Reset Form

Print Form

Iowa Department of Revenue

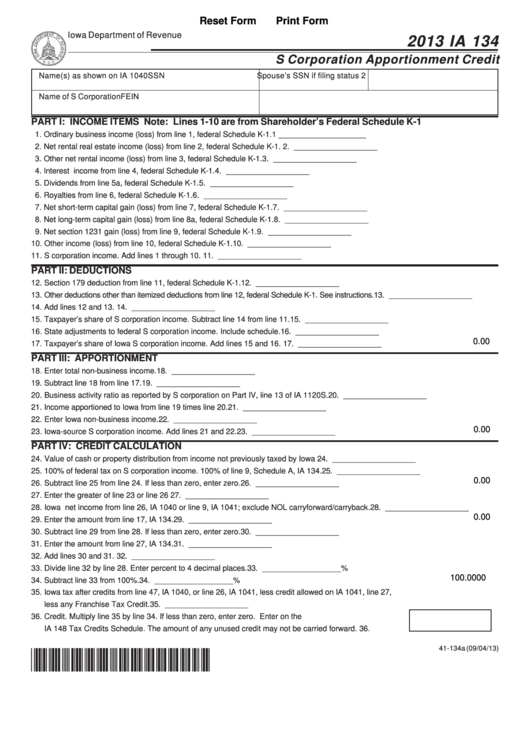

2013 IA 134

S Corporation Apportionment Credit

Name(s) as shown on IA 1040

SSN

Spouse’s SSN if filing status 2

Name of S Corporation

FEIN

PART I: INCOME ITEMS Note: Lines 1-10 are from Shareholder’s Federal Schedule K-1

1. Ordinary business income (loss) from line 1, federal Schedule K-1. ........................................................ 1 ____________________

2. Net rental real estate income (loss) from line 2, federal Schedule K-1. .................................................... 2. ___________________

3. Other net rental income (loss) from line 3, federal Schedule K-1. ............................................................. 3. ___________________

4. Interest income from line 4, federal Schedule K-1. .................................................................................. 4. ___________________

5. Dividends from line 5a, federal Schedule K-1. .......................................................................................... 5. ___________________

6. Royalties from line 6, federal Schedule K-1. ............................................................................................. 6. ___________________

7. Net short-term capital gain (loss) from line 7, federal Schedule K-1. ........................................................ 7. ___________________

8. Net long-term capital gain (loss) from line 8a, federal Schedule K-1. ....................................................... 8. ___________________

9. Net section 1231 gain (loss) from line 9, federal Schedule K-1. ............................................................... 9. ___________________

10. Other income (loss) from line 10, federal Schedule K-1. .......................................................................... 10. ___________________

11. S corporation income. Add lines 1 through 10. ......................................................................................... 11. ___________________

PART II: DEDUCTIONS

12. Section 179 deduction from line 11, federal Schedule K-1. ....................................................................... 12. ___________________

13. Other deductions other than itemized deductions from line 12, federal Schedule K-1. See instructions. ......... 13. ___________________

14. Add lines 12 and 13. ................................................................................................................................. 14. ___________________

15. Taxpayer’s share of S corporation income. Subtract line 14 from line 11. ................................................ 15. ___________________

16. State adjustments to federal S corporation income. Include schedule. .................................................... 16. ___________________

0.00

17. Taxpayer’s share of Iowa S corporation income. Add lines 15 and 16. .................................................... 17. ___________________

PART III: APPORTIONMENT

18. Enter total non-business income. ............................................................................................................. 18. ___________________

19. Subtract line 18 from line 17. .................................................................................................................... 19. ___________________

20. Business activity ratio as reported by S corporation on Part IV, line 13 of IA 1120S. .............................. 20. ___________________

21. Income apportioned to Iowa from line 19 times line 20. ............................................................................ 21. ___________________

22. Enter Iowa non-business income. ............................................................................................................ 22. ___________________

0.00

23. Iowa-source S corporation income. Add lines 21 and 22. ......................................................................... 23. ___________________

PART IV: CREDIT CALCULATION

24. Value of cash or property distribution from income not previously taxed by Iowa .................................... 24. ___________________

25. 100% of federal tax on S corporation income. 100% of line 9, Schedule A, IA 134. ................................. 25. ___________________

0.00

26. Subtract line 25 from line 24. If less than zero, enter zero. ....................................................................... 26. ___________________

27. Enter the greater of line 23 or line 26 ........................................................................................................ 27. ___________________

28. Iowa net income from line 26, IA 1040 or line 9, IA 1041; exclude NOL carryforward/carryback. ........... 28. ___________________

0.00

29. Enter the amount from line 17, IA 134. ...................................................................................................... 29. ___________________

30. Subtract line 29 from line 28. If less than zero, enter zero. ....................................................................... 30. ___________________

31. Enter the amount from line 27, IA 134. ...................................................................................................... 31. ___________________

32. Add lines 30 and 31. ................................................................................................................................. 32. ___________________

33. Divide line 32 by line 28. Enter percent to 4 decimal places. .................................................................... 33. __________________ %

100.0000

34. Subtract line 33 from 100%. ..................................................................................................................... 34. __________________ %

35. Iowa tax after credits from line 47, IA 1040, or line 26, IA 1041, less credit allowed on IA 1041, line 27,

less any Franchise Tax Credit. ................................................................................................................ 35. ___________________

36. Credit. Multiply line 35 by line 34. If less than zero, enter zero. Enter on the

IA 148 Tax Credits Schedule. The amount of any unused credit may not be carried forward. ................. 36.

41-134a (09/04/13)

*1341134019999*

1

1 2

2