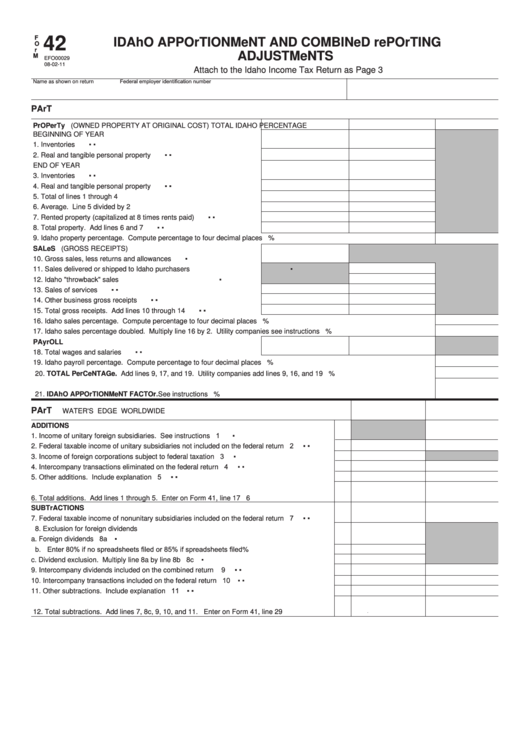

F

42

IDAhO APPOrTIONMeNT AND COMBINeD rePOrTING

O

r

ADJUSTMeNTS

M

EFO00029

08-02-11

Attach to the Idaho Income Tax return as page 3

Federal employer identification number

name as shown on return

PArT I. APPOrTIONMeNT FOrMULA

PrOPerTy (OwnEd prOpErTy AT OrIgInAl cOST)

TOTAl

IdAHO

pErcEnTAgE

BEgInnIng OF yEAr

1. Inventories ........................................................................................

▪

▪

2. real and tangible personal property .................................................

▪

▪

End OF yEAr

3. Inventories ........................................................................................

▪

▪

4. real and tangible personal property .................................................

▪

▪

5. Total of lines 1 through 4 ...................................................................

6. Average. line 5 divided by 2 ............................................................

7. rented property (capitalized at 8 times rents paid) ..........................

▪

▪

8. Total property. Add lines 6 and 7 ......................................................

▪

▪

9. Idaho property percentage. compute percentage to four decimal places ...................................................................................

%

SALeS (grOSS rEcEIpTS)

10. gross sales, less returns and allowances .........................................

▪

11. Sales delivered or shipped to Idaho purchasers ...............................

▪

12. Idaho "throwback" sales ....................................................................

▪

13. Sales of services ...............................................................................

▪

▪

14. Other business gross receipts ..........................................................

▪

▪

15. Total gross receipts. Add lines 10 through 14 ..................................

▪

▪

16. Idaho sales percentage. compute percentage to four decimal places ........................................................................................

%

17. Idaho sales percentage doubled. Multiply line 16 by 2. Utility companies see instructions ........................................................

%

PAyrOLL

18. Total wages and salaries ...................................................................

▪

▪

19. Idaho payroll percentage. compute percentage to four decimal places ......................................................................................

%

20. TOTAL PerCeNTAGe. Add lines 9, 17, and 19. Utility companies add lines 9, 16, and 19 .....................................................

%

21. IDAhO APPOrTIONMeNT FACTOr. See instructions ..............................................................................................................

%

PArT II. COMBINeD rePOrTING ADJUSTMeNTS

wATEr'S EdgE

wOrldwIdE

ADDITIONS

1. Income of unitary foreign subsidiaries. See instructions ........................................................

1

▪

2. Federal taxable income of unitary subsidiaries not included on the federal return .................

2

▪

▪

3. Income of foreign corporations subject to federal taxation .....................................................

3

▪

4. Intercompany transactions eliminated on the federal return ...................................................

4

▪

▪

5. Other additions. Include explanation ......................................................................................

5

▪

▪

6. Total additions. Add lines 1 through 5. Enter on Form 41, line 17 .........................................

6

SUBTrACTIONS

7. Federal taxable income of nonunitary subsidiaries included on the federal return .................

7

▪

▪

8. Exclusion for foreign dividends

8a ▪

a. Foreign dividends .............................................................................................................

b. Enter 80% if no spreadsheets filed or 85% if spreadsheets filed .....................................

8b

%

c. dividend exclusion. Multiply line 8a by line 8b ................................................................

8c ▪

9. Intercompany dividends included on the combined return ......................................................

9

▪

▪

10. Intercompany transactions included on the federal return ......................................................

10 ▪

▪

11. Other subtractions. Include explanation .................................................................................

11 ▪

▪

12. Total subtractions. Add lines 7, 8c, 9, 10, and 11. Enter on Form 41, line 29 ......................

12

1

1