Form Dr 0098 - Special Sales Event Sales Tax Return - Colorado Department Of Revenue

ADVERTISEMENT

DR 0098 (05/07/13)

DR 0098 Web (05/13/13)

DR 0589 (05/13/13)

DR 0589 Web (05/13/13)

Special Sales Event Sales Tax Return

COLORADO DEPARTMENT OF REVENUE

COLORADO DEPARTMENT OF REVENUE

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

Denver CO 80261-0013

Denver CO 80261-0013

You may electronically fi le and pay your return conveniently and securely on Revenue Online at

Filing online ensures timely fi ling and prevents common fi ling errors. Local sales tax rates are listed under Other Services, “View Local

Sales Tax Rates”. There is a fee to pay by eCheck or credit card. See the Taxation Web site at for current fees.

Filing by Electronic Funds Transfer (EFT) is free but pre-registration is required. See the last page of this form for instructions on how to

use the online fi ling system at

A “Special Sales Event” means an event where retail sales are

• All entries of state and local taxes must be rounded to the

made by more than three persons (vendors).A standard sales

nearest dollar. Round amounts under 50 cents down to 0 cents,

tax license is required if you participate in the same event

increase amounts from 50 to 99 cents to the next dollar. Books,

that occurs more than three times at the same location during

records and statements or invoices to buyers must refl ect actual

any calendar year. State sales tax, and if applicable, RTD/CD,

tax amounts and only the totals appearing on this tax return are

RTA, MHA, PSI, or state-collected local tax must be collected on

rounded. You will still collect and keep track of exact amounts of

the gross selling price of items sold with the exception of sales

sales tax. It is only when you fi ll out this return that you round the

to another licensed dealer. In the special districts column, check

numbers you are reporting.

the box for the district (or districts) for which tax was collected.

• Failure to fi le the return and pay the tax subjects the vendor to

RTD (Regional Transportation District), CD (Scientifi c and Cultural

a penalty of 10% plus 1/2% for each additional month not to

District), RTA (Rural Transportation Authority), MHA (Multi-Juris-

exceed 18% of the tax due. Current interest rates are available on

dictional Housing Authority, and Public Safety Improvements (PSI)

Department of Revenue Web site, .

sales taxes must be paid if the sales are made to businesses

• Amended Return — If you are fi ling an amended return you are

located within the boundaries of the districts. Do not remit tax to

required to mark the amended return box. A separate amended

the state for home-rule cities which administer their own tax. The

return must be fi led for each event. The amended return must

applicable taxes, tax rates and service fee information can be

show all tax columns as corrected, not merely the difference(s).

obtained from the event organizer.

The amended return will replace the original return in its entirety.

How to fi le: If unable to fi le and pay the return electronically

Be sure to use the correct vendor fee for the jurisdiction in which

through Revenue Online, mail the return, together with remittance

you are fi ling the tax.

by check, draft, or money order, to the Department of Revenue,

• Any questions regarding the preparation of your return may be

Denver, CO 80261-0013. The payment and returns are due on

directed to: 303-238-SERV (7378).

or before the 20th day of the month following the month in which

• Refer to Form DR 1002 on the Web site at

such special sales event began. A separate return must be fi led

for all sales tax rates, vendor fee rates,

for each special event. Please include your Colorado account

exemptions and other information.

number, signature, and telephone number on your remittance.

• Refer to Form DR 0800 for location/jurisdiction codes.

• Mail to and make check payable to:

Department of Revenue

DETACH FORM

Denver, CO 80261-0013

Photocopy for your records.

ON THIS LINE

Cut here and send only the coupon below. Help us save time and your tax dollars.

Cut here and send only the coupon below. Help us save time and your tax dollars.

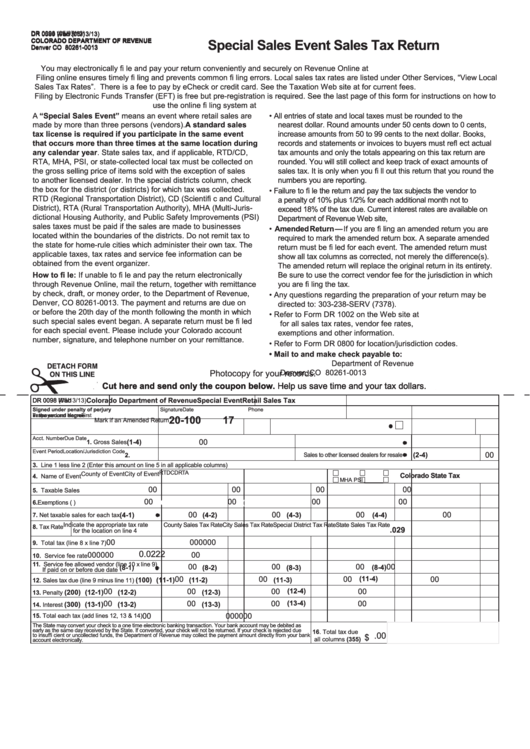

Colorado Department of Revenue

Special Event

Retail Sales Tax

DR 0098 Web

DR 0098

DR 0098 Web

(05/13/13)

Signed under penalty of perjury

Signature

Date

Phone

in the second degree

Taxpayer Last Name

First Name

M.I.

20-100

17

Mark if an Amended Return .........................

Acct. Number

Due Date

00

(1-4)

1. Gross Sales

Event Period

Location/Jurisdiction Code

00

(2-4)

2. Sales to other licensed dealers for resale

3. Line 1 less line 2 (Enter this amount on line 5 in all applicable columns)

RTD

CD

RTA

County of Event

City of Event

Colorado State Tax

4. Name of Event

MHA

PSI

______

00

00

00

(5-4)

00

(5-1)

(5-2)

(5-3)

5. Taxable Sales

00

00

00

(6-4)

00

(6-1)

(6-2)

(6-3)

6. Exemptions (i.e. food for home consumption)

00

00

00

00

(4-4)

(4-1)

(4-2)

(4-3)

7. Net taxable sales for each tax

Indicate the appropriate tax rate

County Sales Tax Rate

City Sales Tax Rate

Special District Tax Rate

State Sales Tax Rate

8. Tax Rate

.029

for the location on line 4

00

00

00

00

9. Total tax (line 8 x line 7)

0.0222

00

00

00

00

10. Service fee rate

11. Service fee allowed vendor (line 10 x line 9)

00

00

00

00

(8-4)

(8-1)

(8-2)

(8-3)

If paid on or before due date

00

00

00

(11-4)

00

(100) (11-1)

(11-2)

(11-3)

12. Sales tax due (line 9 minus line 11)

00

00

00

(12-4)

00

(200) (12-1)

(12-2)

(12-3)

13. Penalty

00

00

00

(13-4)

00

(300) (13-1)

(13-2)

(13-3)

14. Interest

00

00

00

00

15. Total each tax (add lines 12, 13 & 14)

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as

early as the same day received by the State. If converted, your check will not be returned. If your check is rejected due

16. Total tax due

.00

to insuffi cient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank

$

all columns

(355)

account electronically.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1