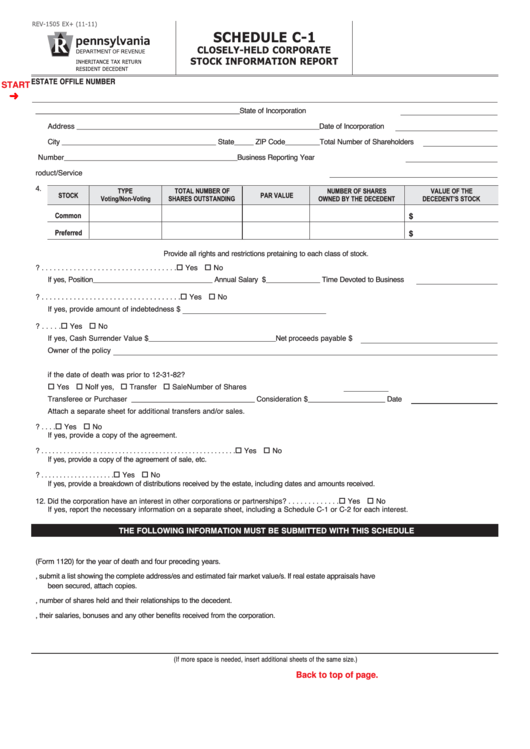

REV-1505 EX+ (11-11)

SCHEDULE C-1

CLOSELY-HELD CORPORATE

STOCK INFORMATION REPORT

INHERITANCE TAX RETURN

RESIDENT DECEDENT

ESTATE OF

FILE NUMBER

START

1. Name of Corporation _____________________________________________________ State of Incorporation

Address _______________________________________________________________ Date of Incorporation

City ________________________________________ State_____ ZIP Code_________ Total Number of Shareholders

2. Federal Employer ID Number _____________________________________________ Business Reporting Year

3. Type of Business __________________________________________ Product/Service

4.

TYPE

TOTAL NUMBER OF

NUMBER OF SHARES

VALUE OF THE

STOCK

PAR VALUE

Voting/Non-Voting

SHARES OUTSTANDING

OWNED BY THE DECEDENT

DECEDENT’S STOCK

Common

$

Preferred

$

Provide all rights and restrictions pretaining to each class of stock.

o

o

5. Was the decedent employed by the corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, Position _______________________________ Annual Salary $______________ Time Devoted to Business

o

o

6. Was the corporation indebted to the decedent? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, provide amount of indebtedness $

o

o

7. Was there life insurance payable to the corporation upon the death of the decedent? . . . . .

Yes

No

If yes, Cash Surrender Value $_________________________________ Net proceeds payable $

Owner of the policy

8. Did the decedent sell or transfer stock in this company within one year prior to death or within two years

if the date of death was prior to 12-31-82?

o

o

o

o

Yes

No

If yes,

Transfer

Sale

Number of Shares

Transferee or Purchaser ________________________________ Consideration $____________________ Date

Attach a separate sheet for additional transfers and/or sales.

o

o

9. Was there a written shareholderʼs agreement in effect at the time of the decedentʼs death? . . . .

Yes

No

If yes, provide a copy of the agreement.

o

o

10. Was the decedentʼs stock sold? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, provide a copy of the agreement of sale, etc.

o

o

11. Was the corporation dissolved or liquidated after the decedentʼs death? . . . . . . . . . . . . . . . . . . . .

Yes

No

If yes, provide a breakdown of distributions received by the estate, including dates and amounts received.

o

o

12. Did the corporation have an interest in other corporations or partnerships? . . . . . . . . . . . . .

Yes

No

If yes, report the necessary information on a separate sheet, including a Schedule C-1 or C-2 for each interest.

THE FOLLOWING INFORMATION MUST BE SUBMITTED WITH THIS SCHEDULE

A. Detailed calculations used in the valuation of the decedentʼs stock.

B. Complete copies of financial statements or federal corporate income tax returns (Form 1120) for the year of death and four preceding years.

C. If the corporation owned real estate, submit a list showing the complete address/es and estimated fair market value/s. If real estate appraisals have

been secured, attach copies.

D. List of principal stockholders at the date of death, number of shares held and their relationships to the decedent.

E. List of officers, their salaries, bonuses and any other benefits received from the corporation.

F. Statement of dividends paid each year. List those declared and unpaid.

G. Any other information relating to the valuation of the decedentʼs stock.

(If more space is needed, insert additional sheets of the same size.)

Reset Entire Form

Back to top of page.

PRINT FORM

1

1