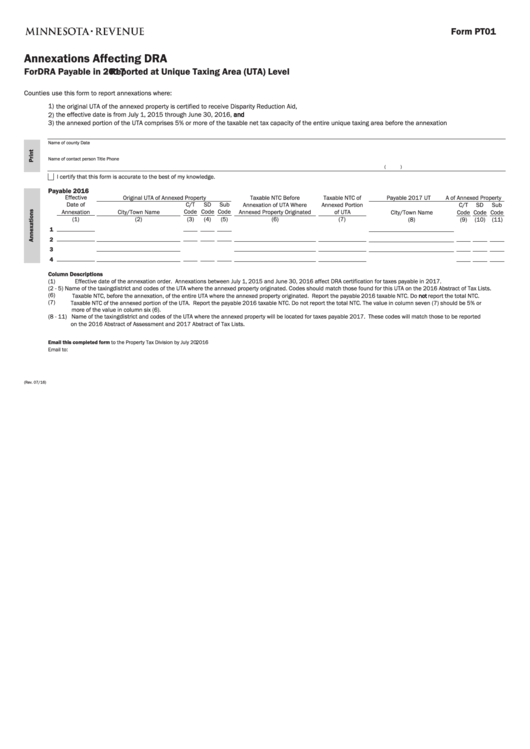

Form PT01

Annexations Affecting DRA

For DRA Payable in 2017 - Reported at Unique Taxing Area (UTA) Level

Counties use this form to report annexations where:

1) the original UTA of the annexed property is certified to receive Disparity Reduction Aid,

2) the effective date is from July 1, 2015 through June 30, 2016, and

3) the annexed portion of the UTA comprises 5% or more of the taxable net tax capacity of the entire unique taxing area before the annexation

Name of county

Date

Name of contact person

Title

Phone

(

)

I certify that this form is accurate to the best of my knowledge.

Payable 2016

Effective

Original UTA of Annexed Property

Taxable NTC Before

Taxable NTC of

Payable 2017 UT A of Annexed Property

Date of

C/T

SD

Sub

Annexation of UTA Where

Annexed Portion

C/T

SD

Sub

Annexation

City/Town Name

Code

Code

Code

Annexed Property Originated

of UTA

City/Town Name

Code

Code

Code

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

(11)

1

2

3

4

Column Descriptions

(1)

Effective date of the annexation order. Annexations between July 1, 2015 and June 30, 2016 affect DRA certification for taxes payable in 2017.

(2 - 5)

Name of the taxing district and codes of the UTA where the annexed property originated. Codes should match those found for this UTA on the 2016 Abstract of Tax Lists.

(6)

Taxable NTC, before the annexation, of the entire UTA where the annexed property originated. Report the payable 2016 taxable NTC. Do not report the total NTC.

(7)

Taxable NTC of the annexed portion of the UTA. Report the payable 2016 taxable NTC. Do not report the total NTC. The value in column seven (7) should be 5% or

more of the value in column six (6).

(8 - 11) Name of the taxing district and codes of the UTA where the annexed property will be located for taxes payable 2017. These codes will match those to be reported

on the 2016 Abstract of Assessment and 2017 Abstract of Tax Lists.

Email this completed form to the Property Tax Division by July 20, 2016

Email to: proptax.admin@state.mn.us

(Rev. 07/16)

1

1