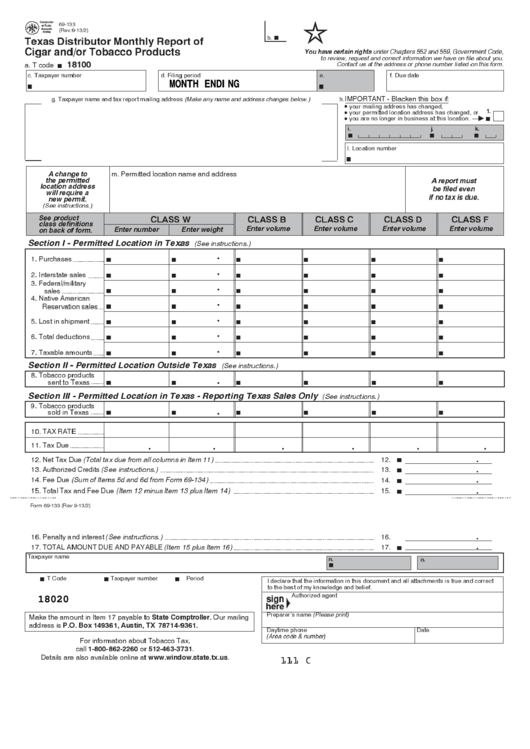

69-133

PRINT FORM

CLEAR FIELDS

(Rev.9-13/2)

b.

b

Texas Distributor Monthly Report of

under Chapters 552 and 559, Government Code,

Cigar and/or Tobacco Products

You have certain rights

to review, request and correct information we have on file about you.

18100

a. T code

Contact us at the address or phone number listed on this form.

b

c. Taxpayer number

d. Filing period

e.

f. Due date

MONTH ENDING

b

b

IMPORTANT - Blacken this box if:

g. Taxpayer name and tax report mailing address (Make any name and address changes below.)

h.

your mailing address has changed,

I

your permitted location address has changed, or

1.

I

you are no longer in business at this location.

R b

I

i.

j.

k.

b

b

b

l. Location number

b

A change to

m. Permitted location name and address

the permitted

A report must

location address

be filed even

will require a

if no tax is due.

new permit.

(See instructions.)

See product

CLASS W

CLASS B

CLASS C

CLASS D

CLASS F

class definitions

Enter volume

Enter volume

Enter volume

Enter volume

Enter number

Enter weight

on back of form.

Section I - Permitted Location in Texas

(See instructions.)

.

1. Purchases

b

b

b

b

b

b

.

2. Interstate sales

b

b

b

b

b

b

3. Federal/military

.

sales

b

b

b

b

b

b

4. Native American

.

Reservation sales

b

b

b

b

b

b

.

5. Lost in shipment

b

b

b

b

b

b

.

6. Total deductions

b

b

b

b

b

b

.

7. Taxable amounts

b

b

b

b

b

b

Section II - Permitted Location Outside Texas

(See instructions.)

8. Tobacco products

.

sent to Texas

b

b

b

b

b

b

Section III - Permitted Location in Texas - Reporting Texas Sales Only

(See instructions.)

9. Tobacco products

.

sold in Texas

b

b

b

b

b

b

10. TAX RATE

11. Tax Due

.

.

.

.

.

.

12. Net Tax Due (Total tax due from all columns in Item 11)

12.

.

b

13. Authorized Credits (See instructions.)

13.

.

b

14. Fee Due (Sum of Items 5d and 6d from Form 69-134)

14.

.

b

15. Total Tax and Fee Due (Item 12 minus Item 13 plus Item 14)

15.

.

b

Form 69-133 (Rev.9-13/2)

16. Penalty and interest (See instructions.)

16.

.

17. TOTAL AMOUNT DUE AND PAYABLE (Item 15 plus Item 16)

17.

.

b

Taxpayer name

AB

n.

o.

b

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

b

b

b

to the best of my knowledge and belief.

Authorized agent

18020

Preparer's name (Please print)

State Comptroller.

Make the amount in Item 17 payable to

Our mailing

P.O. Box 149361, Austin, TX 78714-9361.

address is

Daytime phone

Date

(Area code & number)

For information about Tobacco Tax,

1-800-862-2260

512-463-3731

call

or

.

Details are also available online at

.

111 C

1

1 2

2