Reset Form

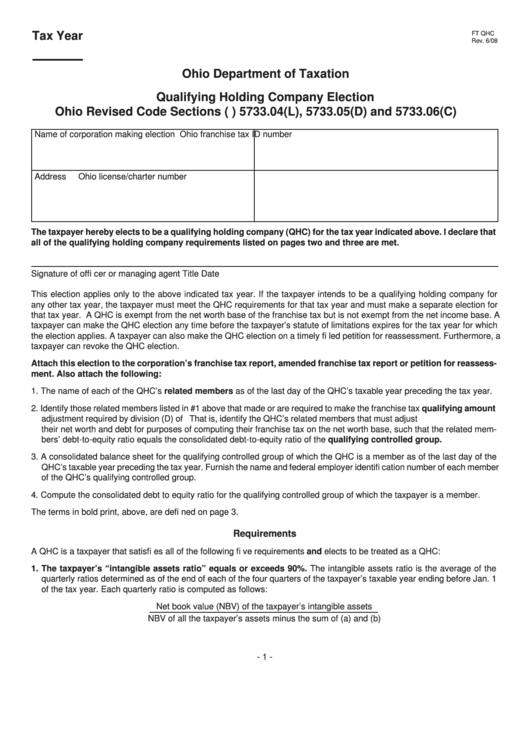

Tax Year

FT QHC

Rev. 6/08

Ohio Department of Taxation

Qualifying Holding Company Election

Ohio Revised Code Sections (R.C.) 5733.04(L), 5733.05(D) and 5733.06(C)

Name of corporation making election

Ohio franchise tax ID number

Address

Ohio license/charter number

The taxpayer hereby elects to be a qualifying holding company (QHC) for the tax year indicated above. I declare that

all of the qualifying holding company requirements listed on pages two and three are met.

Signature of offi cer or managing agent

Title

Date

This election applies only to the above indicated tax year. If the taxpayer intends to be a qualifying holding company for

any other tax year, the taxpayer must meet the QHC requirements for that tax year and must make a separate election for

that tax year. A QHC is exempt from the net worth base of the franchise tax but is not exempt from the net income base. A

taxpayer can make the QHC election any time before the taxpayer’s statute of limitations expires for the tax year for which

the election applies. A taxpayer can also make the QHC election on a timely fi led petition for reassessment. Furthermore, a

taxpayer can revoke the QHC election.

Attach this election to the corporation’s franchise tax report, amended franchise tax report or petition for reassess-

ment. Also attach the following:

1. The name of each of the QHC’s related members as of the last day of the QHC’s taxable year preceding the tax year.

2. Identify those related members listed in #1 above that made or are required to make the franchise tax qualifying amount

adjustment required by division (D) of R.C. section 5733.05. That is, identify the QHC’s related members that must adjust

their net worth and debt for purposes of computing their franchise tax on the net worth base, such that the related mem-

bers’ debt-to-equity ratio equals the consolidated debt-to-equity ratio of the qualifying controlled group.

3. A consolidated balance sheet for the qualifying controlled group of which the QHC is a member as of the last day of the

QHC’s taxable year preceding the tax year. Furnish the name and federal employer identifi cation number of each member

of the QHC’s qualifying controlled group.

4. Compute the consolidated debt to equity ratio for the qualifying controlled group of which the taxpayer is a member.

The terms in bold print, above, are defi ned on page 3.

Requirements

A QHC is a taxpayer that satisfi es all of the following fi ve requirements and elects to be treated as a QHC:

1. The taxpayer’s “intangible assets ratio” equals or exceeds 90%. The intangible assets ratio is the average of the

quarterly ratios determined as of the end of each of the four quarters of the taxpayer’s taxable year ending before Jan. 1

of the tax year. Each quarterly ratio is computed as follows:

Net book value (NBV) of the taxpayer’s intangible assets

NBV of all the taxpayer’s assets minus the sum of (a) and (b)

- 1 -

1

1 2

2 3

3