Form Rpd-41335 - Land Conservation Incentives Tax Credit Application

ADVERTISEMENT

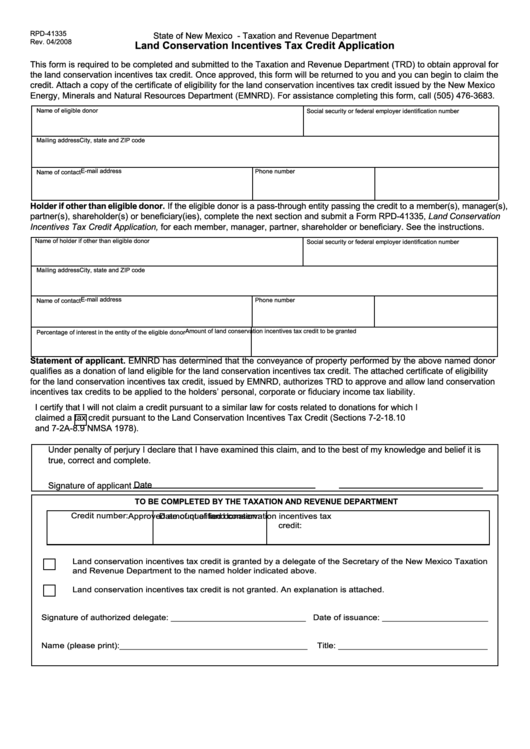

RPD-41335

State of New Mexico - Taxation and Revenue Department

Rev. 04/2008

Land Conservation Incentives Tax Credit Application

This form is required to be completed and submitted to the Taxation and Revenue Department (TRD) to obtain approval for

the land conservation incentives tax credit. Once approved, this form will be returned to you and you can begin to claim the

credit. Attach a copy of the certificate of eligibility for the land conservation incentives tax credit issued by the New Mexico

Energy, Minerals and Natural Resources Department (EMNRD). For assistance completing this form, call (505) 476-3683.

Name of eligible donor

Social security or federal employer identification number

Mailing address

City, state and ZIP code

E-mail address

Phone number

Name of contact

Holder if other than eligible donor. If the eligible donor is a pass-through entity passing the credit to a member(s), manager(s),

partner(s), shareholder(s) or beneficiary(ies), complete the next section and submit a Form RPD-41335, Land Conservation

Incentives Tax Credit Application, for each member, manager, partner, shareholder or beneficiary. See the instructions.

Name of holder if other than eligible donor

Social security or federal employer identification number

Mailing address

City, state and ZIP code

E-mail address

Phone number

Name of contact

Amount of land conservation incentives tax credit to be granted

Percentage of interest in the entity of the eligible donor

Statement of applicant. EMNRD has determined that the conveyance of property performed by the above named donor

qualifies as a donation of land eligible for the land conservation incentives tax credit. The attached certificate of eligibility

for the land conservation incentives tax credit, issued by EMNRD, authorizes TRD to approve and allow land conservation

incentives tax credits to be applied to the holders’ personal, corporate or fiduciary income tax liability.

I certify that I will not claim a credit pursuant to a similar law for costs related to donations for which I

claimed a tax credit pursuant to the Land Conservation Incentives Tax Credit (Sections 7-2-18.10

and 7-2A-8.9 NMSA 1978).

Under penalty of perjury I declare that I have examined this claim, and to the best of my knowledge and belief it is

true, correct and complete.

Date

Signature of applicant

TO BE COMPLETED BY THE TAXATION AND REVENUE DEPARTMENT

Credit number:

Date of qualified donation:

Approved amount of land conservation incentives tax

credit:

Land conservation incentives tax credit is granted by a delegate of the Secretary of the New Mexico Taxation

and Revenue Department to the named holder indicated above.

Land conservation incentives tax credit is not granted. An explanation is attached.

Signature of authorized delegate: ____________________________ Date of issuance: ______________________

Name (please print):_______________________________________

Title: _______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1