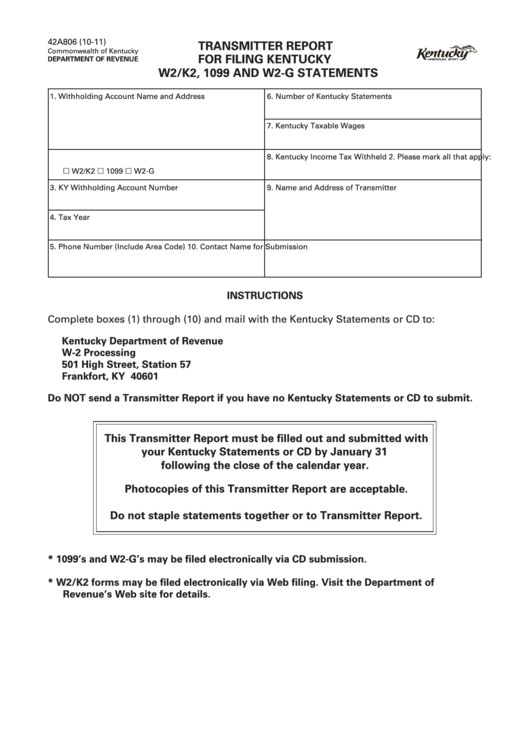

Form 42a806 - Transmitter Report For Filing Kentucky W2/k2, 1099 And W2-G Statements

ADVERTISEMENT

42A806 (10-11)

TRANSMITTER REPORT

Commonwealth of Kentucky

FOR FILING KENTUCKY

DEPARTMENT OF REVENUE

W2/K2, 1099 AND W2-G STATEMENTS

1. Withholding Account Name and Address

6. Number of Kentucky Statements

7. Kentucky Taxable Wages

2. Please mark all that apply:

8. Kentucky Income Tax Withheld

£ W2/K2 £ 1099 £ W2-G

3. KY Withholding Account Number

9. Name and Address of Transmitter

4. Tax Year

5. Phone Number (Include Area Code)

10. Contact Name for Submission

INSTRUCTIONS

Complete boxes (1) through (10) and mail with the Kentucky Statements or CD to:

Kentucky Department of Revenue

W-2 Processing

501 High Street, Station 57

Frankfort, KY 40601

Do NOT send a Transmitter Report if you have no Kentucky Statements or CD to submit.

This Transmitter Report must be filled out and submitted with

your Kentucky Statements or CD by January 31

following the close of the calendar year.

Photocopies of this Transmitter Report are acceptable.

Do not staple statements together or to Transmitter Report.

* 1099’s and W2-G’s may be filed electronically via CD submission.

* W2/K2 forms may be filed electronically via Web filing. Visit the Department of

Revenue’s Web site for details.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1