Form 243 - Claim To Refund Due A Deceased Person

ADVERTISEMENT

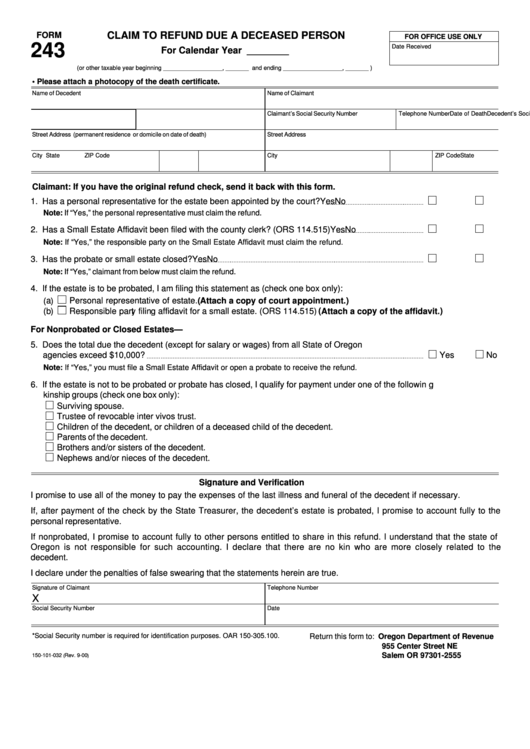

CLAIM TO REFUND DUE A DECEASED PERSON

FORM

FOR OFFICE USE ONLY

243

Date Received

For Calendar Year ________

(or other taxable year beginning __________________, _______ and ending __________________, _______ )

• Please attach a photocopy of the death certificate.

Name of Decedent

Name of Claimant

Date of Death

Decedent’s Social Security Number*

Claimant’s Social Security Number

Telephone Number

Street Address (permanent residence or domicile on date of death)

Street Address

City

State

ZIP Code

City

State

ZIP Code

Claimant: If you have the original refund check, send it back with this form.

1. Has a personal representative for the estate been appointed by the court?

Yes

No

Note: If “Yes,” the personal representative must claim the refund.

2. Has a Small Estate Affidavit been filed with the county clerk? (ORS 114.515)

Yes

No

Note: If “Yes,” the responsible party on the Small Estate Affidavit must claim the refund.

3. Has the probate or small estate closed?

Yes

No

Note: If “Yes,” claimant from below must claim the refund.

4. If the estate is to be probated, I am filing this statement as (check one box only):

(a)

Personal representative of estate. (Attach a copy of court appointment.)

(b)

Responsible party filing affidavit for a small estate. (ORS 114.515) (Attach a copy of the affidavit.)

For Nonprobated or Closed Estates—

5. Does the total due the decedent (except for salary or wages) from all State of Oregon

agencies exceed $10,000?

Yes

No

Note: If “Yes,” you must file a Small Estate Affidavit or open a probate to receive the refund.

6. If the estate is not to be probated or probate has closed, I qualify for payment under one of the following

kinship groups (check one box only):

Surviving spouse.

Trustee of revocable inter vivos trust.

Children of the decedent, or children of a deceased child of the decedent.

Parents of the decedent.

Brothers and/or sisters of the decedent.

Nephews and/or nieces of the decedent.

Signature and Verification

I promise to use all of the money to pay the expenses of the last illness and funeral of the decedent if necessary.

If, after payment of the check by the State Treasurer, the decedent’s estate is probated, I promise to account fully to the

personal representative.

If nonprobated, I promise to account fully to other persons entitled to share in this refund. I understand that the state of

Oregon is not responsible for such accounting. I declare that there are no kin who are more closely related to the

decedent.

I declare under the penalties of false swearing that the statements herein are true.

Signature of Claimant

Telephone Number

X

Social Security Number

Date

*Social Security number is required for identification purposes. OAR 150-305.100.

Return this form to: Oregon Department of Revenue

955 Center Street NE

Salem OR 97301-2555

150-101-032 (Rev. 9-00)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1