Schedule O-Pte (Form 41a720s-O) - Other Additions And Subtractions To/from Federal Ordinary Income

ADVERTISEMENT

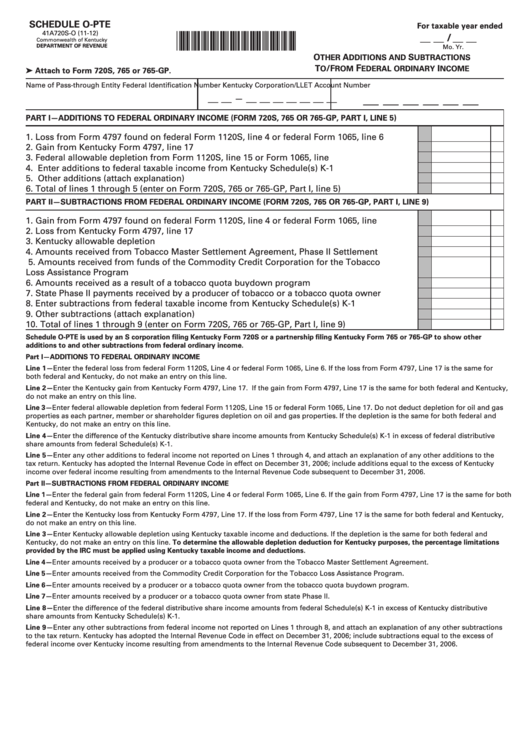

SCHEDULE O-PTE

For taxable year ended

41A720S-O (11-12)

*1200020301*

__ __ / __ __

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Mo.

Yr.

O

A

S

THER

DDITIONS AND

UBTRACTIONS

F

T

/F

I

O

ROM

EDERAL ORDINARY

NCOME

➤ Attach to Form 720S, 765 or 765-GP.

Name of Pass-through Entity

Federal Identification Number

Kentucky Corporation/LLET Account Number

__ __ __ __ __ __

__ __

__ __ __ __ __ __ __

—

PART I—ADDITIONS TO FEDERAL ORDINARY INCOME (FORM 720S, 765 OR 765-GP, PART I, LINE 5)

1. Loss from Form 4797 found on federal Form 1120S, line 4 or federal Form 1065, line 6 .........

1

00

2. Gain from Kentucky Form 4797, line 17 ........................................................................................

2

00

3. Federal allowable depletion from Form 1120S, line 15 or Form 1065, line 17...........................

3

00

4. Enter additions to federal taxable income from Kentucky Schedule(s) K-1 ...............................

4

00

5. Other additions (attach explanation) .............................................................................................

5

00

6. Total of lines 1 through 5 (enter on Form 720S, 765 or 765-GP, Part I, line 5) ...........................

6

00

PART II—SUBTRACTIONS FROM FEDERAL ORDINARY INCOME (FORM 720S, 765 OR 765-GP, PART I, LINE 9)

1. Gain from Form 4797 found on federal Form 1120S, line 4 or federal Form 1065, line 6.........

1

00

2. Loss from Kentucky Form 4797, line 17 ........................................................................................

2

00

3. Kentucky allowable depletion ........................................................................................................

3

00

4. Amounts received from Tobacco Master Settlement Agreement, Phase II Settlement ...........

4

00

5. Amounts received from funds of the Commodity Credit Corporation for the Tobacco

Loss Assistance Program ...............................................................................................................

5

00

6. Amounts received as a result of a tobacco quota buydown program .......................................

6

00

7. State Phase II payments received by a producer of tobacco or a tobacco quota owner ..........

7

00

8. Enter subtractions from federal taxable income from Kentucky Schedule(s) K-1 .....................

8

00

9. Other subtractions (attach explanation) ........................................................................................

9

00

10. Total of lines 1 through 9 (enter on Form 720S, 765 or 765-GP, Part I, line 9) ........................... 10

00

Schedule O-PTE is used by an S corporation filing Kentucky Form 720S or a partnership filing Kentucky Form 765 or 765-GP to show other

additions to and other subtractions from federal ordinary income.

Part I—ADDITIONS TO FEDERAL ORDINARY INCOME

Line 1—Enter the federal loss from federal Form 1120S, Line 4 or federal Form 1065, Line 6. If the loss from Form 4797, Line 17 is the same for

both federal and Kentucky, do not make an entry on this line.

Line 2—Enter the Kentucky gain from Kentucky Form 4797, Line 17. If the gain from Form 4797, Line 17 is the same for both federal and Kentucky,

do not make an entry on this line.

Line 3—Enter federal allowable depletion from federal Form 1120S, Line 15 or federal Form 1065, Line 17. Do not deduct depletion for oil and gas

properties as each partner, member or shareholder figures depletion on oil and gas properties. If the depletion is the same for both federal and

Kentucky, do not make an entry on this line.

Line 4—Enter the difference of the Kentucky distributive share income amounts from Kentucky Schedule(s) K-1 in excess of federal distributive

share amounts from federal Schedule(s) K-1.

Line 5—Enter any other additions to federal income not reported on Lines 1 through 4, and attach an explanation of any other additions to the

tax return. Kentucky has adopted the Internal Revenue Code in effect on December 31, 2006; include additions equal to the excess of Kentucky

income over federal income resulting from amendments to the Internal Revenue Code subsequent to December 31, 2006.

Part II—SUBTRACTIONS FROM FEDERAL ORDINARY INCOME

Line 1—Enter the federal gain from federal Form 1120S, Line 4 or federal Form 1065, Line 6. If the gain from Form 4797, Line 17 is the same for both

federal and Kentucky, do not make an entry on this line.

Line 2—Enter the Kentucky loss from Kentucky Form 4797, Line 17. If the loss from Form 4797, Line 17 is the same for both federal and Kentucky,

do not make an entry on this line.

Line 3—Enter Kentucky allowable depletion using Kentucky taxable income and deductions. If the depletion is the same for both federal and

Kentucky, do not make an entry on this line. To determine the allowable depletion deduction for Kentucky purposes, the percentage limitations

provided by the IRC must be applied using Kentucky taxable income and deductions.

Line 4—Enter amounts received by a producer or a tobacco quota owner from the Tobacco Master Settlement Agreement.

Line 5—Enter amounts received from the Commodity Credit Corporation for the Tobacco Loss Assistance Program.

Line 6—Enter amounts received by a producer or a tobacco quota owner from the tobacco quota buydown program.

Line 7—Enter amounts received by a producer or a tobacco quota owner from state Phase II.

Line 8—Enter the difference of the federal distributive share income amounts from federal Schedule(s) K-1 in excess of Kentucky distributive

share amounts from Kentucky Schedule(s) K-1.

Line 9—Enter any other subtractions from federal income not reported on Lines 1 through 8, and attach an explanation of any other subtractions

to the tax return. Kentucky has adopted the Internal Revenue Code in effect on December 31, 2006; include subtractions equal to the excess of

federal income over Kentucky income resulting from amendments to the Internal Revenue Code subsequent to December 31, 2006.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1