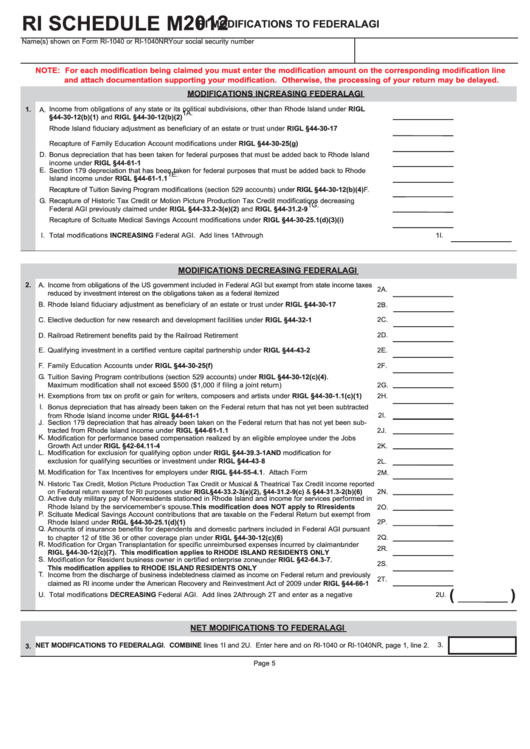

2012

RI SCHEDULE M

RI MODIFICATIONS TO FEDERAL AGI

Name(s) shown on Form RI-1040 or RI-1040NR

Your social security number

NOTE: For each modification being claimed you must enter the modification amount on the corresponding modification line

and attach documentation supporting your modification. Otherwise, the processing of your return may be delayed.

MODIFICATIONS INCREASING FEDERAL AGI

1.

Income from obligations of any state or its political subdivisions, other than Rhode Island under RIGL

A.

1A.

§44-30-12(b)(1) and RIGL §44-30-12(b)(2)................................................................................................

B.

Rhode Island fiduciary adjustment as beneficiary of an estate or trust under RIGL §44-30-17.................

1B.

C.

Recapture of Family Education Account modifications under RIGL §44-30-25(g).....................................

1C.

D.

Bonus depreciation that has been taken for federal purposes that must be added back to Rhode Island

income under RIGL §44-61-1.....................................................................................................................

1D.

E.

Section 179 depreciation that has been taken for federal purposes that must be added back to Rhode

1E.

Island income under RIGL §44-61-1.1........................................................................................................

F.

Recapture of Tuition Saving Program modifications (section 529 accounts) under RIGL §44-30-12(b)(4)....

1F.

Recapture of Historic Tax Credit or Motion Picture Production Tax Credit modifications decreasing

G.

1G.

Federal AGI previously claimed under RIGL §44-33.2-3(e)(2) and RIGL §44-31.2-9 respectively............

H.

Recapture of Scituate Medical Savings Account modifications under RIGL §44-30-25.1(d)(3)(i)..............

1H.

I.

Total modifications INCREASING Federal AGI. Add lines 1A through 1H.................................................................................

1I.

MODIFICATIONS DECREASING FEDERAL AGI

2.

A.

Income from obligations of the US government included in Federal AGI but exempt from state income taxes

2A.

reduced by investment interest on the obligations taken as a federal itemized deduction.................................

B.

Rhode Island fiduciary adjustment as beneficiary of an estate or trust under RIGL §44-30-17..................

2B.

C.

Elective deduction for new research and development facilities under RIGL §44-32-1..............................

2C.

D.

Railroad Retirement benefits paid by the Railroad Retirement Board.........................................................

2D.

E.

Qualifying investment in a certified venture capital partnership under RIGL §44-43-2................................

2E.

F.

Family Education Accounts under RIGL §44-30-25(f).................................................................................

2F.

G.

Tuition Saving Program contributions (section 529 accounts) under RIGL §44-30-12(c)(4).

Maximum modification shall not exceed $500 ($1,000 if filing a joint return)..............................................

2G.

H.

Exemptions from tax on profit or gain for writers, composers and artists under RIGL §44-30-1.1(c)(1).....

2H.

I.

Bonus depreciation that has already been taken on the Federal return that has not yet been subtracted

from Rhode Island income under RIGL §44-61-1........................................................................................

2I.

J.

Section 179 depreciation that has already been taken on the Federal return that has not yet been sub-

2J.

tracted from Rhode Island income under RIGL §44-61-1.1.........................................................................

K.

Modification for performance based compensation realized by an eligible employee under the Jobs

Growth Act under RIGL §42-64.11-4............................................................................................................

2K.

L.

Modification for exclusion for qualifying option under RIGL §44-39.3-1 AND modification for

exclusion for qualifying securities or investment under RIGL §44-43-8.......................................................

2L.

M.

Modification for Tax Incentives for employers under RIGL §44-55-4.1. Attach Form RI-107.....................

2M.

N.

Historic Tax Credit, Motion Picture Production Tax Credit or Musical & Theatrical Tax Credit income reported

on Federal return exempt for RI purposes under RIGL §44-33.2-3(e)(2), §44-31.2-9(c) & §44-31.3-2(b)(6)....

2N.

O.

Active duty military pay of Nonresidents stationed in Rhode Island and income for services performed in

Rhode Island by the servicemember’s spouse.This modification does NOT apply to RI residents.......

2O.

P.

Scituate Medical Savings Account contributions that are taxable on the Federal Return but exempt from

Rhode Island under RIGL §44-30-25.1(d)(1)...............................................................................................

2P.

Q.

Amounts of insurance benefits for dependents and domestic partners included in Federal AGI pursuant

to chapter 12 of title 36 or other coverage plan under RIGL §44-30-12(c)(6).............................................

2Q.

R.

Modification for Organ Transplantation for specific unreimbursed expenses incurred by claimant under

2R.

RIGL §44-30-12(c)(7). This modification applies to RHODE ISLAND RESIDENTS ONLY....................

S.

Modification for Resident business owner in certified enterprise zone under RIGL §42-64.3-7.

2S.

This modification applies to RHODE ISLAND RESIDENTS ONLY..........................................................

T.

Income from the discharge of business indebtedness claimed as income on Federal return and previously

2T.

claimed as RI income under the American Recovery and Reinvestment Act of 2009 under RIGL §44-66-1

(

)

U.

Total modifications DECREASING Federal AGI. Add lines 2A through 2T and enter as a negative amount............................ 2U.

NET MODIFICATIONS TO FEDERAL AGI

NET MODIFICATIONS TO FEDERAL AGI. COMBINE lines 1I and 2U. Enter here and on RI-1040 or RI-1040NR, page 1, line 2.

3.

3.

Page 5

1

1