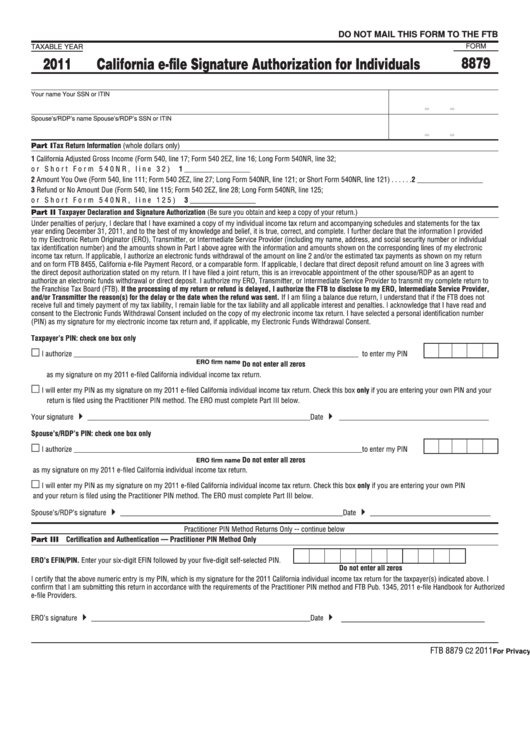

DO NOT MAIL THIS FORM TO THE FTB

FORM

TAXABLE YEAR

8879

2011

California e-file Signature Authorization for Individuals

Your name

Your SSN or ITIN

-

-

Spouse’s/RDP’s name

Spouse’s/RDP’s SSN or ITIN

-

-

Part I Tax Return Information (whole dollars only)

1 California Adjusted Gross Income (Form 540, line 17; Form 540 2EZ, line 16; Long Form 540NR, line 32;

or Short Form 540NR, line 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 __________________

2 Amount You Owe (Form 540, line 111; Form 540 2EZ, line 27; Long Form 540NR, line 121; or Short Form 540NR, line 121) . . . . . . 2 __________________

3 Refund or No Amount Due (Form 540, line 115; Form 540 2EZ, line 28; Long Form 540NR, line 125;

or Short Form 540NR, line 125) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 __________________

Part II Taxpayer Declaration and Signature Authorization (Be sure you obtain and keep a copy of your return .)

Under penalties of perjury, I declare that I have examined a copy of my individual income tax return and accompanying schedules and statements for the tax

year ending December 31, 2011, and to the best of my knowledge and belief, it is true, correct, and complete . I further declare that the information I provided

to my Electronic Return Originator (ERO), Transmitter, or Intermediate Service Provider (including my name, address, and social security number or individual

tax identification number) and the amounts shown in Part I above agree with the information and amounts shown on the corresponding lines of my electronic

income tax return . If applicable, I authorize an electronic funds withdrawal of the amount on line 2 and/or the estimated tax payments as shown on my return

and on form FTB 8455, California e-file Payment Record, or a comparable form . If applicable, I declare that direct deposit refund amount on line 3 agrees with

the direct deposit authorization stated on my return . If I have filed a joint return, this is an irrevocable appointment of the other spouse/RDP as an agent to

authorize an electronic funds withdrawal or direct deposit . I authorize my ERO, Transmitter, or Intermediate Service Provider to transmit my complete return to

the Franchise Tax Board (FTB) . If the processing of my return or refund is delayed, I authorize the FTB to disclose to my ERO, Intermediate Service Provider,

and/or Transmitter the reason(s) for the delay or the date when the refund was sent. If I am filing a balance due return, I understand that if the FTB does not

receive full and timely payment of my tax liability, I remain liable for the tax liability and all applicable interest and penalties . I acknowledge that I have read and

consent to the Electronic Funds Withdrawal Consent included on the copy of my electronic income tax return . I have selected a personal identification number

(PIN) as my signature for my electronic income tax return and, if applicable, my Electronic Funds Withdrawal Consent .

Taxpayer’s PIN: check one box only

m

I authorize ______________________________________________________________________________ to enter my PIN

Do not enter all zeros

ERO firm name

as my signature on my 2011 e-filed California individual income tax return .

m

I will enter my PIN as my signature on my 2011 e-filed California individual income tax return . Check this box only if you are entering your own PIN and your

return is filed using the Practitioner PIN method . The ERO must complete Part III below .

Your signature

_____________________________________________________________ Date

_________________________________________

Spouse’s/RDP’s PIN: check one box only

m

I authorize _______________________________________________________________________________to enter my PIN

Do not enter all zeros

ERO firm name

as my signature on my 2011 e-filed California individual income tax return .

m

I will enter my PIN as my signature on my 2011 e-filed California individual income tax return . Check this box only if you are entering your own PIN

and your return is filed using the Practitioner PIN method . The ERO must complete Part III below .

Spouse’s/RDP’s signature

_____________________________________________________________ Date

_________________________________

Practitioner PIN Method Returns Only -- continue below

Part III Certification and Authentication — Practitioner PIN Method Only

ERO’s EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN .

Do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the 2011 California individual income tax return for the taxpayer(s) indicated above . I

confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method and FTB Pub . 1345, 2011 e-file Handbook for Authorized

e-file Providers .

_________________________

ERO’s signature

____________________________________________________________ Date

FTB 8879

2011

C2

For Privacy Notice, get form FTB 1131.

1

1 2

2