Reset Form

Please do not use staples.

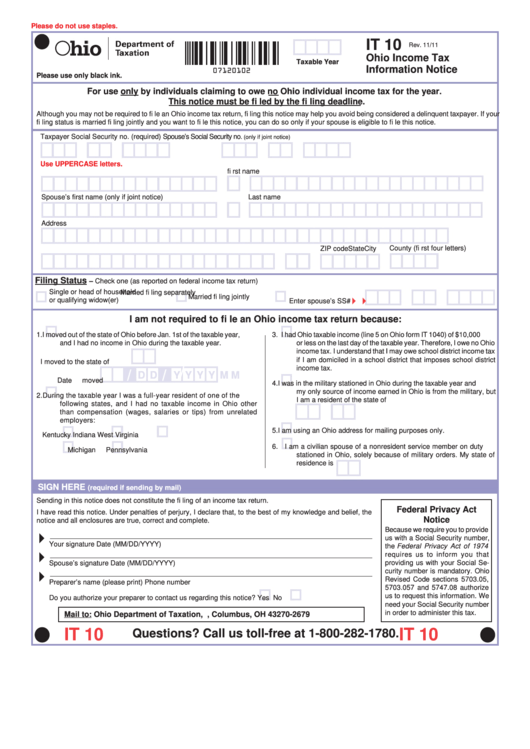

IT 10

Rev. 11/11

Ohio Income Tax

Taxable Year

Information Notice

07120102

Please use only black ink.

For use only by individuals claiming to owe no Ohio individual income tax for the year.

This notice must be fi led by the fi ling deadline.

Although you may not be required to fi le an Ohio income tax return, fi ling this notice may help you avoid being considered a delinquent taxpayer. If your

fi ling status is married fi ling jointly and you want to fi le this notice, you can do so only if your spouse is eligible to fi le this notice.

Taxpayer Social Security no. (required)

Spouse’s Social Security no.

(only if joint notice)

Use UPPERCASE letters.

Your fi rst name

M.I.

Last name

Spouse’s fi rst name (only if joint notice)

M.I.

Last name

Address

County (fi rst four letters)

City

State

ZIP code

Filing Status

– Check one (as reported on federal income tax return)

Single or head of household

Married fi ling separately

Married fi ling jointly

or qualifying widow(er)

Enter spouse’s SS#

I am not required to fi le an Ohio income tax return because:

1.

I moved out of the state of Ohio before Jan. 1st of the taxable year,

3.

I had Ohio taxable income (line 5 on Ohio form IT 1040) of $10,000

and I had no income in Ohio during the taxable year.

or less on the last day of the taxable year. Therefore, I owe no Ohio

income tax. I understand that I may owe school district income tax

if I am domiciled in a school district that imposes school district

I moved to the state of

income tax.

/

/

/

M M

D D

Y Y Y Y

Date moved

4.

I was in the military stationed in Ohio during the taxable year and

my only source of income earned in Ohio is from the military, but

2.

During the taxable year I was a full-year resident of one of the

I am a resident of the state of

following states, and I had no taxable income in Ohio other

than compensation (wages, salaries or tips) from unrelated

employers:

5.

I am using an Ohio address for mailing purposes only.

Kentucky

Indiana

West Virginia

6.

I am a civilian spouse of a nonresident service member on duty

Michigan

Pennsylvania

stationed in Ohio, solely because of military orders. My state of

residence is

SIGN HERE

(required if sending by mail)

Sending in this notice does not constitute the fi ling of an income tax return.

Federal Privacy Act

I have read this notice. Under penalties of perjury, I declare that, to the best of my knowledge and belief, the

Notice

notice and all enclosures are true, correct and complete.

Because we require you to provide

us with a Social Security number,

Your signature

Date (MM/DD/YYYY)

the Federal Privacy Act of 1974

requires us to inform you that

Spouse’s signature

Date (MM/DD/YYYY)

providing us with your Social Se-

curity number is mandatory. Ohio

Revised Code sections 5703.05,

Preparer’s name (please print)

Phone number

5703.057 and 5747.08 authorize

us to request this information. We

Do you authorize your preparer to contact us regarding this notice?

Yes

No

need your Social Security number

in order to administer this tax.

Mail to: Ohio Department of Taxation, P.O. Box 2679, Columbus, OH 43270-2679

IT 10

IT 10

Questions? Call us toll-free at 1-800-282-1780.

1

1