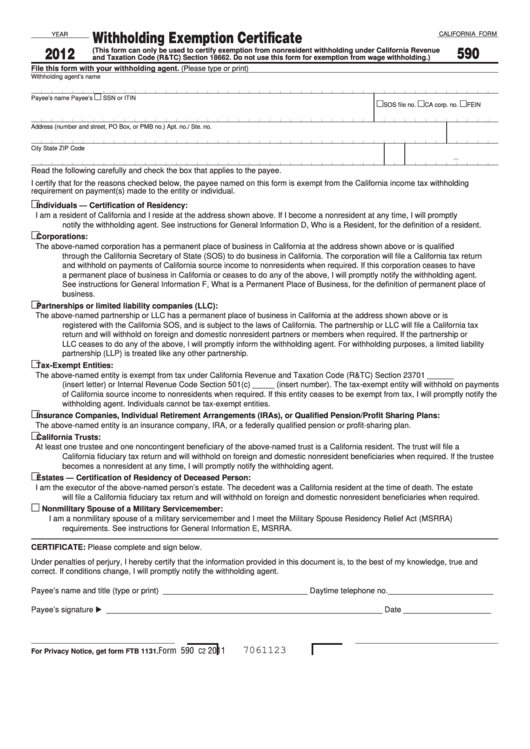

Withholding Exemption Certificate

CALIFORNIA FORM

YEAR

590

2012

(This form can only be used to certify exemption from nonresident withholding under California Revenue

and Taxation Code (R&TC) Section 18662. Do not use this form for exemption from wage withholding.)

File this form with your withholding agent. (Please type or print)

Withholding agent’s name

Payee’s name

Payee’s

SSN or ITIN

SOS file no.

CA corp. no.

FEIN

Address (number and street, PO Box, or PMB no.)

Apt. no./ Ste. no.

City

State

ZIP Code

Read the following carefully and check the box that applies to the payee.

I certify that for the reasons checked below, the payee named on this form is exempt from the California income tax withholding

requirement on payment(s) made to the entity or individual.

Individuals — Certification of Residency:

I am a resident of California and I reside at the address shown above. If I become a nonresident at any time, I will promptly

notify the withholding agent. See instructions for General Information D, Who is a Resident, for the definition of a resident.

Corporations:

The above-named corporation has a permanent place of business in California at the address shown above or is qualified

through the California Secretary of State (SOS) to do business in California. The corporation will file a California tax return

and withhold on payments of California source income to nonresidents when required. If this corporation ceases to have

a permanent place of business in California or ceases to do any of the above, I will promptly notify the withholding agent.

See instructions for General Information F, What is a Permanent Place of Business, for the definition of permanent place of

business.

Partnerships or limited liability companies (LLC):

The above-named partnership or LLC has a permanent place of business in California at the address shown above or is

registered with the California SOS, and is subject to the laws of California. The partnership or LLC will file a California tax

return and will withhold on foreign and domestic nonresident partners or members when required. If the partnership or

LLC ceases to do any of the above, I will promptly inform the withholding agent. For withholding purposes, a limited liability

partnership (LLP) is treated like any other partnership.

Tax-Exempt Entities:

The above-named entity is exempt from tax under California Revenue and Taxation Code (R&TC) Section 23701 ______

(insert letter) or Internal Revenue Code Section 501(c) _____ (insert number). The tax-exempt entity will withhold on payments

of California source income to nonresidents when required. If this entity ceases to be exempt from tax, I will promptly notify the

withholding agent. Individuals cannot be tax-exempt entities.

Insurance Companies, Individual Retirement Arrangements (IRAs), or Qualified Pension/Profit Sharing Plans:

The above-named entity is an insurance company, IRA, or a federally qualified pension or profit-sharing plan.

California Trusts:

At least one trustee and one noncontingent beneficiary of the above-named trust is a California resident. The trust will file a

California fiduciary tax return and will withhold on foreign and domestic nonresident beneficiaries when required. If the trustee

becomes a nonresident at any time, I will promptly notify the withholding agent.

Estates — Certification of Residency of Deceased Person:

I am the executor of the above-named person’s estate. The decedent was a California resident at the time of death. The estate

will file a California fiduciary tax return and will withhold on foreign and domestic nonresident beneficiaries when required.

Nonmilitary Spouse of a Military Servicemember:

I am a nonmilitary spouse of a military servicemember and I meet the Military Spouse Residency Relief Act (MSRRA)

requirements. See instructions for General Information E, MSRRA.

CERTIFICATE: Please complete and sign below.

Under penalties of perjury, I hereby certify that the information provided in this document is, to the best of my knowledge, true and

correct. If conditions change, I will promptly notify the withholding agent.

Payee’s name and title (type or print) _________________________________ Daytime telephone no.________________________

Payee’s signature _______________________________________________________________ Date ____________________

Form 590

2011

7061123

C2

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3