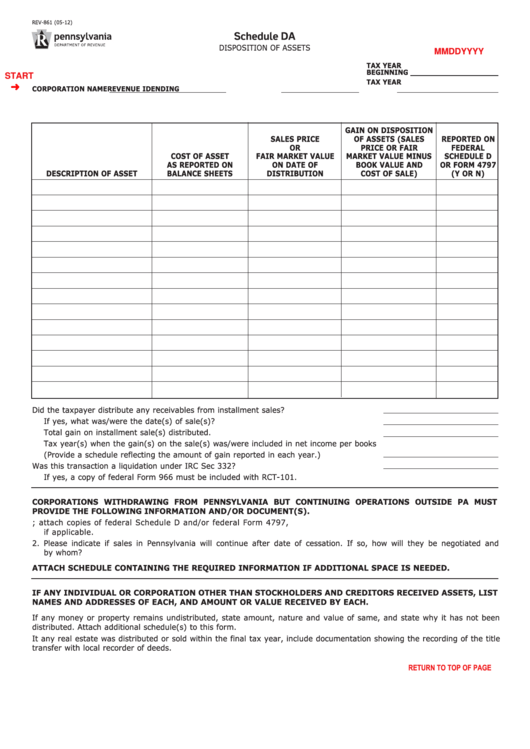

REV-861 (05-12)

Schedule DA

DISPOSITION OF ASSETS

MMDDYYYY

TAX YEAR

BEGINNING

START

TAX YEAR

CORPORATION NAME

REVENUE ID

ENDING

GAIN ON DISPOSITION

SALES PRICE

OF ASSETS (SALES

REPORTED ON

OR

PRICE OR FAIR

FEDERAL

COST OF ASSET

FAIR MARKET VALUE

MARKET VALUE MINUS

SCHEDULE D

AS REPORTED ON

ON DATE OF

BOOK VALUE AND

OR FORM 4797

DESCRIPTION OF ASSET

BALANCE SHEETS

DISTRIBUTION

COST OF SALE)

(Y OR N)

Did the taxpayer distribute any receivables from installment sales?

If yes, what was/were the date(s) of sale(s)?

Total gain on installment sale(s) distributed.

Tax year(s) when the gain(s) on the sale(s) was/were included in net income per books

(Provide a schedule reflecting the amount of gain reported in each year.)

Was this transaction a liquidation under IRC Sec 332?

If yes, a copy of federal Form 966 must be included with RCT-101.

CORPORATIONS WITHDRAWING FROM PENNSYLVANIA BUT CONTINUING OPERATIONS OUTSIDE PA MUST

PROVIDE THE FOLLOWING INFORMATION AND/OR DOCUMENT(S).

1. Full details of disposition of Pennsylvania property; attach copies of federal Schedule D and/or federal Form 4797,

if applicable.

2. Please indicate if sales in Pennsylvania will continue after date of cessation. If so, how will they be negotiated and

by whom?

ATTACH SCHEDULE CONTAINING THE REQUIRED INFORMATION IF ADDITIONAL SPACE IS NEEDED.

IF ANY INDIVIDUAL OR CORPORATION OTHER THAN STOCKHOLDERS AND CREDITORS RECEIVED ASSETS, LIST

NAMES AND ADDRESSES OF EACH, AND AMOUNT OR VALUE RECEIVED BY EACH.

If any money or property remains undistributed, state amount, nature and value of same, and state why it has not been

distributed. Attach additional schedule(s) to this form.

It any real estate was distributed or sold within the final tax year, include documentation showing the recording of the title

transfer with local recorder of deeds.

PRINT FORM

Reset Entire Form

RETURN TO TOP OF PAGE

1

1