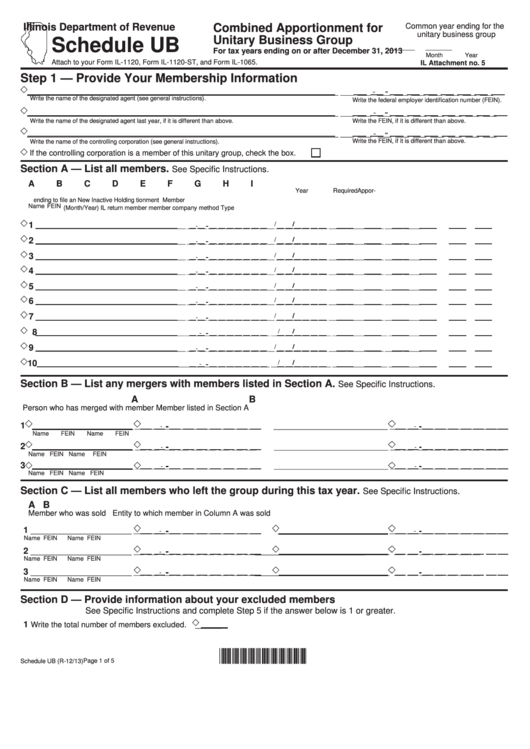

Schedule Ub - Attach To Form Il-1120, Form Il-1120-St, And Form Il-1065 - Combined Apportionment For Unitary Business Group - 2013

ADVERTISEMENT

Common year ending for the

Illinois Department of Revenue

Combined Apportionment for

unitary business group

Unitary Business Group

Schedule UB

______

______

For tax years ending on or after December 31, 2013

Month

Year

Attach to your Form IL-1120, Form IL-1120-ST, and Form IL-1065.

IL Attachment no. 5

Step 1 — Provide Your Membership Information

___ ___ - ___ ___ ___ ___ ___ ___ ___

_______________________________________________________________________

Write the name of the designated agent (see general instructions).

Write the federal employer identification number (FEIN).

_______________________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Write the name of the designated agent last year, if it is different than above.

Write the FEIN, if it is different than above.

_______________________________________________________________________

___ ___ - ___ ___ ___ ___ ___ ___ ___

Write the name of the controlling corporation (see general instructions).

Write the FEIN, if it is different than above.

If the controlling corporation is a member of this unitary group, check the box.

See Specific Instructions.

Section A — List all members.

A

B

C

D

E

F

G

H

I

Year

Required

Appor-

ending

to file an

New

Inactive

Holding

tionment Member

Name

FEIN

(Month/Year)

IL return member member company

method

Type

__ __ / __ __ __ __

1

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

2

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

3

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

4

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

5

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

6

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

7

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

8

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

9

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

__ __ / __ __ __ __

10

__________________________________________

__ __ - __ __ __ __ __ __ __

_____

_____

_____

_____

_____

_____

See Specific Instructions.

Section B — List any mergers with members listed in Section A.

A

B

Person who has merged with member

Member listed in Section A

_______________________

__________________________

1

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name

FEIN

Name

FEIN

_______________________

__________________________

2

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name

FEIN

Name

FEIN

_______________________

__________________________

3

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name

FEIN

Name

FEIN

See Specific Instructions.

Section C — List all members who left the group during this tax year.

A

B

Member who was sold

Entity to which member in Column A was sold

_______________________

_________________________

1

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name

FEIN

Name

FEIN

_______________________

_________________________

2

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name

FEIN

Name

FEIN

_______________________

_________________________

3

___ ___ - ___ ___ ___ ___ ___ ___ ___

___ ___ - ___ ___ ___ ___ ___ ___ ___

Name

FEIN

Name

FEIN

Section D — Provide information about your excluded members

See Specific Instructions and complete Step 5 if the answer below is 1 or greater.

Write the total number of members excluded.

______

1

*333301110*

Page 1 of 5

Schedule UB (R-12/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5