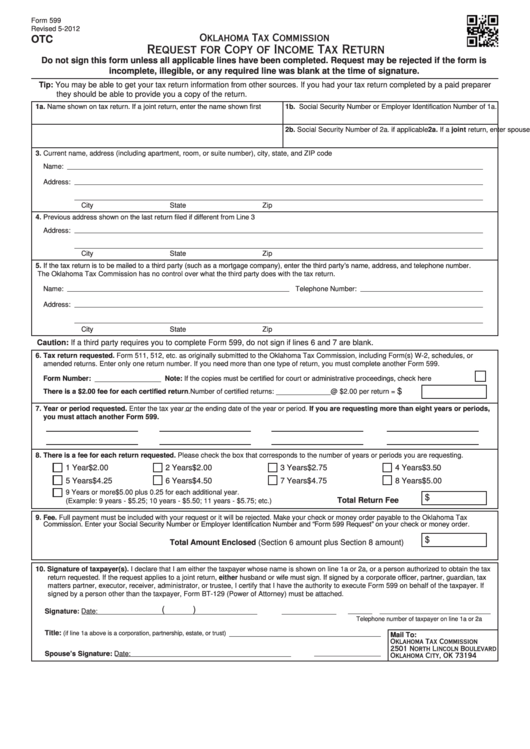

Form 599

Revised 5-2012

Oklahoma Tax Commission

OTC

Request for Copy of Income Tax Return

Do not sign this form unless all applicable lines have been completed. Request may be rejected if the form is

incomplete, illegible, or any required line was blank at the time of signature.

Tip: You may be able to get your tax return information from other sources. If you had your tax return completed by a paid preparer

they should be able to provide you a copy of the return.

1b. Social Security Number or Employer Identification Number of 1a.

1a. Name shown on tax return. If a joint return, enter the name shown first

2a. If a joint return, enter spouse’s name shown on tax return

2b. Social Security Number of 2a. if applicable

3. Current name, address (including apartment, room, or suite number), city, state, and ZIP code

Name:

Address:

City

State

Zip

4. Previous address shown on the last return filed if different from Line 3

Address:

City

State

Zip

5. If the tax return is to be mailed to a third party (such as a mortgage company), enter the third party’s name, address, and telephone number.

The Oklahoma Tax Commission has no control over what the third party does with the tax return.

Name:

Telephone Number:

Address:

City

State

Zip

Caution: If a third party requires you to complete Form 599, do not sign if lines 6 and 7 are blank.

6. Tax return requested. Form 511, 512, etc. as originally submitted to the Oklahoma Tax Commission, including Form(s) W-2, schedules, or

amended returns. Enter only one return number. If you need more than one type of return, you must complete another Form 599.

Form Number: _________________ Note: If the copies must be certified for court or administrative proceedings, check here .....................

There is a $2.00 fee for each certified return. ...........Number of certified returns: ______________ @ $2.00 per return =

$

7. Year or period requested. Enter the tax year or the ending date of the year or period. If you are requesting more than eight years or periods,

you must attach another Form 599.

8. There is a fee for each return requested. Please check the box that corresponds to the number of years or periods you are requesting.

3 Years................ $2.75

4 Years................ $3.50

1 Year .......... $2.00

2 Years................ $2.00

5 Years......... $4.25

6 Years................ $4.50

7 Years................ $4.75

8 Years................ $5.00

9 Years or more ...... $5.00 plus 0.25 for each additional year.

$

Total Return Fee .........

(Example: 9 years - $5.25; 10 years - $5.50; 11 years - $5.75; etc.)

9. Fee. Full payment must be included with your request or it will be rejected. Make your check or money order payable to the Oklahoma Tax

Commission. Enter your Social Security Number or Employer Identification Number and “Form 599 Request” on your check or money order.

$

Total Amount Enclosed (Section 6 amount plus Section 8 amount) .......

10. Signature of taxpayer(s). I declare that I am either the taxpayer whose name is shown on line 1a or 2a, or a person authorized to obtain the tax

return requested. If the request applies to a joint return, either husband or wife must sign. If signed by a corporate officer, partner, guardian, tax

matters partner, executor, receiver, administrator, or trustee, I certify that I have the authority to execute Form 599 on behalf of the taxpayer. If

signed by a person other than the taxpayer, Form BT-129 (Power of Attorney) must be attached.

(

)

Signature:

Date:

Telephone number of taxpayer on line 1a or 2a

Title:

(if line 1a above is a corporation, partnership, estate, or trust)

Mail To:

Oklahoma Tax Commission

2501 North Lincoln Boulevard

Spouse’s Signature:

Date:

Oklahoma City, OK 73194

1

1