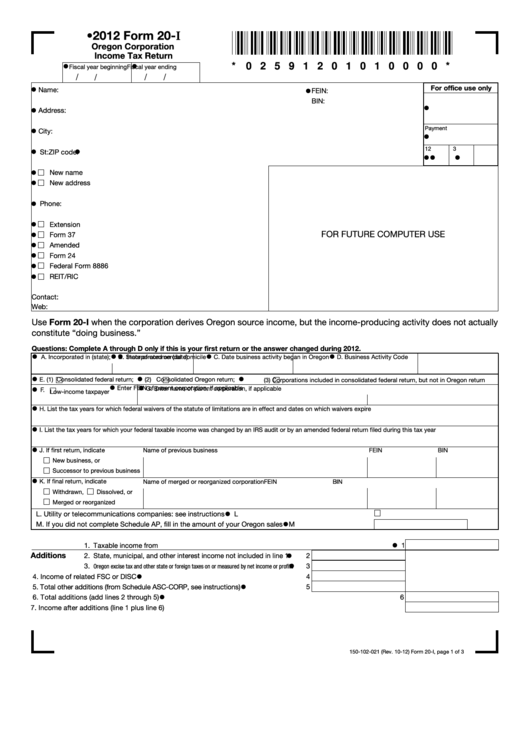

•2012 Form 20-I

Oregon Corporation

Income Tax Return

•

•

* 0 2 5 9 1 2 0 1 0 1 0 0 0 0 *

Fiscal year beginning

Fiscal year ending

/

/

/

/

•

•

For office use only

Name:

FEIN:

BIN:

•

•

Address:

•

Payment

City:

•

•

•

1

2

3

St:

ZIP code:

•

•

•

•

New name

•

New address

•

Phone:

•

Extension

•

FOR FUTURE COMPUTER USE

Form 37

•

Amended

•

Form 24

•

Federal Form 8886

•

REIT/RIC

Contact:

Web:

Use Form 20-I when the corporation derives Oregon source income, but the income-producing activity does not actually

constitute “doing business.”

Questions: Complete A through D only if this is your first return or the answer changed during 2012.

•

•

•

•

•

A. Incorporated in (state);

Incorporated on (date)

B. State of commercial domicile

C. Date business activity began in Oregon

D. Business Activity Code

•

•

•

E. (1)

Consolidated federal return;

(2)

Consolidated Oregon return;

(3)

Corporations included in consolidated federal return, but not in Oregon return

•

•

•

Enter FEIN of parent corporation, if applicable

G. Enter name of parent corporation, if applicable

F.

Low-income taxpayer

•

H. List the tax years for which federal waivers of the statute of limitations are in effect and dates on which waivers expire

•

I. List the tax years for which your federal taxable income was changed by an IRS audit or by an amended federal return filed during this tax year

•

J. If first return, indicate

Name of previous business

FEIN

BIN

New business, or

Successor to previous business

•

K. If final return, indicate

Name of merged or reorganized corporation

FEIN

BIN

Withdrawn,

Dissolved, or

Merged or reorganized

•

L. Utility or telecommunications companies: see instructions ...................................................................

L

•

M. If you did not complete Schedule AP, fill in the amount of your Oregon sales ......................................

M

•

1. Taxable income from U.S. corporation income tax return ..................................................................

1

•

Additions

2. State, municipal, and other interest income not included in line 1 .....

2

•

3.

....

3

Oregon excise tax and other state or foreign taxes on or measured by net income or profits

•

4. Income of related FSC or DISC .......................................................

4

•

5. Total other additions (from Schedule ASC-CORP, see instructions)....

5

•

6. Total additions (add lines 2 through 5) ..............................................................................................

6

7. Income after additions (line 1 plus line 6).............................................................................................. 7

150-102-021 (Rev. 10-12) Form 20-I, page 1 of 3

1

1 2

2 3

3